S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Apr, 2023

By Allison Good

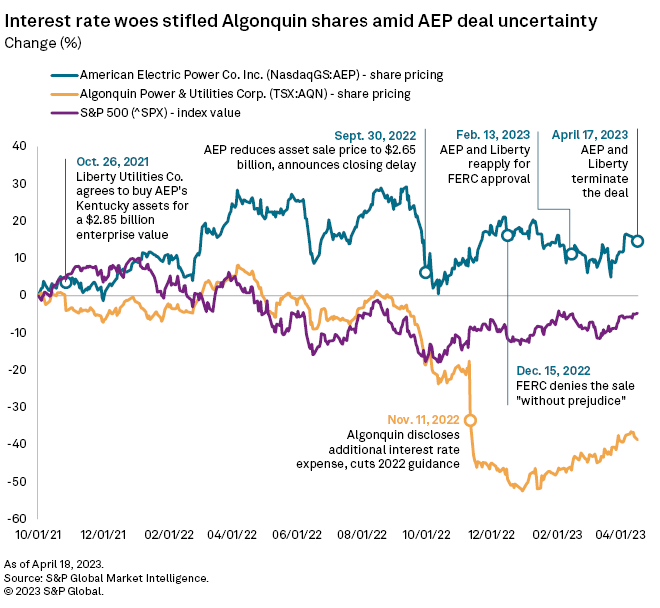

A decision to terminate the proposed sale of American Electric Power Co. Inc.'s Kentucky utility assets to Algonquin Power & Utilities Corp. utility Liberty Utilities Co. came as no surprise to investors following a string of regulatory roadblocks, industry analysts said.

"There was already a growing expectation among investors we've spoken to that this deal was not going to play out," Guggenheim analysts told clients April 17. Mizuho and Evercore ISI agreed that shareholders were not optimistic the deal would close.

American Electric Power's (AEP) stock price rose less than 1% on April 17 following the announcement and had lost that gain by midday April 18, while Algonquin units were down 6% from the April 14 market close and traded at $8.11.

The transaction for AEP Kentucky Transmission Co Inc. and regulated utility Kentucky Power Co. was first announced in October 2021 at an enterprise value of $2.85 billion, including the assumption of about $1.2 billion in Kentucky Power debt. The following year, AEP reduced the sale price of the assets to $2.65 billion and delayed closing of the transaction from October 2022 to January 2023.

The Federal Energy Regulatory Commission denied approval of the sale "without prejudice" at the end of 2022, saying the parties "failed to show that the proposed transaction will not have an adverse effect on rates." (FERC docket EC22-26)

In February, the companies reapplied for FERC authorization and added details about maintaining the return on equity and current cost cap on equity, as well as additional information on plans to finance future credit investment at the current credit rating and on capping certain operating and administrative costs. But the revised filing drew protests from the Kentucky Public Service Commission and Kentucky Attorney General's Office. (FERC docket EC23-56)

Interest rates vs. M&A

Analysts at Morningstar wrote April 17 that they "liked the strategic rationale for divesting a utility that had struggled to earn its allowed returns on equity in one of AEP's more challenging regulatory jurisdictions, and reallocating the capital to more attractive internal growth opportunities."

Mizuho does not expect that there are other interested buyers for Kentucky Power, which according to CreditSights has "some of the weakest credit metrics across AEP's opcos at 10% FFO/debt" and a "staggeringly low" 5.3% regulated ROE for 2023.

Although Kentucky Power was the smallest of AEP's regulated electric utilities, with about 170,000 customers out of about 5.5 million when the agreement was announced, the collapse could still indicate utility sector dealmaking may be slowing down.

"As interest rates continue to rise, and equity valuations continue to fall, utility M&A may become even more challenging," Mizuho analysts wrote. "Added to the list of headwinds are regulatory concerns with inflation and customer bill impact (which was the reason FERC initially rejected the Kentucky transaction). We believe investors may continue to lower valuation expectations should future utility assets come up for sale."

Algonquin blamed the "evolving macro environment" for scuttling the deal, though the Canada-headquartered company told investors in March that it had about $1 billion of capital spending plans to pursue outside of the transaction on safety, reliability and resiliency. Under the Liberty Utilities name, Algonquin operates electric, natural gas and water utilities in more than a dozen US states and Canada.

In November 2022, the company's shares nosedived after it disclosed an additional third-quarter interest rate expense of $23.3 million and slashed expected 2022 adjusted net earnings per share to a range of 66 cents to 69 cents for the year from a range of 72 cents to 77 cents. Algonquin ultimately posted full-year 2022 normalized EPS of 69 cents.

Next steps

AEP in a statement said it will rethink its Kentucky strategy, with plans to file a base rate case in June and securitize retired coal assets through reduced rates for customers. Guggenheim noted the company plans to target unit 2 of the coal-fired Big Sandy plant, which was retired in 2015, and that AEP "has tools" to mitigate the region's challenging regulatory environment.

AEP could also put its retail energy unit up for sale later in 2023, Morningstar analysts said.

Scotiabank told clients April 17 that both AEP and Algonquin shares should recover now that any uncertainty about the transaction has been eliminated, but emphasized that a discount for the latter "is still warranted to reflect limited EPS growth in 2024/2025 as well as some questions on the strategic path forward for the company."

AEP in February announced an agreement to sell its 1,365-MW portfolio of unregulated renewables assets to IRG Acquisition Holdings LLC — a partnership owned by Invenergy LLC, the Caisse de dépôt et placement du Québec and Blackstone Infrastructure Partners LP — at an enterprise value of $1.5 billion including project debt.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.