S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

23 Mar, 2022

By Karin Rives

|

Money managers that pledged to decarbonize their investment portfolios face criticism for not effectively pushing corporations away from fossil fuels. |

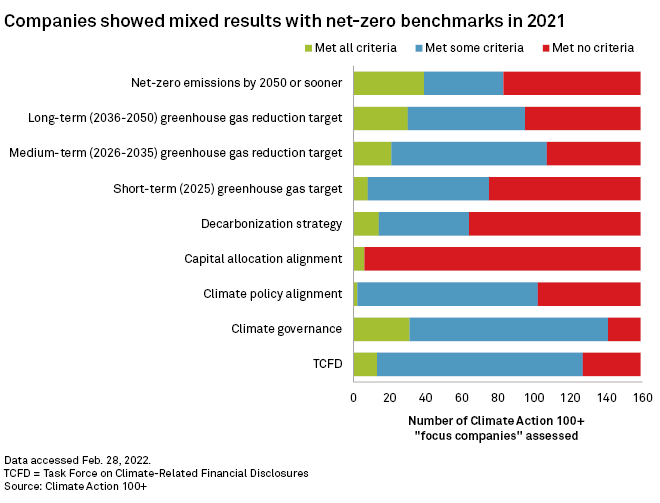

With $65 trillion in assets under management, the world's largest climate-focused investor network should have plenty of leverage. Yet critics note that one-third of the Climate Action 100+ "focus companies" — 167 corporations accounting for 80% of carbon pollution from the world's publicly traded companies — have yet to set net-zero emission goals.

Climate Action 100+ is not alone in facing scrutiny. Several high-profile investor announcements promising to transition portfolio companies away from fossil fuels have been criticized by groups that say the initiatives are not delivering as promised. Some even said investment firms poured billions into new oil, natural gas and coal projects after pledging to zero out greenhouse gas emissions from their portfolios.

The dozen or so climate-focused networks of asset managers and banks operating worldwide say the criticism is unfair or premature, considering that some initiatives are barely getting started. They also say investors need to do more.

"There will always be a small lag between ambition and putting that into action," said Pratima Divgi, head of capital markets for the environmental disclosure platform CDP North America.

"Can the pace be accelerated further? Yes, there's no doubt about that," Divgi said in an interview. "But I think we also need to kind of take a bit of a pause and say, 'OK, if there is a transition in place, let's understand how this asset manager or financial institution is intending to transition.'"

'Failing to uphold fiduciary responsibility'

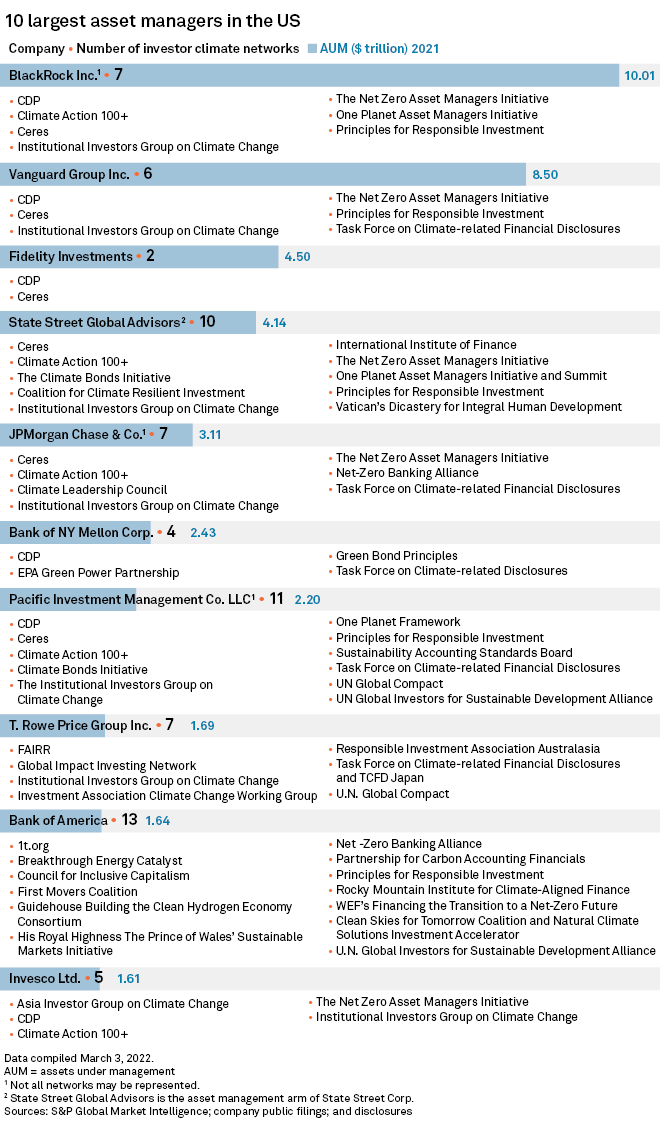

Shareholder advocacy group Majority Action released a report in February that described many Climate Action 100+ high-profile investors as "laggards" in holding corporate boards accountable. Members of the network include seven of the world's 10 largest asset managers and owners, with BlackRock topping the list with $10 trillion under management.

In 2021, four years after Climate Action 100+ formed, 23 of 45 U.S.-based companies on the network's priority focus list were not meeting critical decarbonization benchmarks, Majority Action found. That includes aligning with the goal set under the Paris Agreement on climate change to limit global warming to 1.5 degrees Celsius over preindustrial levels.

Another stinging report also released in February, by the London-based nonprofit ShareAction said European banks that joined the United Nations-convened Net-Zero Banking Alliance, or NZBA, invested "at least" $38 billion in oil and natural gas expansion projects in 2021. More than half of the money came from HSBC Holdings PLC, BNP Paribas SA, Deutsche Bank AG and Barclays PLC, ShareAction said; those banks helped to spearhead the NZBA in April 2021.

On the heels of that report, the German advocacy group Urgewald published an exposé saying 376 banks channeled $363 billion in loans to the coal industry between January 2019 and November 2021. Twelve banks accounted for nearly half of the lending, 10 of which belong to the NZBA, Urgewald said.

"No investor can credibly claim that they don't understand the risks of blowing past 1.5 degrees of warming, and no investor can credibly claim that they can't measure companies against that objective," Eli Kasargod-Staub, Majority Action's executive director and co-founder, said in an interview. "What we see are investors that are failing to uphold their fiduciary responsibility."

Investors mostly pass on board shake-ups

The shareholder season in 2021 did bring unprecedented wins for investor advocates. Shareholders ousted three members from Exxon Mobil Corp.'s board and replaced them with people thought to be more attuned to climate concerns. Some of Exxon's largest institutional investors — BlackRock, Vanguard Group Inc., and State Street Corp. — supported the resolution to revamp the oil company's board.

"We don't think the [criticism] is totally fair," the Rev. Kirsten Snow Spalding, senior program director of the Ceres Investor Network, said of Majority Action's report. Ceres is a founding partner of Climate Action 100+.

Spalding specifically cited the Exxon Mobil board shake-up, which would not have succeeded without the voting power of Climate Action 100+ signatories. Still, some of those large investors are not showing the same resolve in working toward the net-zero emissions goals set by the networks they joined, critics say.

Critics note that investors with the network voted in 2021 to keep most directors in place instead of holding U.S. corporate boards accountable for not meeting net-zero emissions benchmarks promoted by Climate Action 100+. More than half of the 47 largest Climate Action 100+ investors for which voting data is available supported over 90% of directors at the 23 companies that underperformed, Majority Action said.

BlackRock, JPMorgan Chase & Co., Fidelity Investments, Invesco Ltd. and Northern Trust Corp. were among firms that Majority Action found supported directors deemed to stand in the way of corporate climate policies. BlackRock also voted against shareholder resolutions the network had flagged at Chevron Corp., Dominion Energy Inc., Duke Energy Corp., and Caterpillar Inc., Majority Action reported.

"Momentum is in the right direction, but more rigor and accountability is needed," said Lisa Sachs, director of Columbia University's Center on Sustainable Investment. "Existing efforts are inadequate."

Climate Action 100+ acknowledged gaps in engagement in its 2021 progress report, noting that many of its focus companies failed to meet critical benchmarks.

"No company performed at a high level across all indicators and there were clear gaps around short- and medium-term targets, Scope 3 emissions, and aligning [capital expenditure] with a 1.5 degree C global warming scenario," the report said. "These results … shone a clear light on the urgent gaps where faster corporate climate action needs to happen."

'Complex process of transition'

The activist reports have also been problematic for the United Nations, which galvanized support from investors and banks to "mobilize trillions" needed to build a global fossil-free economy.

The top institutional investors highlighted in the Urgewald report were BlackRock and Vanguard, which Urgewald said held coal-related bonds and shares valued at $109 billion and $101 billion, respectively. Both companies belong to the Net Zero Asset Manager Initiative, another U.N.-affiliated global investor network representing 236 companies with $57.5 trillion under management.

Like other investor and financial industry initiatives that formed in recent years, signatories to the Net Zero Asset Manager Initiative have committed to the goal set under the Paris Agreement to limit global warming. (S&P Global is a founding member of the Net Zero Financial Services Provider Alliance, which is part of the broader U.N. Race to Zero campaign.)

In a March 3 statement on the U.N. Environment Programme's website, the NZBA called the advocacy groups' scrutiny welcome but "unsurprising." Because the banking network got its start in April 2021, its members are just a few months into the effort to shift their portfolios away from fossil fuel, the NZBA said.

"This commitment is the first step in a complex process of transition, one that will require years to plan and execute," the NZBA said. "Thus, claims of breach of the commitment are, in our opinion, premature."

Investors: We do as our clients ask

Vanguard did not comment on the reports of support for companies with coal interests, instead referring to December 2021 guidance it published for companies with "significant coal exposure."

BlackRock also declined to comment directly on the reports from Majority Action and Urgewald; the company pointed to its 2021 client engagement summary, among other resources. BlackRock engaged with several dozen utilities and other energy companies over the year, including nine times with Chevron, to discuss their climate risk management, the summary shows.

The asset managers say they are legally required to manage investments as their clients wish. With most of their equity held in index funds, immediate divestment from fossil fuel holdings is not an option, they say.

"We're not dictating a particular path," John Galloway, Vanguard's global head of investment stewardship, said in a recent interview with S&P Global Commodity Insights. "What we're looking to understand is what the company's board is doing to oversee the strategy. Then over time, we'll look to see the success or failure of that strategy."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.