S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

24 Jun, 2021

By Sarah James

The COVID-19 pandemic forced many advertisers to do more with less. But insurance giant The Progressive Corp. opted to do more with more.

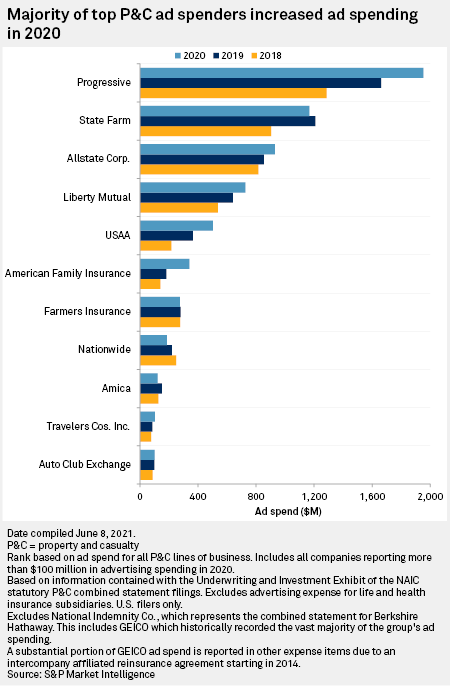

Progressive spent $1.95 billion on advertising in 2020, according to an S&P Global Market Intelligence analysis of statutory data, 17.5% more than the $1.66 billion it spent in 2019.

Notably absent from this analysis is Berkshire Hathaway Inc.'s GEICO Corp., as Market Intelligence was unable to locate a product filing that verified its own calculation for GEICO's advertising expenses from 2019 to 2020. Based on the methodology used in 2019 — which doubles the reported statutory expense to reflect a 50% quota share reinsurance agreement established in 2014 between GEICO and National Indemnity Co., another Berkshire subsidiary — GEICO spent an estimated $2.16 billion on advertising in 2020, making it a top spender.

GEICO did not respond to requests for comment.

In an annual report to shareholders, Progressive President and CEO Tricia Griffith said it was a record year for the company in terms of TV and online video production.

Progressive adjustments

But due to the pandemic, Progressive had to be flexible with its marketing plan.

"When we couldn't shoot in Los Angeles, we did it in Cleveland," Griffith said. "When we needed a specific camera angle but wanted to be distant from our actors, we used a baby monitor to record."

Progressive's "Work from Home" advertising spots were 100% virtually directed, for example. The ads were shot on mobile devices with talent handling their own makeup, wardrobe, sets and lighting, Griffith said.

Outside of Progressive's television campaigns, the company also upped its spending on digital spots and has been relying more heavily on data to drive individual transactions with consumers.

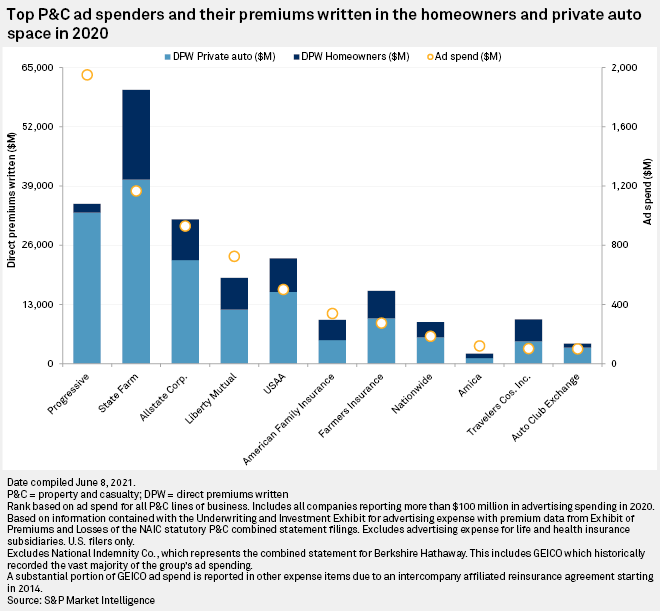

While Progressive is the top advertising spender among property and casualty insurers, it is by no means the industry's leader in premiums written. That title still belongs to State Farm Mutual Automobile Insurance Co., which recorded almost $40.40 billion in private auto direct premiums written and $19.72 billion in homeowners direct premiums written in 2020, according to Market Intelligence data.

By comparison, Progressive tallied nearly $33.17 billion in private auto direct premiums written and $1.90 billion in homeowners premiums.

Neighbor's overhaul

State Farm spent $1.17 billion on advertising in 2020, down 3.5% from $1.21 billion a year earlier.

By State Farm's account, however, 2020 was a big year for the company's ad team, starting with its move in January to rekindle its iconic tagline, "Like a good neighbor, State Farm is there." The company also overhauled its media investments and ad partnerships as it was forced to move beyond its traditional sports-heavy strategy when live sports were temporarily shut down due to COVID-19. For instance, State Farm sponsored Jimmy Fallon's "At Home" edition in April 2020 and a special "Parks and Recreation" reunion on NBC.

By early 2021, State Farm was back to spending big on sports, snagging a 30-second spot during the Super Bowl. The celebrity-filled spot, featuring Green Bay Packers' quarterback Aaron Rodgers, actor Paul Rudd and singer Drake, was the only insurance ad to air during the NFL championship game.

Thirty-second spots during the game reportedly fetched some $5.5 million per unit.

In good hands

Turning to the No. 3 ad spender, The Allstate Corp. logged advertising expenses in 2020 of $929.9 million, up almost 9% from $853.6 million in 2019.

The higher ad spending was notable as Allstate took measures to cut other costs in 2020, including laying off 3,800 people.

"Our strategy is to both keep reducing costs every place we can so that we can have a more affordable product for our customers and, therefore, a better price," Allstate Board Chair, President and CEO Tom Wilson II said during a May earnings call. "At the same time, our advertising was way up. And so we tried to balance between those two."