S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Jan, 2021

By RJ Dumaual and KRIS ELAINE FIGURACION

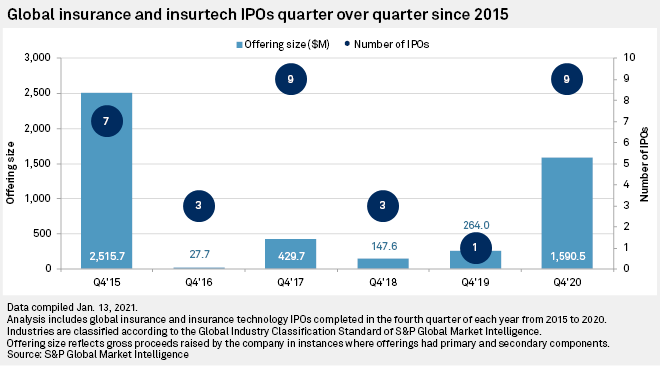

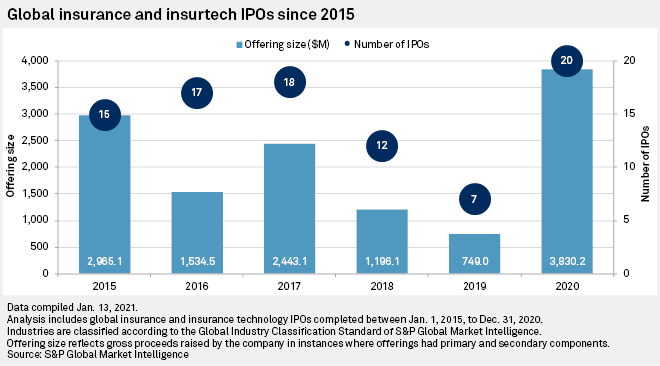

Global insurance and insurtech companies raised about $3.83 billion from IPOs in 2020, the largest amount in at least five years, while the 2020 fourth-quarter total of $1.59 billion was the biggest for the final quarter of a year since 2015, according to an S&P Global Market Intelligence analysis.

The insurance industry also recorded 20 IPOs in 2020, the most since at least 2015, and nine flotations in the fourth quarter of that year, the most since the last three months of 2017.

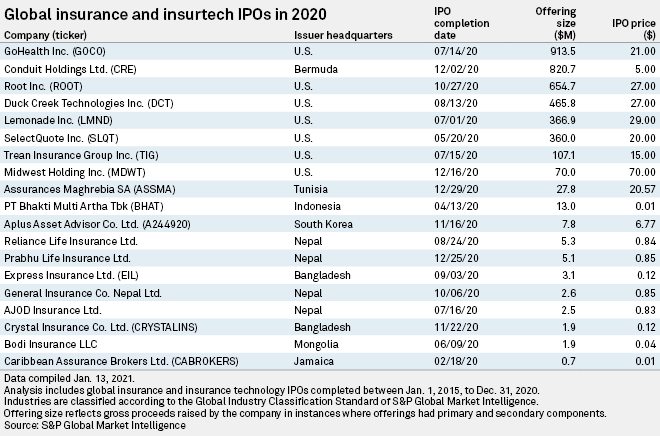

Insurtechs accounted for four of the top five biggest IPOs, with GoHealth Inc. having the largest float at $913.5 million. Fellow insurtechs Root Inc., Duck Creek Technologies Inc. and Lemonade Inc. conducted IPOs with sizes of $654.7 million, $465.8 million and $366.9 million, respectively.

S&P Global Market Intelligence said in its annual U.S. Insurtech Market Report that, despite the coronavirus pandemic, the IPO window remained open in 2020. Several U.S. insurtech companies of all varieties took advantage of those conditions.

However, market performance has been mixed, with Lemonade, which went public in July, having had an exceptionally strong showing. On the other hand, digital agency GoHealth, which went public the same month, has not fared as well.

More IPOs and M&A activity are expected in 2021 and 2022 as the large cohort of companies that started in 2015 and 2016 reach the point at which they could consider either transaction and, in so doing, provide an exit for their private investors, the report added.

Bermuda-based Conduit Holdings Ltd. had the second-largest IPO in 2020 at $820.7 million.

Tunisia's Assurances Maghrebia SA recorded the biggest IPO outside the West at $27.8 million. Indonesia-based PT Bhakti Multi Artha Tbk had the largest IPO in Asia at $13.0 million, according to the analysis.

It was also a busy year of IPOs in Nepal as Reliance Life Insurance Ltd., Prabhu Life Insurance Ltd., General Insurance Co. Nepal Ltd. and AJOD Insurance Ltd. all went public.