Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Apr, 2022

By RJ Dumaual

Insurance technology companies dealing with poor profitability and tumbling share prices have recruited industry veterans to take on significant roles as they grapple with the complexity of the business.

Publicly traded Lemonade Inc., Hippo Holdings Inc. and Root Inc. in recent months have hired senior executives away from traditional insurance companies as they seek to move past losses that have plagued their bottom lines. While insurtechs have mostly focused on customer experience and distribution, they are finding out that insurers need to have sophisticated balance sheet management and solid underwriting practices, analysts said.

Though the model of insurance seems pretty straightforward, insurers simply charge more for coverage than they pay out in claims and operating expenses, the mechanics of making that work are very nuanced, said Kaenan Hertz, managing partner at Insurtech Advisors LLC. Many insurtechs did not have the expertise or the institutional history to understand these nuances and ended up performing poorly in terms of profitability, said Hertz.

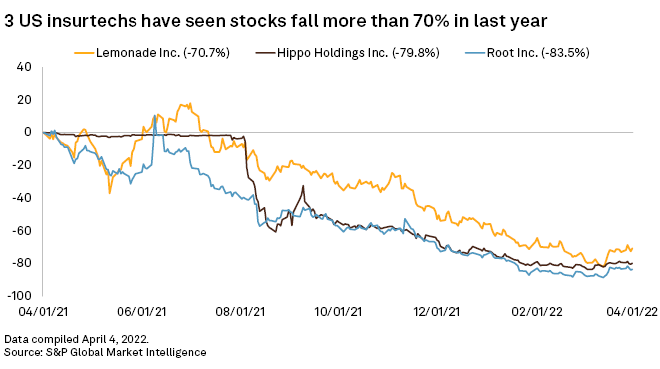

"As the publicly traded insurtechs have seen their share prices crater, and they have had to report performance results, it became evident that the insurance part of 'insurtech' wasn't working," Hertz said.

Adding experienced hands

Within the last six months, Lemonade hired United Services Automobile Association's Sean Burgess to be its chief claims officer, Root Inc. brought in Ategrity Specialty Insurance Co.'s Rob Bateman as CFO, Hippo Holdings Inc. named Hiscox Ltd.'s Grace Hanson as its first chief claims officer and Ethos Technologies Inc. appointed life insurance industry veteran Marty Schafer as its chief distribution officer.

Public insurtechs are realizing that a number of their internal processes, such as core underwriting, need to be improved, said Doug McElhaney, partner at McKinsey's insurance practice. Industry veterans bring the pattern recognition that can be leveraged to address near-term operating losses, he added.

Startup FutureProof Technologies in March brought in XL Catlin's Fid Norton as co-founder and chief insurance officer, while German insurtech wefox in September 2021 appointed former Zurich Insurance Group AG executive Peter Huber chief insurance officer.

Top insurance officer 'absolutely critical'

Kin has raised about $318.9 million in funding, according to an S&P Global Market Intelligence estimate. The spokesperson said Kin will continue to hire more insurance talent as it expects to launch in several new markets and provide coverage to more people in 2022.

Hippo CEO Assaf Wand in the insurtech's fourth-quarter 2021 shareholder letter said that, despite dealing with a tight labor market, the Hippo team grew to 621 employees that year, and he was excited to bring Hanson on board as top claims officer.

Lemonade and Root did not respond to requests for comment.

More shuffling to come?

As more insurtechs scale up, they are likely to continue to look to adding personnel from legacy carriers, said Grier Tumas Dienstag, another partner at McKinsey. Some executives at those more conventional insurers will be attracted by the potential for outsized financial gains, including equity, at rapidly growing companies. They could also be lured in by the promise of more flexible and innovative work experiences, Tumas Dienstag said.