S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Aug, 2022

By Dylan Thomas and Annie Sabater

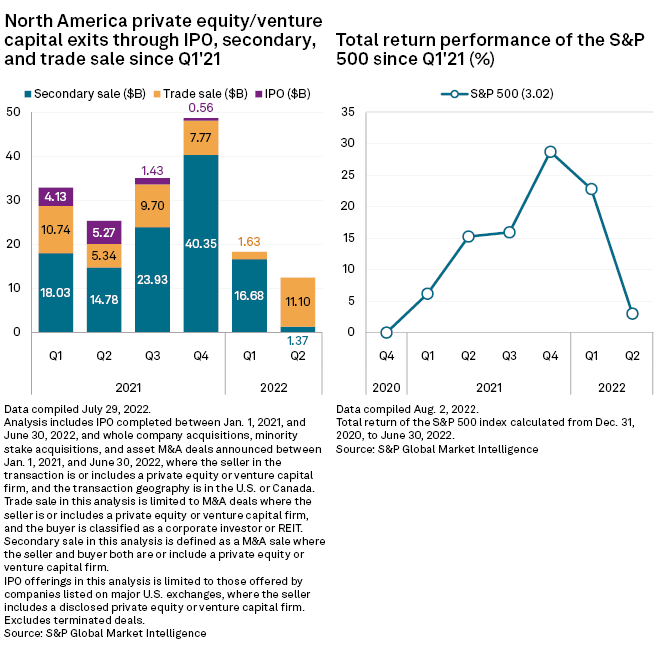

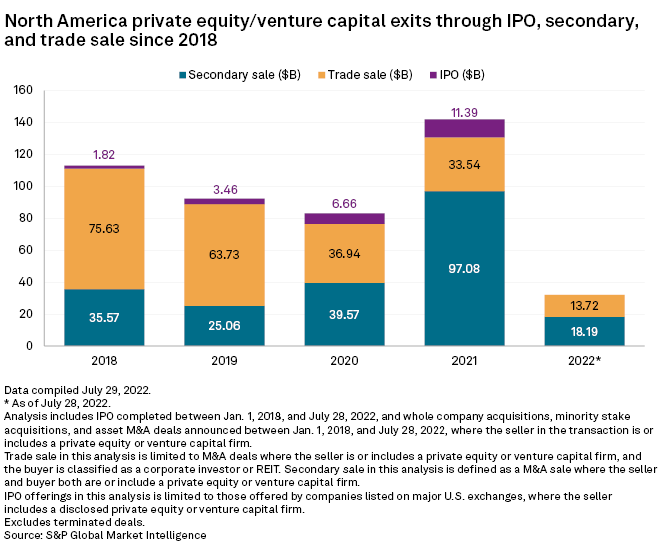

North American private equity and venture capital exit activity fell by nearly half year over year in the first half, as firms gave choppy public markets a wide berth and avoided IPOs.

"Trade sales remain pretty robust. Sales to other private equity firms remain pretty robust. But [there has been] just this dramatic decline in IPOs," said Pete Witte, global private equity lead analyst for EY.

The total value of private equity exits fell 47% year over year to $30.78 billion in the first half of 2022, according to S&P Global Market Intelligence data. Private equity-backed IPOs on the major U.S. exchanges, which totaled $9.40 billion in the first half of 2021, disappeared in the first six months of 2022 as public market returns declined sharply.

Trade sale strength

Trade sales to strategic buyers, by comparison, were down just 21% year over year to $12.73 billion through June 30.

Witte said private equity managers tend to keep a list of potential strategic buyers in their back pocket even as they are planning a portfolio company's public debut.

"When the IPO window shuts, as we’ve seen in recent months, they’re able to quickly pivot and still put together a deal that makes sense for all parties," he said.

"The discussions for a lot of these deals were fairly far along when volatility really began to hit in earnest midway through the first quarter," he said adding this contributed to the relative strength of these deals. That volatility has made it harder to get a clear view on valuations.

* Click here to download a spreadsheet of data featured in this story.

* Click here to read more about private equity exit activity in Q2.

* Click here to read more private equity coverage.

Exits via secondaries dropped 45% year over year to $18.05 billion in the first half. Still, the two largest private equity exits during the period were secondary sales: the $10.08 billion sale of business planning software company Anaplan Inc. to Thoma Bravo LP by a group of private equity and venture capital investors, announced in March and Golden Gate Capital's $4.63 billion sale of Cornerstone Building Brands Inc. to Clayton Dubilier & Rice LLC, announced in February.

Outlook

Witte said the market volatility that closed the window for IPOs remains a drag on exit velocity.

"Sellers want the price from six months ago when everything was great. Buyers want the price from today. It just takes time to sort that out," he said.

On the firm's second-quarter earnings call, Apollo Global Management Inc. reported delaying exits due to market volatility in the first half of the year, echoing an earlier report from Partners Group Holding AG. Additionally, TPG Inc. joined Apollo in predicting lighter exit activity through the end of the year.

Witte said private equity managers can afford to bide their time after a blockbuster year for exits in 2021.

"That has taken some of the pressure off of private equity funds to sell. They were able to get liquidity for a lot of their portfolio companies last year," he said.