Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Oct, 2021

By RJ Dumaual

The number of M&A deals in the insurance industry grew year over year during the third quarter, according to an S&P Global Market Intelligence analysis, with asset managers and private equity firms getting involved some of the largest deals disclosed during the period.

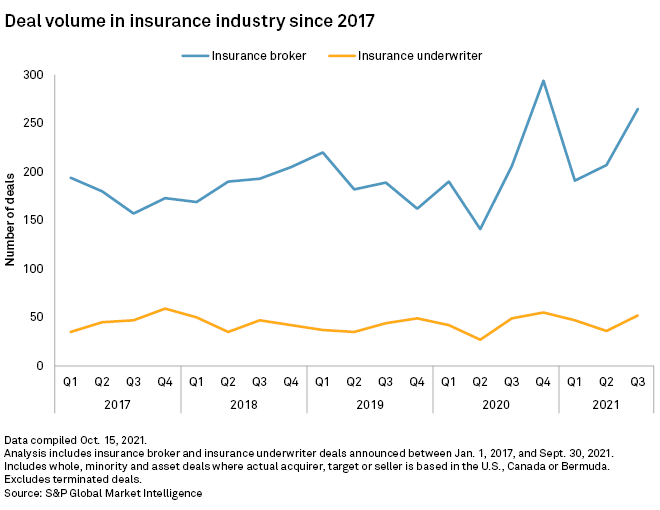

There were a total of 317 insurance deals announced during the third quarter, compared to 255 in the prior-year period.

There were 265 deals in the insurance brokerage space, up from 206 transactions a year ago. In its third-quarter agent and broker M&A update, OPTIS Partners LLC said a number of new private equity-backed buyers have emerged over the last two years; those who have been around for the last two-to-five years that are pushing the deal count higher. That list includes PCF, World Insurance Associates LLC, High Street Insurance Partners Inc. and Relation Insurance Services Inc.

Insurance underwriters accounted for 52 transactions, versus 49 in the third quarter of 2020.

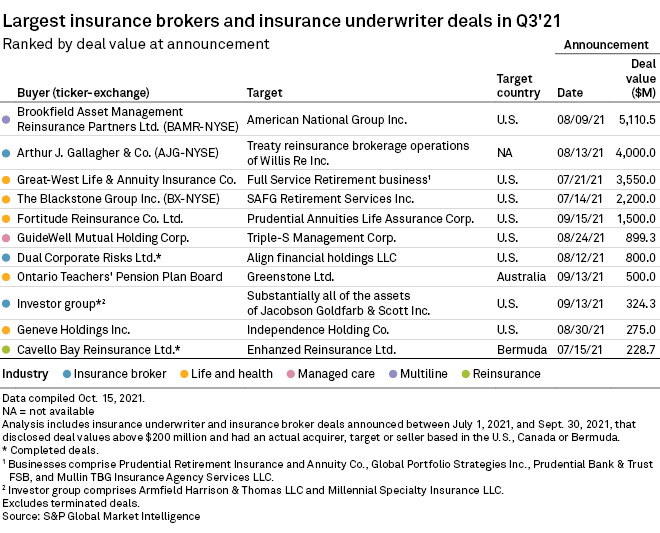

The largest deal announced during the third quarter was Brookfield Asset Management Reinsurance Partners Ltd.'s proposed acquisition of American National Group Inc., valued at about $5.11 billion. S&P Global Ratings said the deal could result in growth in Brookfield Asset Management Inc.'s fee-bearing capital in the long term, as well as greater diversification of its investor base. Its business risk is expected to be unchanged.

The second-largest deal was Arthur J. Gallagher & Co.'s pending acquisition of the treaty reinsurance brokerage operations of Willis Re Inc. from Willis Towers Watson PLC. The two sides pressed on with their transaction following the collapse of what was once a related proposed merger between Aon PLC and Willis Towers Watson.

The Blackstone Group in July agreed to acquire a 9.9% stake in American International Group Inc. subsidiary SAFG Retirement Services Inc. The sale is designed to be a strategic investor for AIG as part of its potential life and retirement company IPO expected to take place this year or in early 2021, Piper Sandler analyst Paul Newsome said.

Also announced in the period was The Carlyle Group Inc.-backed Fortitude Reinsurance Co. Ltd. making a deal to acquire Prudential Annuities Life Assurance Corp. and diversifying into variable annuities.

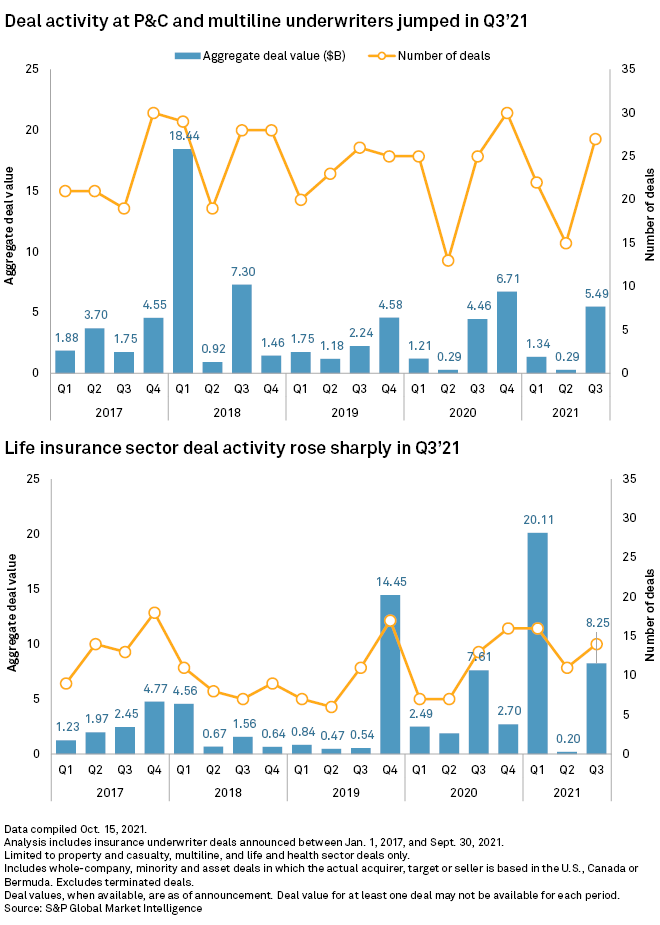

M&A activity in the property and casualty and multiline sectors rose during the quarter to 27 deals from 25 in the prior-year period.

The life and health space recorded 14 deals, compared with 13 in the third quarter of 2020. The number of managed care transactions was the same as last year, at six deals.