Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Sep, 2021

By J. Holzman

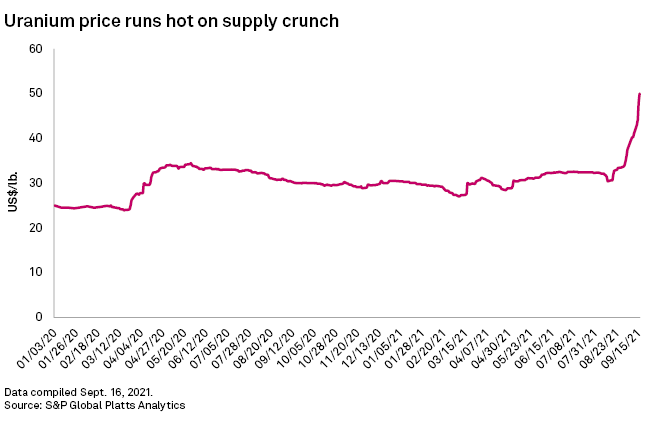

Uranium spot prices are blasting upward with no sign of slowing as a Canadian investment fund hoovers up the existing supply, but analysts are unsure prices will hold.

The spot price hit $50/lb on Sept. 16, a 64.5% increase from $30.4/lb on Aug. 13, according to S&P Global Platts. The sudden increase in costs roiled the uranium market, especially as market fundamentals driven by an expected decline in nuclear generation suggested to some that demand and prices should stay low. Theories for the price spike abounded, from an internet-inspired pile-on to a supply shock. However, most uranium analysts point to a flurry of spot market purchases by Sprott Asset Management LP, which launched a uranium trust in July to scoop up material and give investors exposure to the price of physical uranium.

"We have a uranium market completely driven by a single financial player," said Matt Zabloski, managing director of Delbrook Capital Advisors, who intends to short uranium. "Kudos to them, they've figured out a way to get people excited about the market."

Real deal or meme stock?

Some analysts and media reports have speculated retail investment was a primary driver of the current uranium rally, comparing the momentum in uranium to "meme stocks" such as GameStop Corp. and AMC Entertainment Holdings Inc.

However, the volume and value of the calls being made by investors on uranium equities such as Cameco Corp. during this rally indicates retail investors are not the ones piloting this bull market, Sachem Cove Partners Chief Investment Officer Mike Alkin said. "I think that's a lot of hype, frankly."

Sprott said on Twitter it had purchased an additional 1.45 million pounds of uranium as of Sept. 16, bringing its total holding to 27.7 million pounds worth $1.46 billion. The fund now holds more than double the annual output from Cigar Lake, the world's largest uranium mine, according to S&P Global Market Intelligence data.

Dedicated uranium industry investors say it is about time. Sprott's purchasing activity is bringing institutional capital back to the industry by demonstrating the uranium price fell below its real value, they say. Large financiers fled the space after the 2011 Fukushima Daiichi reactor disaster in Japan led to a political backlash against nuclear power, but rising commodity prices and positive tailwinds for "green" businesses seem to be sparking a return to U3O8.

"We've been working for a really long time to show there was an opportunity [in uranium]," said Arthur Hyde, a partner and portfolio manager at hedge fund Segra Capital Management. Hyde helps manage the fund's uranium and nuclear energy investments.

"Are there people viewing an opportunity here? Of course. That opportunity was created by the market. That's what commodity markets do."

Don't get 'hosed'

The skyward price and wave of capital injected into Sprott's purchasing activity may be causing a scramble for material in the market for nuclear fuel.

Denison Mines Corp. has had "a number of folks" reaching out to the company "trying to get us to liberate our pounds so they'd be in a position to use those to probably meet commitments," President and CEO David Cates said Sept. 14 during an interview with BNN Bloomberg.

"They have a difficult time finding pounds from conventional sources in the market," Cates said. "The fact that folks are looking for our uranium to try to put it into the market tells me that the discretionary supplies in our market are thin."

Utilities with nuclear assets should monitor the upward price "very carefully," Hyde said. "They're a buyer of an increasingly scarce resource … In significant market shocks such as this, it is important to make sure your procurement strategy is well defined."

Sachem Cove Partners' Alkin agreed, issuing a warning to utilities choosing to hold out on negotiating new supply contracts. "If they continue to choose to stay out of the market and think this is just a flash in the pan, that's a good way to get yourself hosed as a fuel buyer."

The Nuclear Energy Institute, which represents U.S. utilities, did not respond to requests for comment.

But for how long?

Not all market observers are convinced the market upswing will last. Global nuclear power generation, the primary consumer of uranium, is expected to decline by 20 gigawatts by 2050, according to the U.S. Energy Information Administration. Analysts at Morgan Stanley recently told clients they do not believe the uranium bull market will continue into 2022, and investment firm Haywood Securities estimated miners will likely wait for the price to stabilize before making any decisions on restarting production or opening new mines.

Delbrook Capital's Zabloski

"It's not based on any fundamentals," Zabloski said of Sprott. "They've tried to backfill with fundamental arguments [that] don't hold."

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.