S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Aug, 2022

By Joyce Guevarra and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Investment in life science real estate tumbled 33.6% year over year to $7.7 billion in the first half, reflecting a slowdown in life science venture capital funding, which was down 18.5% to $20.8 billion in the first six months of 2022, according to Newmark Group Inc.'s "2022 Mid-Year Life Science Overview & Market Clusters" report.

Despite this, pricing for life science and research and development assets, which has been rising since 2018, reached a new record-high of $564 per square foot, indicating continued demand. Prices go as high as over $1,000-plus per square foot for class A products in leading markets such as Cambridge, Mass.; South San Francisco, Calif.; Sorrento Mesa, Calif.; and South Lake Union, Wash.

Five public real estate investment trusts were among the top 10 owners of life science properties, which collectively own 116.7 million square feet across 856 properties. Alexandria Real Estate Equities Inc. leads the pack with 407 assets spanning 47 million square feet.

The sector is poised for growth as supply has not kept pace with demand in most of the cluster markets. There are also high barriers to entry such as construction costs and technical expertise, the report added.

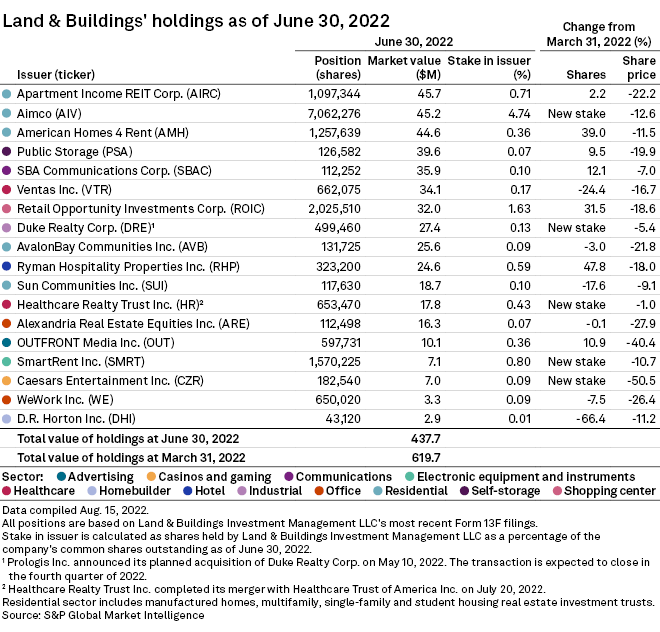

CHART OF THE WEEK: Land & Buildings adds 5 new positions in Q2

⮞

⮞

⮞

Financing deals

* Carter Multifamily secured $302 million in refinancing for its six-property multifamily portfolio, Multi-Housing News reported. The company received $262 million in debt and $40 million in equity for the 1,494-unit, garden-style properties across Maryland, Virginia and Alabama.

* A joint venture between Hana Alternative Asset Management Co. Ltd. and Ocean West Capital Partners LLC obtained $275 million in refinancing for the Washington, D.C., headquarters of NASA, the Commercial Observer reported. The 1992-built building spans 597,253 square feet.

* The Domain Cos. LLC received a $176 million construction financing for its 360-unit multifamily project in Brooklyn, N.Y. The class A development at 420 Carroll St. will comprise a 20-story tower and a 15-story building and is slated for completion in December 2024.

Property transactions

* Highwoods Properties Inc. acquired an office building in Charlotte, N.C., from Lincoln Harris LLC and Goldman Sachs Asset Management LP for $201.2 million, the Charlotte Business Journal reported, citing county real estate records. The 650 South Tryon building spans 362,000 square feet across 18 stories.

* Electra America Hospitality Group acquired the Loews Boston Hotel in the city's Back Bay neighborhood for $116.7 million, the Boston Business Journal reported, citing a deed. A Perella Weinberg Partners affiliate sold the 225-room hotel.

REIT Replay: REIT share prices climb during week ended Aug. 12