Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Feb, 2021

By Bill Holland

With shale oil drilling in the U.S. still on the ropes, keeping billions of cubic feet of associated natural gas off the market, investors are still putting money to work with pure-play shale gas drillers on the condition that the drillers keep spending limited and generate free cash.

Analysts said investors do not want to hear about production growth in fourth-quarter 2020 earnings calls over the next three weeks. They want to hear about maintenance drilling plans and efforts to eliminate or refinance any debt coming due soon.

"Investors continue to worry the industry will break ranks from its commitment towards capital discipline given the improvement in crude prices," analysts at energy investment bank Tudor Pickering Holt & Co. said Jan. 26.

Based on conversations with shale gas producers, "concerns on this front should be put to rest this quarter as the industry is committed to maintaining a cap on growth in 2021 with the intention to use free cash flow generation to pay down debt or accelerate shareholder returns," Tudor Pickering Holt said.

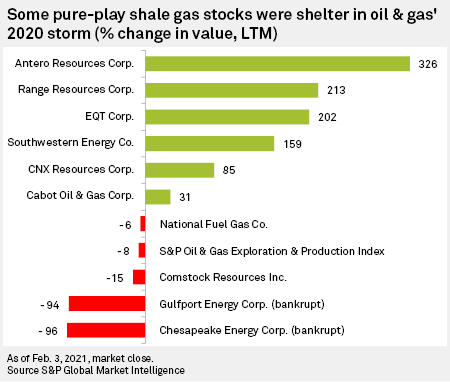

Investors lopped 5% off the stock price of the only producer to break ranks and hike spending in the third-quarter 2020 earnings season. Vertically-integrated New York gas company National Fuel Gas Co. told analysts on its Nov. 6, 2020, third-quarter call that it would spend $60 million above its guidance in 2021 to add a rig in Pennsylvania in hopes of capturing higher pricing in 2022.

"Appalachian operators have posted the largest capital spending reductions to date at 15% year-over-year, driven by significant well cost reductions observed [in] 2H20," said Dane Gregoris, an analyst at energy data firm Enverus. "Within the basin, Antero Resources Corp. and CNX Resources Corp. recorded the highest percentage reductions at 23% and 13%, respectively, while Cabot Oil & Gas Corp. reported the smallest capex decrease at 7% year-over-year."

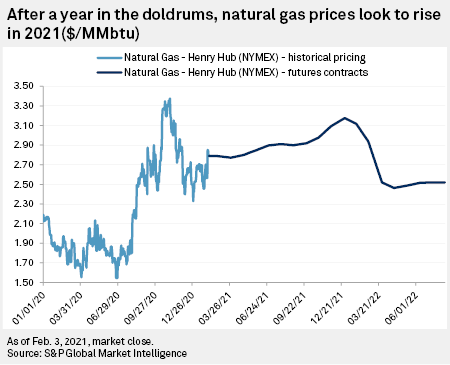

But a disappointing year of natural gas prices at 25-year lows showed how tightly the fortunes of gas producers are tied to weather and the commodity price tape.

Only three of Appalachia's drillers are estimated to show positive cash flows for full year 2020, despite spending cuts, according to S&P Global Market Intelligence data. The low 2020 prices have recovered with the onset of winter, and while 2021 prices are shy of the $3/MMBtu benchmark, they are stable and about $1/MMBtu above 2020.

"The cold weather is set to exacerbate the undersupply in the market and result in forecast cumulative draws of 683 Bcf over the next four prints, or 169 Bcf greater than the 5-year average of 514 Bcf," Tudor Pickering Holt said Feb. 1. "We see this materially boosting near-term prices while further pressuring the back end of the 2021 curve, which we ultimately see needing to move to $3.50/MMBtu by Q4 to balance the market."

"Bullish sentiment towards [shale gas] equities is gaining traction, and we continue to believe owning gas equity exposure at these levels may be some of the best risk-reward investments in upstream at the moment given our conviction in our macro call," Tudor Pickering Holt said. In Appalachia, Southwestern Energy Co. and Range Resources Corp. offer the best risk-reward option, with Cabot as the safety stock, the investment bank said.

For Comstock Resources Inc., the only shale gas pure-play outside of Appalachia, the fourth-quarter 2020 results will need to repair the damage of a spotty third quarter, according to analysts. "Still only Haynesville game in town, and [Comstock] can regain traction if gas bulls come back out to play, but must work through penalty box situation created from messy Q3 results, which will take time," U.S. Capital Advisors LLC analyst Cameron Horowitz told clients.