S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Apr, 2021

By Brian Scheid

Record amounts of money continue to pour into inflation-protected government bonds despite deeply negative yields and no guarantee for just how hot the Federal Reserve will let the post-pandemic economy run before raising interest rates.

"There is a lingering fear that the Fed is purposefully staying behind the curve in this cycle, and will let the economy run hot in order to reap greater job market gains," said Antoine Bouvet, a senior rates strategist with ING. "This is a commendable goal but this risks inflation overshooting well above the Fed's tolerance levels, hence the need to hedge inflation risk."

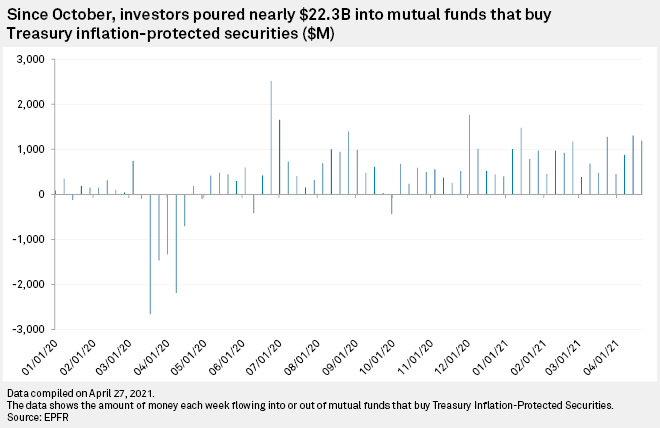

Since the start of August, roughly $22.3 billion has flowed into mutual funds that buy Treasury inflation-protected securities, or TIPS, according to EPFR, which tracks fund flows and allocations. TIPS-buying funds have seen 29 straight weeks of inflows, the most in over a decade.

TIPS, which are linked to an inflationary gauge in order to counter the potential decline in purchasing power from rising inflation, have gained favor amidst the Fed's push to let inflation run above 2%. When the bonds mature, investors are paid either the original principal or an inflation-adjusted principal if the latter is greater.

"TIPS are seen as one of the more liquid ways to hedge a portfolio against inflation given that the payments are linked directly to inflation readings in the future," said Gennadiy Goldberg, senior U.S. rates strategist with TD Securities.

In the first three weeks of April alone, $3.38 billion flowed into these funds, as investors looked to ramp up hedges against potentially climbing inflation.

But since the pandemic began, this hedge has also had negative yields, a sign that investors could lose out if inflation does rise as expected.

"There have been steady inflows into TIPS despite negative yields, but this is due to investor expectations that they will be compensated when adjusting for inflation," Goldberg said.

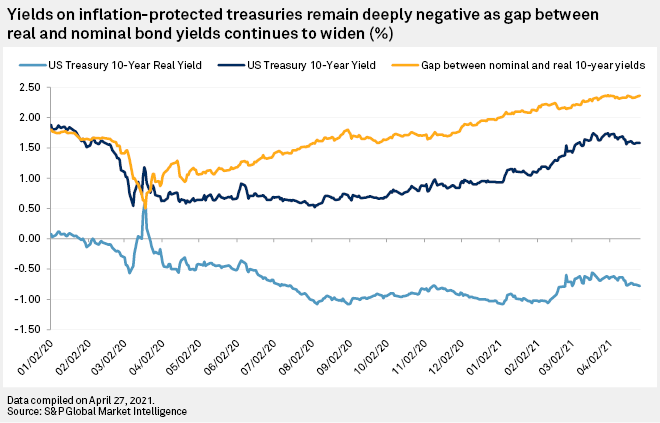

Since spiking above 0.6% in mid-March 2020, the yield on the 10-year Treasury inflation-protected bond, also known as the real yield, has tumbled into negative territory. The 10-year real yield fell as low as -1.08% on Jan. 4, 2021, and closed at -0.76% on April 27. TIPS yields peaked at 1.16% on Nov. 2, 2018.

While the rally in nominal Treasury yields has recently stagnated, the gap between real and nominal yields has also seen a dramatic rise, climbing to 236 basis points this week, up from 50 basis points in March 2020.

The gap may continue to grow due to expectations of rising inflation and Fed Chairman Jerome Powell's pledge to let inflation run above 2% for "some time."

The price index for core personal consumption expenditures, or PCE, is expected to climb 1.8% from March 2020 to March 2021, according to James Knightley, chief international economist at ING. The metric strips out food and energy prices from the consumer price index and is the Fed's preferred inflation measure.

That March number will be released April 30. Knightley expects core PCE to increase by 2.3% from April 2020 to April 2021.

Oxford Economics forecasts core PCE inflation to top out at about 2.5% year over year this summer as much of the economy reopens and supply chain bottlenecks increase certain prices, said Oren Klachkin, Oxford's lead U.S. economist.

Core PCE is expected to cool to about 2% year over year by the end of 2021, Klachkin said.

"The TIPS market is likely to get most of the action on this front, though investors could also hedge against inflation in gold and real estate markets," Klachkin said in an interview.

Goldberg with TD Securities said a sharp acceleration in inflation this year likely will not last since many of the items seeing the biggest price jumps, such as airfares and hotels, will settle as the economy fully emerges from the pandemic.