S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

5 Mar, 2021

By Darren Sweeney

Top investment bankers expect to see further consolidation in the utility sector and the infiltration of special purpose acquisition companies in 2021.

"It's an industry where there may be bursts [of deal activity], but it's going to be steady as she goes," said George Bilicic, vice chairman and global head of Power, Energy and Infrastructure investment banking at Lazard Ltd. "Like molasses flowing on a cold winter day, you're going to see utility M&A consolidation."

Bilicic was speaking as part of a panel of investment bankers at the 34th annual S&P Global Market Intelligence Power and Gas M&A Symposium.

Avangrid Inc.'s planned acquisition of PNM Resources Inc. was the biggest driver of utility and power sector deal activity in 2020.

Orange, Conn.-headquartered Avangrid in October 2020 announced plans to acquire Albuquerque, N.M.-headquartered PNM in a $4.32 billion cash deal, including the assumption of about $4 billion in debt, for an overall enterprise value Avangrid put at $8.3 billion. The transaction ended PNM's nearly two-year search for a merger partner.

"One of my predictions is going to be there will be at least one significant M&A transaction this year," Joseph Sauvage, vice chairman and global head of the Power Group at Citigroup Inc., said at the Feb. 24 virtual roundtable. "I think there will be one. There may be more than one. But it's a very, very difficult industry and M&A is really bespoke in the sector."

In September 2020, Wall Street analysts were highly skeptical of NextEra Energy Inc.'s ability to acquire Duke Energy Corp. to create a "mega-utility" with a market capitalization of more than $200 billion. Neither company confirmed the market speculation.

Just weeks later, reports emerged that Juno Beach, Fla.-headquartered NextEra made a $15 billion all-stock bid for Missouri utility Evergy Inc.

It is unclear which utility could be the next target.

"When we’ve been dealing with the companies with firepower, they've been very disciplined," Sauvage said.

Jeffrey Holzschuh, chairman of the Institutional Securities and Global Power and Utility groups at Morgan Stanley, said he expects to see continued interest from infrastructure funds.

Duke Energy announced Jan. 28 that it will sell a 19.9% indirect minority interest in Duke Energy Indiana LLC to GIC Pte. Ltd. affiliate EPSOM Investment Pte. Ltd. in a $2.05 billion all-cash deal.

The transaction with the Singapore sovereign wealth fund is expected to close in two phases and will allow Duke Energy to forgo previous plans to raise $1 billion in common equity.

"For the company, whether it's Duke or anybody else, it's a bit of an arbitrage," Holzschuh said. "I mean, the ability to take in capital for an asset that has a return and a cost of equity that exceeds it, it is an accretive way to raise capital for many U.S. companies."

'Tough marketplace'

On the power side, Exelon Corp. on Feb. 24 announced the separation of its regulated utility business and its competitive power generation business into two publicly traded companies.

The move came after Exelon launched a strategic review of its corporate structure, which included the possibility of splitting its unregulated Exelon Generation Co. LLC arm from its utility operations.

Public Service Enterprise Group Inc. is exploring strategic alternatives for PSEG Power LLC's non-nuclear generation fleet and the PSEG Solar Source LLC portfolio.

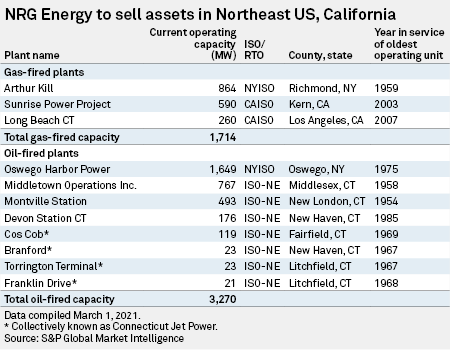

In addition, NRG Energy Inc. on March 1 announced the sale of about 4,850 MW of its fossil-fueled power plants in New York, Connecticut and California to Generation Bridge, an affiliate of ArcLight Capital Partners LLC, for $760 million.

Still, investment bankers believe M&A involving merchant fleets and power generation is complicated.

"It's a tough marketplace," Bilicic said. "With the investment thesis being unclear, you have to buy it right. What the duration of those assets will be is a great question for the new owner of the assets.”

Sauvage noted that conventional generation has become a private equity business.

"I think that you've seen some very creative approaches in terms of continuation funds taking portfolios, carving them up, etcetera, that you're going to continue to see in terms of the private equity exit of that business," Sauvage said.

Rise of SPACs

Investment bankers also expect to continue to see more activity in the renewables space, especially with more interest in special purpose acquisition companies, or SPACs.

"It's creating more exit alternatives for private equity and other private capital investors around companies that fit in the energy transition broadly," Bilicic said. "A positive dynamic of the SPAC phenomenon is it's assisting in the gathering of capital to support these energy transition companies and pulling forward or taking capital needs off the table, arguably, which facilitates the implementation of business plans including in some companies that are more binary risks from a technology perspective."

In early February, a SPAC backed by ArcLight Capital Partners filed with the SEC for a $250 million IPO.

ArcLight Clean Transition Corp. II is the second blank check company formed by ArcLight Capital Partners targeting renewables.

In September 2020, ArcLight Clean Transition Corp. also priced an IPO of 25 million units at $10 each under the ticker symbol ACTCU.

"Our group is like SPACs to the right, SPACs to the left, SPACs in between," Sauvage said. "You can't really count the number of situations that we're working on in that area."

Sauvage predicts that at least one utility company will either sponsor a corporate SPAC "or will have an energy transition business that they have been building up that they will merge with a SPAC."

"I think that for the public companies in the sector, this energy transition is tough because they're rewarded for infrastructure investment that produces relatively more rapid earnings," Sauvage said. "These businesses don't quite have that type of earnings profile, but many companies have been building up businesses and I think … the valuation opportunity is quite exceptional."

Like with any unchartered territory, there could be some bumps in the road.

"I think we're going to see one spectacular SPAC failure," Bilicic said, adding that he does not expect that to necessarily end the movement.