S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Jan, 2023

Tumbling valuations as U.S. equity markets lost significant ground in 2022 and slowing U.S. inflation have yet to lure investors back to Big Tech and the growth trading strategies that dominated much of the last decade.

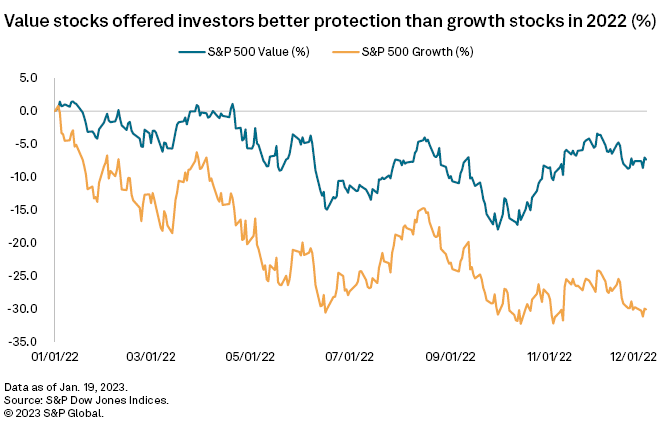

The S&P 500 Growth index, a basket of stocks that exhibit growth in sales, earnings to price and momentum, fell by 30.1% in 2022. That was worse than the 19.4% drop the broader S&P 500 experienced for the year.

Apple Inc., the largest company in the index and a long-term leading growth stock, lost $840 billion of its market capitalization in 2022.

Growth stocks benefited from an era of cheap borrowing and modest inflation during the last decade, trends that reversed in 2022 as the Federal Reserve began an aggressive cycle of interest rate hikes to combat record price increases. While the Fed is slowing the pace of rate hikes as inflation cools, which generally can benefit risk assets like stocks and cryptocurrency — Big Tech and other growth buys still appear too pricey to lure investors away from stocks offering more immediate value.

"We think it is still too early to get back into tech stocks," said David Lefkowitz, head of equities Americas at UBS Global Wealth Management. "While valuations for growth stocks are now less demanding, they are still high relative to value stocks. And we think some tech companies may still be vulnerable to earnings downgrades in the months ahead."

Value outperformed

Rising interest rates in 2022 moved investors to reevaluate future profits at the fast-growing tech stocks and determine that the companies were significantly overvalued.

Electric-car maker Tesla Inc. was one of the highest-profile victims of the market retrenchment, as its shares plunged 65% in 2022. Even the more-profitable Big Tech stocks that led the growth stock boom in recent years were not immune to the declines. Google owner Alphabet Inc. shed 39.1% of its value while Apple fell 26.8%.

Instead, investors found a degree of protection in value stocks, characterized by healthy price-to-book values and high sales relative to share prices. The S&P 500 Value index fell just 7.4% in 2022.

Value trading strategies benefited from exposure to previously unloved energy stocks. The energy sector was alone in benefiting from the Russia-Ukraine war, with Exxon Mobil Corp. and Chevron Corp., respectively the fourth and sixth largest stocks in the value index in 2022, enjoying price gains of 75.4% and 53.4% for the year.

The two energy majors performed so well that they have now been relisted in the growth index by S&P Dow Jones Indices. The energy sector is now just 1.6% of the value index, down from 8.2% in 2022, whereas its share of the growth index is up to 8% from 1.4%. The value index is led by financial companies like Berkshire Hathaway Inc. and Bank of America Corp. Information technology has grown its share in the index after the humbling of leading stocks like Facebook owner Meta Platforms Inc.

Value-focused trading cycles have historically lasted about five years, according to Ian Lance, a co-fund manager of Temple Bar Investment Trust.

"Growth is nowhere close to being cheap," Lance said. "We would [expect] such excesses to unwind over a number of years rather than just one."

Inflation down but not out

The consumer price index came in at 6.5% in December 2022, down from 7.1% a month earlier and well off the 9.1% peak in June of that year. Slowing inflation is good news for battered growth stocks as it brings the prospect of the Fed restraining future interest rate increases.

However, S&P Global Market Intelligence economists forecast that the Fed will not change course until members are confident inflation is heading toward the target of 2%. The economists anticipate the federal funds rate will peak near 5% in spring 2023 with rate cuts not starting until sometime in 2024.

Prolonged central bank tightening will result in continued market volatility, according to Paul Britton, CEO of Capstone Investment Advisers.

"Asset managers are still trying to figure out if this headwind is a gentle breeze or if it risks developing into a full-scale hurricane," Britton said. "What is clear is that some strategies that worked for the last 10 years will not be effective in the near future."