Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jun, 2021

By Tom Jacobs

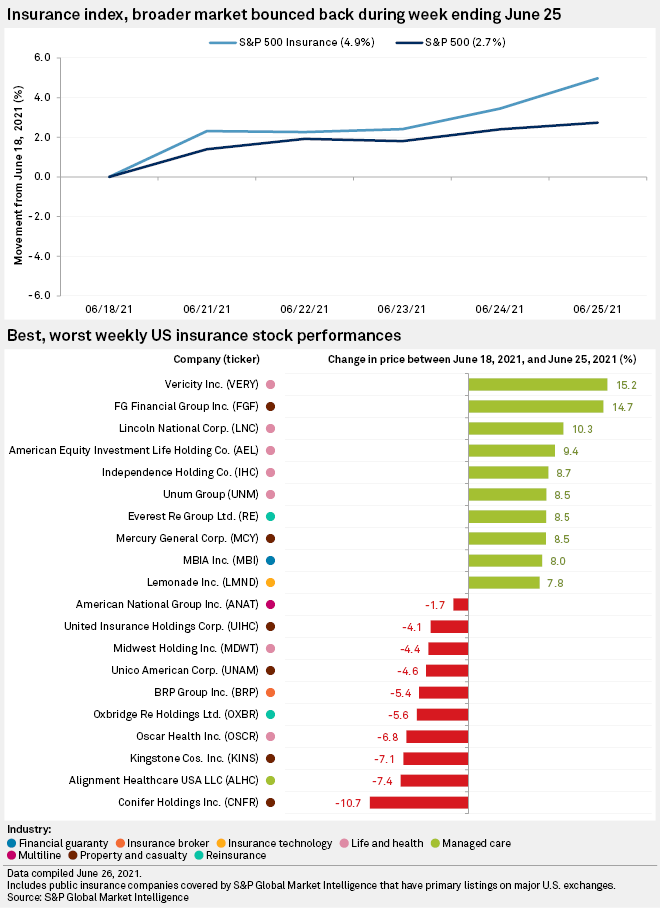

Insurance stocks outperformed the broader market in a week that saw the S&P 500 record multiple all-time highs.

The stock benchmark closed the week ending June 25 up 2.74% at 4,280.70, while the SNL U.S. Insurance Index rose 3.44% to 1,388.81.

The race to finish the link-up between Aon PLC and Willis Towers Watson PLC was given a new hurdle when the U.S. Justice Department last week filed an antitrust suit to block the merger between two of the three largest insurance brokers in the world. The DOJ said the deal would "eliminate substantial head-to-head competition and likely lead to higher prices and less innovation."

Craig Wildfang, a partner at Robins Kaplan LLP, said it is not uncommon for the DOJ's antitrust division to go after mergers in markets that would go from "essentially three large players to only two."

"[The DOJ] defined the relevant product markets, not only by what is the particular product or service that is being offered but also who the customer is," Wildfang said in an interview. "That is consistent with the DOJ's merger guidelines, but it's something you don't see every day."

The question is how the parties will deal with the legal battle, and if it will seek to address the issues raised by the DOJ. Wells Fargo analyst Elyse Greenspan said in a note that the outcome of the court fight was a "tossup," and a settlement could trigger more asset sales.

Wildfang said he is confident there have already been behind-the-scenes discussions to "soothe investors and preserve the competitive balance that the DOJ is worried about going away as a result of the merger."

Lawyers for Aon and the DOJ clashed this week over the timing of certain disclosures and the start of a civil trial. According to court documents, the DOJ is seeking to begin the trial in late February 2022, while Aon's legal team said it can be ready to try the case as soon as this August.

Aon finished the week up 3.64%, while Willis climbed 3.26%.

Changes in the economy as a result of the COVID-19 pandemic led to a significant rise in Medicaid membership, according to an analysis released June 17 by the Kaiser Family Foundation. Enrollment stood at 80.5 million in January, as compared to 71.2 million in February 2020, an analysis of the Centers for Medicare and Medicaid Services Performance Indicator Project Data showed.

The report said the rise in membership was due to the economic downturn caused by the pandemic and the federal government mandating that states keep Medicaid beneficiaries enrolled until the end of the national emergency.

In the managed care space, UnitedHealth Group Inc. added 2.44%, Centene Corp. rose 1.55%, Molina Healthcare Inc. climbed 4.22% and Humana Inc. picked up 4.02%.

Only a handful of insurance companies recorded stock declines this week, with the worst performer being lightly traded Conifer Holdings Inc. Its shares slid 6.51%.