Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jan, 2022

By RJ Dumaual and Husain Rupawala

Insurtech companies set records in both fundraising and valuations in 2021. That may prove difficult to replicate, given the specter of rising interest rates and the struggles of publicly traded insurtechs.

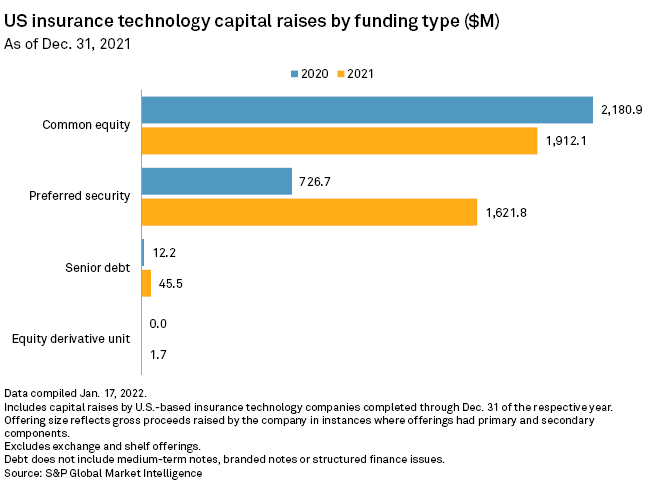

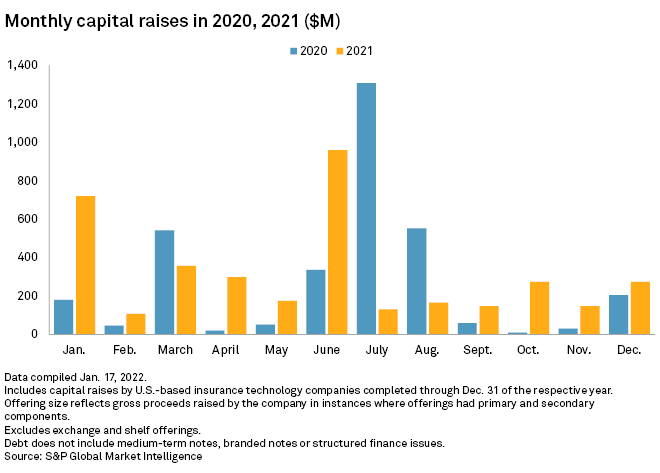

U.S.-based insurtechs raised about $3.58 billion from issuances of common equity, preferred securities and senior debt in 2021, according to an S&P Global Market Intelligence analysis.

Willis Towers Watson PLC estimated that insurtechs raised $10.5 billion during the first three quarters of 2021, while market scanning platform Sønr put total investments at $39.14 billion for that period. Funding could face an uphill climb in 2022 as bond yields improve and the Federal Reserve sends out signals that it will raise interest rates multiple times this year. Additionally, the shares of publicly listed insurtech companies have plummeted in the last year. Even Lemonade Inc., which bucked the trend and soared through the end of 2020, had a brutal 2021.

Rising interest rates are becoming a "reality check" for venture capital investors, Robert Hartwig, director of the University of South Carolina's Center for Risk and Uncertainty Management, wrote in an email. "Higher yielding bonds become somewhat more attractive as do beaten down share prices for equities."

Hartwig said it should have been "patently obvious" in 2021 that insurtechs carried "insane" valuations, and that investors and insurtechs were in the "midst of a bubble at risk of imminent collapse."

Caribou Honig, partner at SemperVirens Venture Capital, said tightening monetary policy will be a headwind for insurtech fundraising. Commitments to venture capital funds have been "through the roof" in the past two years, which means that funds still have a significant amount of capital to deploy, said Honig.

"Insurance remains a category full of tech-driven opportunity," Honig said, adding that trends in early- and late-stage funding lead him to believe 2022 will be even bigger for funding than 2021.

Dot-com bubble similarities

Kaenan Hertz, managing partner at Insurtech Advisors LLC, said insurtech funding in 2021 reminded him of the late dot-com era, when tech stocks dived after years of massive gains. Multiple rate hikes played into that bubble bursting as investors became more focused on profit. Few startups were in a position to pivot, but those that did ended up surviving, Hertz said. The same will happen within the insurtech ecosystem as companies with profitable operating models will likely survive and grow, he said.

Cyber opportunity

Honig said one category that stands out is cyber, which drew big valuations in 2021. The space is "compelling" for startups because incumbents do not have the same advantage in cyber as other sectors.

Hertz expects cyber insurtechs to continue to perform well as they bring "something new and differentiated" from the products that legacy carriers currently provide.

"I don't see the legacy carriers starting to provide the advanced cyber threat and mitigation services that has helped differentiate this segment from their legacy competitors," Hertz said.