Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Dec, 2021

By Beata Fojcik and Cheska Lozano

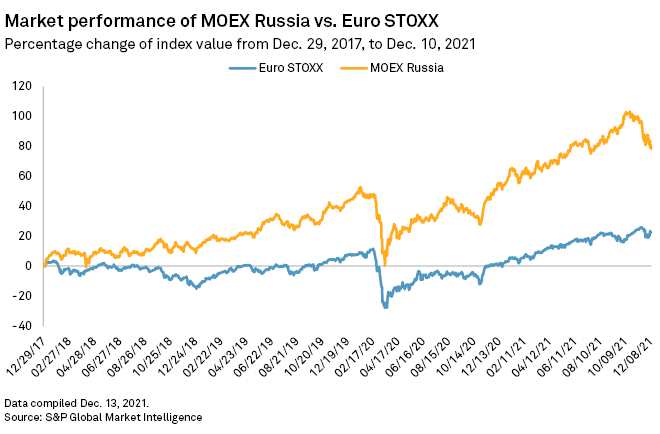

The strong recovery in Russian equity capital markets is presenting opportunities for issuers and banks alike, and the positive momentum is forecast to continue into 2022.

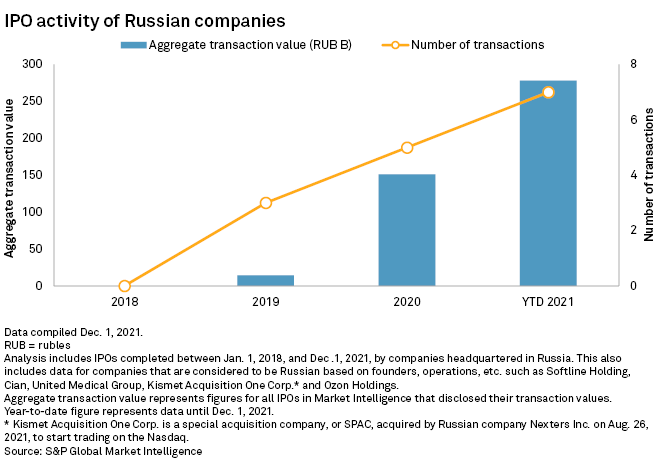

Almost as many IPOs of Russia-linked companies have taken place so far in 2021 as in the previous three years combined, S&P Global Market Intelligence data shows. Major listed corporates have also been able to access fresh capital from follow-on offerings, a combination that has set Russian capital markets on course for a bumper year.

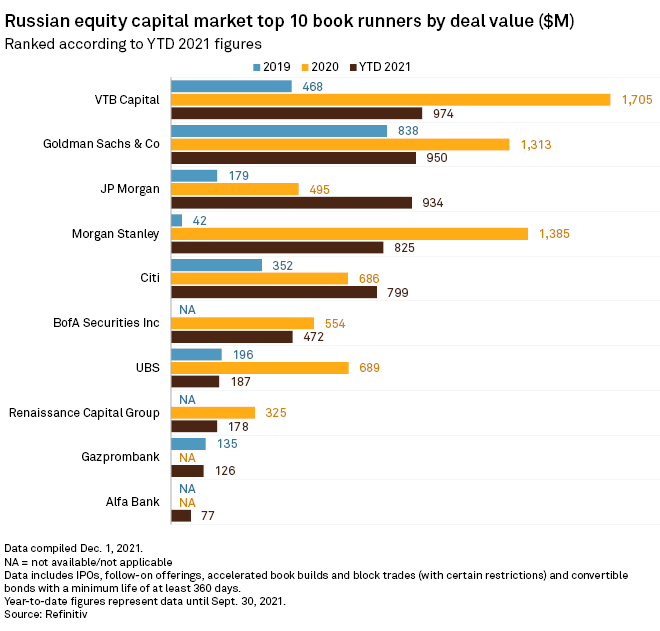

U.S. banks in particular are among the biggest beneficiaries of this recovery. U.S. institutions comprise five of the top six bookrunners on Russian equity capital markets, or ECM, transactions by deal value this year, according to Refinitiv.

"This will be a record year for us and for the entire Russian market," said Alex Metherell, co-head of global banking at Russia-based VTB Capital. "This is a trend that is set to continue."

On the rebound

Seven listings of Russia-linked companies have taken place so far in 2021, Market Intelligence data shows, compared to five in 2020, three

The largest IPO to date in 2021 was that of retail store chain Fix Price Group, which raised roughly $2 billion in a March dual-listing in Moscow and London. Other major floats included those of IT company Softline and real estate database operator Cian, which also listed their shares in Russia and abroad.

Softline and Cian are the most recent examples of Russian companies opting to register parent entities in foreign jurisdictions in order to place their securities on foreign stock exchanges and bypass foreign listing restrictions introduced in Russia in the 2000s. A less recent example is TCS Group Holding PLC, the owner of Russia-based JSC Tinkoff Bank, which held its stock exchange debut in the U.K. in 2013, raising $1.1 billion at the time. The company later secured a second listing on the Moscow Exchange.

In an effort to encourage Russian businesses to tap public markets, the central bank in November 2021 removed limits on the number of shares Russian companies are allowed to place on foreign stock exchanges, labelling them "unnecessary barriers."

The Moscow Stock Exchange is in discussions with about 40 companies considering IPOs in the coming years, its CEO Yuri Denisov said during an investment forum in early December. Interest in listings is high across various sectors including telecommunications, IT and e-commerce, according to Leonid Delitsyn, an analyst at Russia-based brokerage Finam. In the U.S., special purpose acquisition companies targeting Russian IT companies have already raised funds, Delitsyn noted.

VTB Capital, part of state-controlled VTB Bank PJSC and Russia's leading ECM adviser in 2021 according to Refinitiv data, is working on several future IPOs with businesses in the financial, TMT and mining sectors.

"If we see that the favorable market conditions continue in 2022, we can expect … just as many IPOs as we have done this year," Metherell said.

Eastern promises

The Russian bookrunning market has been dominated by Western, mainly U.S. investment banks, such as The Goldman Sachs Group Inc., Morgan Stanley, JP Morgan and Bank of America Corp., which are benefiting the most from the latest Russian IPO surge and will continue to do so, according to Delitsyn.

Cian's IPO demonstrated U.S. bookrunners' ability to usher through listings smoothly, the Finam analyst said.

"Russian issuers that are determined to conduct an IPO quickly will hire exactly these underwriters, given that the likelihood of a successful result increases significantly," Delitsyn said.

Some $5.7 billion was raised on Russian ECM in the first nine months of 2021, up 33% from the same period last year, with IPOs counting for 46% of ECM proceeds and the remainder comprising follow-on offerings and other transactions, according to Refinitiv. U.S. banks acted as bookrunners on almost $4 billion worth of ECM transactions during the analyzed period, with their combined market share reaching 68%. They also held a significant combined market share in previous years.

Politics at play

The Russian IPO surge comes after several fallow years amid investor fears over the impact of sanctions imposed on Russia in 2014 in relation to the annexation of the Crimean peninsula and after the country's alleged interference in the 2016 U.S. election. There were 16 Russia-linked IPOs between 2015 and 2017, compared with 43 deals between 2008 and 2014, according to Reuters.

Reports of a potential Russian invasion of Ukraine have restoked geopolitical tensions, which Finam's Delitsyn sees as the biggest risk factor for potential IPOs. "For the IPO of Russian innovative companies to be a success, we need optimistic U.S. investors," he said.

Some IPO hopefuls, such as car-sharing company Delimobil and discount alcohol retailer Mercury Retail Group, postponed their plans in November amid worsening

Yet this volatility is not specific to Russia and has been reflected across global markets, according to Victor Dima, partner and head of the stock market analysis department at Russian investment company Aton. "We expect to see the same level of interest in share placements in 2022 [as in 2021], provided the market remains stable," Dima said.

Homegrown support

Russian capital markets are also somewhat less reliant on international investors than in the past thanks to growing interest from domestic retail investors seeking to protect the value of their savings amid low deposit interest rates. The number of retail investors on the Moscow Exchange reached 15 million in October, growing by 6.2 million in 2021.

Russian retail investor participation in IPOs amounts to between 10% and 30% of the book, according to Moscow Exchange's Denisov, while VTB estimates that the value of retail investments in the Russian stock market could double in the next three years from the current level of roughly 9 trillion rubles.

In a move that should give domestic investors further confidence, President Vladimir Putin recently proposed a mechanism that would protect long-term retail investments in Russian securities, similar to the banking deposit protection scheme.

As of Dec. 17, US$1 was equivalent to 74.19 Russian rubles.