Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Feb, 2022

By Brian Scheid

Months of COVID-19 variants, soaring inflation and persistent supply chain issues have dragged stocks with relatively small market capitalization to their lowest levels in more than a year.

The Federal Reserve's anticipated series of rate hikes this year and a tightening of monetary policy will likely slow economic growth and hammer those stocks even more.

"Generally speaking, small-cap stocks tend to have weaker balance sheets, less market power, and lower profit margins than their large-cap peers, so they are far more sensitive to general economic conditions," said Matt Weller, global head of research for FOREX.com and City Index.

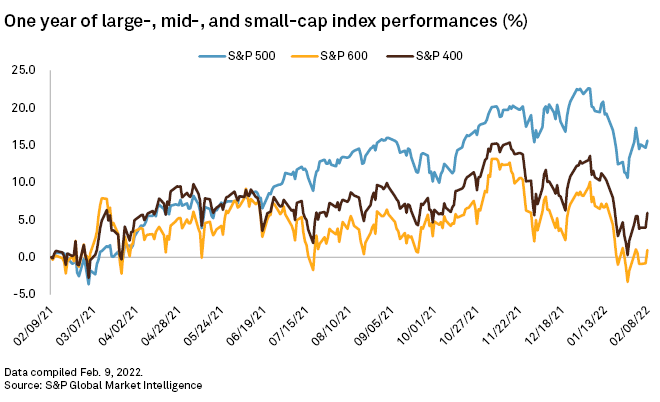

In the 12 months ending Feb. 9, the S&P 500 has gained 17.3%, compared to gains of 2.1% for the S&P 600, an index of small-cap stocks. The Russell 2000, another small-cap index that includes a broader set of companies, has fared worse, falling 9.4% over the past year. The S&P 400, an index of mid-cap stocks, gained about 7.9% over that time.

Throughout the first five months of 2021, the S&P 600 gained about 22.6%, outpacing the large-cap S&P 500, which climbed nearly 12% during that time. The gains in small-cap stocks, which tend to be more sensitive to domestic economic health, were largely caused by COVID-19 vaccine approvals and optimism over the U.S. economy's anticipated recovery.

Smaller stocks, typically defined as a company with a market cap between $300 million and $2 billion, began to stumble as inflation climbed to its highest levels since the early 1980s and the delta and omicron variants caused COVID-19 cases in the U.S. to surge to new highs. The Russell 2000, for example, lost nearly 21% from its Nov. 8, 2021, peak to its low on Jan. 27.

"If people are worried about where the economy is going, small-cap stocks are going to struggle," said Steven DeSanctis, an equity strategist at Jefferies.

Fed pressure

In order to curb rising inflation, the Federal Reserve is preparing to tighten monetary policy in March, including hiking rates and reducing its nearly $9 trillion balance sheet. This will certainly slow growth and increase borrowing costs.

"To take inflation out of the economy you have to cool demand," said Ed Al-Hussainy, a senior interest rate and currency analyst at asset management company Columbia Threadneedle Investments. "There is no option B."

The shift in Fed policy could disproportionately impact smaller businesses, which rely more on borrowing than larger companies that may turn instead to issuing new equity to raise capital, said Fawad Razaqzada, a market analyst with ThinkMarkets.

"As debt costs increase, this is bad news for stocks in general, but more so for smaller companies," Razaqzada said.

Domestic link

The S&P 600 has a higher correlation to U.S. GDP growth and its consumption and investment components than the S&P 500, said Hamish Preston, director for U.S. equity indices at S&P Dow Jones Indices. Smaller-cap stocks tend to perform better when the domestic economy is humming and the economic outlook is positive.

"[Smaller companies] get a greater proportion of their revenues typically from the domestic consumer, whereas their larger counterparts may still get a healthy chunk of their revenues from the domestic consumer but they also have an international exposure in revenues," Preston said.

In addition, smaller companies tend to have less diversity in their product lines unlike their larger-cap peers, said Jefferies' DeSanctis. If growth declines in a sector, smaller-cap companies cannot just rely on another one of the company's other billion-dollar businesses, like Amazon.com Inc. could, DeSanctis added.

Wall Street investors may continue to shun small-cap stocks as inflation continues to rise, impacting smaller firms with less pricing power, said Edward Moya, a senior market analyst with Oanda.

"Small caps are struggling as they are last in line when it comes to getting supplies, struggling to match wage increases that larger companies can offer, and are still unable to keep up with demand," Moya said. "Once inflation has clearly peaked and pricing pressures start to ease, investors will start to rotate back to small caps as long as the growth outlook remains intact."