S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Apr, 2022

By Michael Copley and Taylor Kuykendall

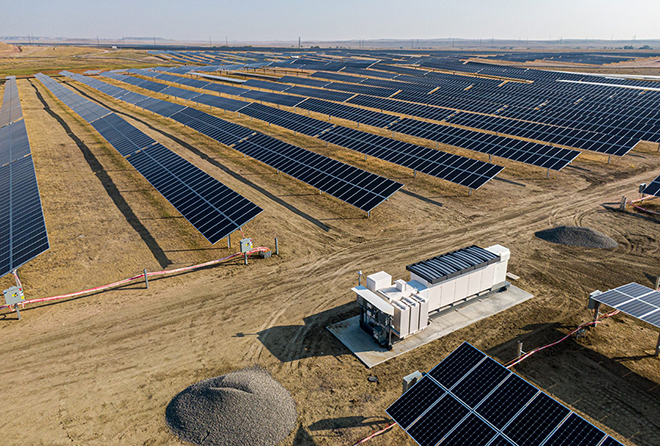

| Solar and battery storage builder DEPCOM Power, recently acquired by Koch Engineered Solutions, is part of Koch Industries' growing portfolio of energy transition plays. |

Koch Industries Inc., one of the world's wealthiest private companies, has emerged as the latest fossil fuel giant to seek new fortunes in carbon-free energy, joining the likes of BP PLC, Chevron Corp. Shell PLC, TotalEnergies SE and Saudi Arabian Oil Co.

The Wichita, Kan., industrial conglomerate with deep roots in oil refining and opposition to climate regulations has pumped roughly $1.7 billion into what company insiders call "energy transformation" technologies. Following a series of investments and acquisitions orchestrated largely over the past year, Koch's clean energy portfolio totals at least 18 companies specialized across electric vehicle, energy storage and renewable energy value chains, according to S&P Global Market Intelligence data.

At the center are batteries, the heart of the EV revolution and the electrochemical storage surge in the power sector, where Koch is spreading its investments broadly in search of winners.

"This is a new energy business," said Jeremy Bezdek, managing director of Koch Strategic Platforms LLC, or KSP, an investment arm focused on promising "new economy" companies. "How margins are going to play through the value chain will evolve over the next decade."

Koch's energy transition bets range from early-stage upstarts to profitable commercial suppliers. In between are a host of companies that went public last year in special purpose acquisition company mergers.

"We had capital to deploy in a space that was thirsty for it," Bezdek said in an interview.

The investments are small compared with Koch's estimated annual revenues of more than $100 billion and its $32 billion in total technology investments in recent years. Critics of the company question its commitment to clean tech and blast its lobbying against carbon taxes and renewable energy incentives. But Koch's recent moves appear to signify a meaningful pivot aimed at turning the biggest potential long-term threats to its current core business into possibly the company's most lucrative opportunities.

In Bezdek's view, Koch remains "decades away" from seeing some of its traditional energy businesses disappearing, necessitating continued investment to make refineries, pipelines and other assets more efficient and competitive.

"And in the meantime, we'll be looking for opportunities to invest … in alternative forms of energy and areas [that] we believe can be economic and desired by the general public moving forward," he said.

That makes Koch a late convert to an energy transition that is well underway, critics say.

"Cost gaps are narrowing to the point that today renewables are pretty much competitive with gas … and those trends [have] been happening for some time now," said Basav Sen, project director of climate policy at the Institute for Policy Studies, a progressive think tank. "So, in a sense, Koch jumping on this bandwagon, they're jumping on it somewhat late."

'Koch isn't going to cut bait in a year'

Regardless of the timing, Koch's investments are multiplying, especially into a variety of battery technologies. The company is most bullish about lithium-ion, the dominant chemistry for EVs and energy storage.

"We feel very confident that lithium is here to stay and will be a key material in the battery value chain for as long as we can [see]," Bezdek said.

Koch is funneling financial and in many cases operational support into companies that collectively link critical sections of that chain. These span from lithium extraction upstart Standard Lithium Ltd. to safety materials specialist Aspen Aerogels Inc. to aspiring battery-makers Freyr Battery, Lithion Battery Inc. and Microvast Holdings Inc. Further downstream, Koch has invested in EV drive integrator REE Automotive Ltd. and charging system specialist EVBox BV.

KSP portfolio company Li-Cycle Holdings Corp. is developing a recycling network across North America to process used batteries and harvest their valuable nickel, lithium and cobalt materials for reuse. Active across the entire value chain is Wildcat Discovery Technologies Inc., a technology, research and consulting firm that works with national laboratories, materials suppliers, battery developers and automakers.

Koch's broad positioning comes amid a global battery shortage, as well as U.S. concerns over China's control of the supply chain — conditions that favor the ambitions of Koch investment targets to establish manufacturing or supply chains in North America.

Koch is entering the market "at just the time we need it," said Chris Berry, president of House Mountain Partners and an adviser to Standard Lithium, which is pursuing lithium projects in Arkansas and California. "Koch isn't going to cut bait in a year."

In addition to investing $100 million in Standard Lithium and providing the company with engineering support, Koch plans to be a buyer of its lithium hydroxide. The London Metal Exchange and CME Group Inc. created futures contracts for the specialty commodity in 2021, and Koch has a minerals trading business.

"They're not just saying, 'OK, this is only a lithium-ion play.' They're saying the battery is going to underpin the electrification thesis, and they want to have exposure to all of that along the supply chain," Berry said.

Koch has the ability to "connect the dots between different stakeholders in the space and unlock partnerships," said Tom Jensen, CEO of European lithium-ion battery cell production startup Freyr Battery. Koch's expanding battery ecosystem can help "drive the energy transition even faster," Jensen said.

|

Freyr Battery CEO Tom Jensen believes Koch will "drive the energy transition even faster." |

Freyr and Koch have created a joint venture to manufacture battery cells in the U.S. They invested $70 million into Massachusetts-based cell developer 24M Technologies Inc. and secured a limited exclusive license for its recipe.

"We are full steam ahead," Jensen said. "We have a technology that is an American technology, that … is the next-generation lithium-ion battery solution."

The companies plan to select one or several manufacturing sites this year.

Another recent Koch target is Arizona-based DEPCOM Power Inc., a builder of solar and battery storage projects. Acquired by subsidiary Koch Engineered Solutions LLC in November 2021, DEPCOM is purchasing sun trackers from KSP portfolio company GameChange Solar LP.

"Not only are we now unconstrained by capital, which gives us flexibility in our strategy of sourcing, but it also helps us tap into much larger global procurements, relationships, strategies, infrastructure, global logistics capabilities," DEPCOM CEO Johnnie Taul said.

The company is exploring construction of solar-plus-storage projects to power multiple Koch industrial sites, Taul said, including in Minnesota and Texas, where Koch operates major refineries.

'Wrong side of history'?

To its critics, Koch is scrambling to profit from a budding industry that it had fought to suppress. One of the biggest spenders in U.S. politics, Koch says it opposes mandates and subsidies of all kinds, and it has put its money to work trying to block government policies including solar investment tax credits, electric vehicle subsidies and carbon taxes.

Koch has a "deep legacy of aggressively blocking anything that would tax carbon or raise the cost of doing business as a fossil fuel company," said Kert Davies, director of the Climate Investigations Center.

"Whether or not they've actually come around to realizing that they're on the wrong side of history and that they need to be not on the wrong side of history, I would be surprised," Davies added. "But whether they see there's money to be made in it, yeah. They're good at placing bets."

With scientists warning that the world is quickly running out of time to avoid the worst effects of climate change, Koch's opposition to climate regulation outweighs the environmental benefits that might flow from its new investments, said Sen of the Institute for Policy Studies.

"I would question the significance of [Koch's] shift, not just with the relative amounts of money, but also from the standpoint that we don't need to just expand renewable energy but actually phase out fossil fuels," Sen said.

Rather than try to reduce the production and consumption of hydrocarbons, however, Koch is an "active backer of legislation to prop up fossil fuels as well as bills to outlaw protests at fossil fuel infrastructure," Sen said.

| Koch's Pine Bend oil refinery in Minnesota. The company plans to continue investing in fossil fuel infrastructure as it finances EVs, batteries and solar as well. |

Some employees at KSP portfolio company GameChange Solar raised concerns over Koch's position and reputation on climate issues. When GameChange leadership was considering whether to accept a $150 million preferred stock investment from KSP in December, some at the company flagged a potential mismatch, according to CFO Mark Gibbens.

"That was a discussion we had with the team," Gibbens said in an interview. "Look, I think [Koch] demonstrated their commitment to the space and the investment in the [energy] transition … but there was discussion. We got comfortable with them."

DEPCOM had no such concerns when it was acquired by Koch, Taul said.

"On the contrary, the alignment of values and principles were a major driver of our mutual selection to join forces," the CEO said.

Taul cites the transformation of utility-scale solar into the lowest cost form of electricity as putting the industry in a place where tax subsidies — historically opposed by Koch — now can only do more harm than good.

"I think we're doing a little bit of a disservice now to our industry by continuing to manipulate these incentives in ways that are disruptive, in my view," Taul said. "I just don't think it's necessary."

Operating across multiple sectors, now including electric vehicles, battery storage and renewable energy, also means "we play by the rules that are currently in place — even if we disagree with them and actively work to eliminate them," Christin Fernandez, communications director at Koch Industries, added in an email.

Koch willing to take the risk

Looking back on Koch's first wave of renewable energy and battery storage investments, Bezdek is encouraged.

"It's not just about putting money in play ... it's also about bringing capability that Koch has to help these people grow," he said. "And that's where we've seen the most success, really, to date."

|

KSP plans to build on energy transition bets like Li-Cycle, which recycles lithium-ion batteries. |

KSP is preparing for more transformational energy plays, according to Bezdek.

"I think there will be some follow-on investments with some of our key partners in 2022, as they continue to scale and find opportunities that will require more capital," he said.

In February, KSP announced an additional $150 million investment into Aspen Aerogels after an initial $75 million financing in 2021. In April, Blue Current Inc., a Berkeley, Calif.-based developer of solid-state batteries, disclosed a $30 million investment from KSP to accelerate its commercialization.

Bezdek and his team are on the lookout for additional companies with differentiated technologies, including in geothermal, hydrogen and nuclear energy.

The executive knows there will be challenges along the way, including how the stock market views the wave of innovative young companies that have recently gone public.

"When you're dealing in this kind of growth equity game, that's the risk that you are absorbing and taking, and we're willing to do that," Bezdek said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.