Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Feb, 2022

By Morgan Frey and Husain Rupawala

Digital therapeutics companies still need to educate overwhelmed patients and skeptical physicians about the benefits of treating disease with apps and video games.

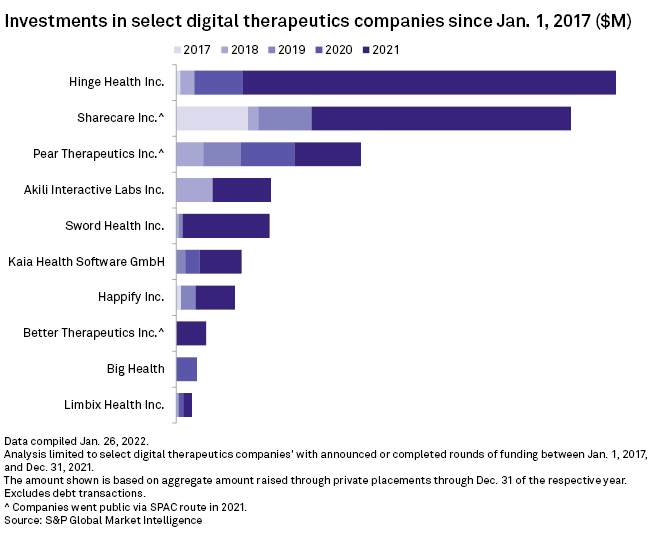

Investments in U.S. digital therapeutic products — evidence-based tools that use software to prevent or treat diseases — grew 2.6 times between 2020 and 2021, according to digital health venture firm Rock Health. Digital health companies focused on patient solutions, including digital therapeutics, were the highest-funded digital health subset in North America last year, health tech research firm Galen Growth reported.

Adoption of digital therapeutics, offered by companies like Pear Therapeutics Inc.

"People are still a little bit wary about going out in public and being around a lot of people and some are still hesitant to go to healthcare providers," 451 Research analyst Brian O'Rourke told S&P Global Market Intelligence. "[Digital therapeutics] really fit with what's been going on in the healthcare world the last couple years."

Notable digital therapeutics highlights from 2021 included maker of video game therapy Akili Interactive Labs Inc.'s $110 million series D round and musculoskeletal sensor-developer Hinge Health Inc.'s $400 million series E round.

Companies offering devices called prescription digital therapeutics, or PDTs, which are subject to authorization by the U.S. Food and Drug Administration and are available only by prescription, also attracted new investors in 2021. PDT-focused companies Pear — which offers FDA-authorized digital therapies for substance abuse disorders and insomnia — and Better Therapeutics Inc. went public via special purpose acquisition companies.

Going public increased Pear's access to capital and a similar move will help accelerate the growth of other PDT companies, CFO Chris Guiffre told Market Intelligence.

With more than 350,000 health-related mobile apps worldwide, according to a July 2021 report from life science analytics company IQVIA Holdings Inc., the challenge for digital therapeutic and PDT companies is to distinguish themselves from their non-clinical competitors. People are used to seeing mobile health apps available in app stores and do not always understand why they may need a prescription digital therapeutic, Guiffre said.

"It's part of the education we still have to do as a leader in a new category," the CFO said. "Our products don't count calories, they don't track steps, they don't give you the chance to stop and think about something mindful. They actually treat disease, so you need a doctor to be involved."

However, patients may be more easily convinced of digital therapeutics' benefits once they have access to them. When it comes to Kaia's digital therapy for musculoskeletal conditions, patients "get it," the New York-based company's president, Nigel Ohrenstein, told Market Intelligence.

"Individuals that engage with the [platform] absolutely love it," Ohrenstein said. "The digital technology is supplemented by health coaches and PTs and so you have that amazing ability to combine artificial intelligence with human care."

Physicians also need convincing that these tools can help their patients, said Christopher Wasden, head of pharma specialty solutions and corporate strategy at mental-health-focused Happify Inc.

The biggest barrier to digital therapeutic adoption are physicians because they are uncertain how to incorporate these tools into their workflow, Wasden told a Jan. 7 panel at CES 2022, the tech industry's largest annual conference. Using a digital therapeutic requires more initial work by the doctor, and as a result, it can provide data that ultimately leads to better outcomes, Wasden said.

Big Pharma, CMS take note

|

|

While physicians still require some persuasion, payers and pharmaceutical companies have started to show interest in the potential for digital therapeutics, especially around improving medicines adherence.

In 2019, France's largest pharmaceutical company, Sanofi, struck a deal with Happify to develop an app that would help manage and improve psychological outcomes for patients with multiple sclerosis. The digital health company now counts eight of the world's 20 largest pharma companies as customers, Wasden told Market Intelligence.

These pharmaceutical companies see the value in digital solutions that can improve how regularly patients take their medicines, Wasden said.

The Centers for Medicare and Medicaid Services gave a boost to digital medicine adherence tools in November by including five new codes for remote therapeutic monitoring in its 2022 physician fee schedule. The new codes expand Medicare's reimbursement of remote patient monitoring tools to include those that collect patient data on therapeutic areas such as a patient's medication adherence, response to therapies and pain level. Medicare covers almost 64 million Americans.

"This will be a huge trend," Sebastian Seiguer, CEO of medication adherence company emocha Mobile Health Inc., told Market Intelligence. "Now providers can be reimbursed for helping a patient be successful on their medications and monitoring their medications on a daily basis as opposed to a three-month basis."

Pear's Guiffre said the CMS' decision will not only benefit the company's own products and pipeline but other PDT providers as well.

Changing of the guard

|

|

Digital therapeutics companies will continue to see increased adoption from regulators, payers and healthcare providers, said Pear's chief commercial officer, Julia Strandberg, who anticipates more FDA authorizations as well as greater integration of digital therapies into how large hospital systems deliver care.

The CES 2022 conference featured healthcare companies more prominently than in years past, Strandberg told Market Intelligence. Many of the conversations that took place at the event were focused on building out the systems that deliver healthcare, the executive said.

"It's not just about a singular device or single piece of hardware that I can either have somebody implement or implant or inject into my body to support a therapeutic endpoint," Strandberg said. "It's really about how do we make sure that we're building the right ecosystem."

The digital health space has seen multiple acquisitions, including Teladoc Health Inc.'s 2020 merger with Livongo and Headspace Inc.'s merger with mental health app Ginger. Wasden expects to see further consolidation in a move toward what Happify calls precision care, where patients can have multiple health needs met using digital tools and services.

"As you look out there at various companies, ourselves and others, you need to have that lens on of, 'What is it they're doing in the pursuit-of-care domain?'" Wasden said. "What pieces do they have? What pieces do they need to acquire?"

"Precision care can't be delivered without these digital platforms we're creating," the Happify executive said. "You can't do [it] with just analog physician services."

451 Research is part of S&P Global Market Intelligence.