Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Aug, 2023

By Siri Hedreen

| Construction workers lift a wind turbine blade with a crane at the Lone Star Wind Farm near Abilene, Texas. The Biden administration is considering requiring subsidized hydrogen plants to procure new zero-carbon electricity from sources such as wind and solar. |

Twelve months ago, clean hydrogen developers were celebrating historic federal investments in the nascent industry, expected to give the zero-emission gas the ability to compete with fossil fuels in the US. But on July 11, a lobbying group for the sector ran a full-page advertisement in The New York Times depicting a production plant posted with the sign "FACTORY CLOSURE."

|

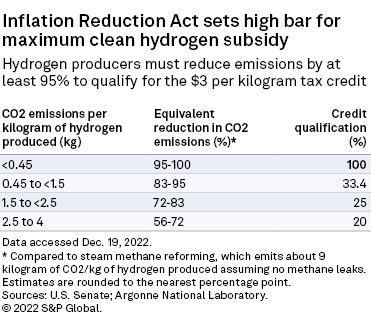

The US Inflation Reduction Act (IRA), enacted in August 2022, authorized a tax credit for hydrogen producers worth up to $3 per kilogram, depending on the overall carbon footprint of the product. The program, called 45V, was designed to lower the cost of "clean" hydrogen by spurring investment in new production methods that use electricity or carbon capture technology to abate emissions.

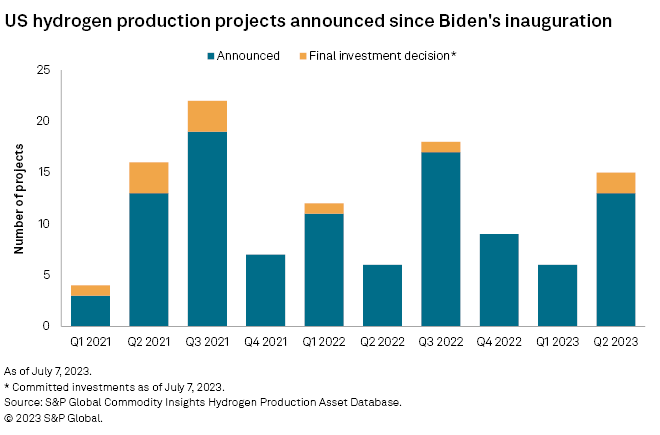

But of the 115 hydrogen projects announced in the US since President Joe Biden's inauguration, only 11 have secured capital commitments, according to S&P Global Commodity Insights' hydrogen production assets database. The industry's dormancy can be traced to an in-the-weeds policy debate over how the US Treasury Department should measure hydrogen's emissions. Now, one side has launched a mass marketing campaign.

"America cannot reach our goals without clean, domestic hydrogen," said the advertisement, paid for by the Fuel Cell & Hydrogen Energy Association. "Additionality would undercut it all."

The ad refers to the "additionality rule," a proposal that would require hydrogen producers to procure new clean power capacity before claiming that their electricity is zero-carbon. Without the rule, some plants could gain eligibility for tax credits by purchasing renewable energy certificates.

Groups such as the Natural Resources Defense Council said the Treasury Department must adopt the additionality rule, along with two other proposals collectively referred to as the three pillars, to prevent a sudden build-out in hydrogen plants from overloading the power grid.

The other pillars are a time-matching requirement, designed to match hydrogen production with peak renewable generation, and a "deliverability" rule requiring that clean generation be in the same geography as the plant.

Studies from Princeton, Rhodium Group and the American Council on Renewable Energy draw various conclusions on how the three pillars would affect hydrogen emissions. But they all agreed that, without additionality requirements, the tax credit program would only increase US carbon dioxide emissions.

Hydrogen producers lobby up

But industry groups said the rules will slow deployment of the extensive hydrogen infrastructure necessary to decarbonize hard-to-abate sectors such as steelmaking and aviation.

The IRA sets a high bar for the full $3-per-kilogram credit, requiring producers to limit their carbon footprint to the equivalent of 5% that of conventional hydrogen production from fossil fuels. Failure to meet that top-tier emissions standard immediately bumps down the value of the tax credit to $1.

"One thing that I think the IRA did is that it moved the spotlight to the US, in terms of investment opportunity here," Adam Peters, CEO of L'Air Liquide SA North America, said in an interview after a presentation to congressional staffers on July 11. The meeting was the Fuel Cell & Hydrogen Energy Association's annual briefing on Capitol Hill. "So if it becomes too restrictive, does it start shifting the spotlight back?" Peters continued. "I think it's a question that's out there."

Peters reported Air Liquide has invested $1 billion in the US hydrogen economy and $5 billion globally. The industrial gas producer plans to invest another $10 billion in the sector by 2035. What the company is waiting for is, "basically, these regulations to come out, to see to what extent we can deploy that capital here in the US," Peters said.

Air Liquide is not the only international hydrogen company to consider spending its money elsewhere, depending on the Treasury Department's determination.

Speaking after the same meeting that Peters attended, Plug Power Inc. President and CEO Andy Marsh said the company hired consultants to model the impact of stringent eligibility requirements for the US incentive. The conclusion was that the so-called three pillars "could be really damaging to the development of green hydrogen in the United States, to where we thought, quite honestly, we had a greater opportunity in Europe," Marsh said.

The green hydrogen and electrolyzer producer announced plans in May to invest $6 billion in three hydrogen plants in Finland.

Referring to a shift in capital to Europe, "I wouldn't count that out," Alex Nevokshonoff, a senior associate with Enverus Intelligence Research, said in an interview.

The European Commission recently set its own standards for clean hydrogen production that would add new requirements in phases, including a rule that would require hourly time-matching between electrolyzer run times and renewable electricity generation starting in 2027.

Nevokshonoff cited the time-matching rule as a potential area for the US to adopt stricter rules out of the gate, but added that this was unlikely based on past US policy. "They want to build out this hydrogen industry," Nevokshonoff said.

If the US does adopt a strict time-matching rule, "you probably will see some investors move over to Europe. But I wouldn't think it would be a complete mass exodus from US investment because that $3 per kilogram is extremely attractive," Nevokshonoff continued. "Even with hourly matching, there's still ways to make very economical projects."

Not all hydrogen companies are opposed to high US emissions standards. Electrolyzer manufacturer Electric Hydrogen Co. is one such three pillars advocate, arguing that lax standards would defeat the purpose of clean hydrogen as a fossil fuel alternative.

"The reason that we have a level of confidence around the industry's ability to meet those requirements is looking at some of the historical precedents out there," Paul Wilkins, VP of policy and government engagement, said at a July 31 panel in Washington, DC, on hydrogen policy.

Wilkins noted the industry reaction to Europe's standards, proposed in February. "The number of announced projects go up by 10%, which I'll caveat is just announced projects," Wilkins said. "But the number of projects in advanced planning or some level of interim planning actually went up by 30%."

Congress gave the Treasury Department until Aug. 16, the one-year anniversary of the IRA's passage, to release draft guidance on the 45V hydrogen production tax credit program. However, the department has already missed deadlines for guidance on the spending package's other subsidies, and some industry members are not expecting the 45V tax credit rules to come out until fall 2023.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.