Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Aug, 2021

By Sydney Price

The $1 trillion infrastructure bill moving through Congress stands to be a windfall for broadband providers, but how quickly the money is spent and by whom could hinge on the details, telecom attorneys said.

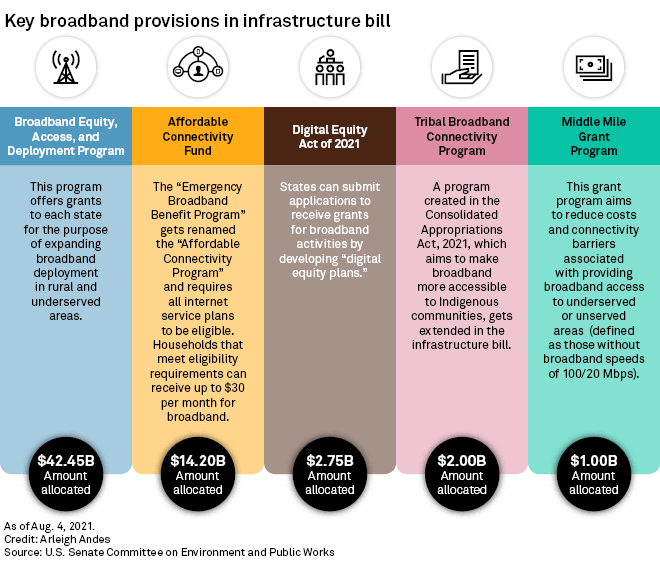

The broadband provisions of the infrastructure bill — which collectively would allocate roughly $65 billion toward internet deployment and affordability efforts — are designed to increase connectivity across the country, close the digital divide and boost internet access for communities hard-hit by the pandemic. But rules and regulations regarding when, where and how internet services providers deploy the funds are likely to impact which companies choose to participate in the various programs covered by the legislation.

Rural connectivity

The broadband affordability provisions will be a boon to rural areas in the U.S. where infrastructure is expensive to build out, said Rebecca Goldman, an attorney at Lerman Senter PLLC, a Washington, D.C., firm that specializes in communication law.

"This should be a significant opportunity to eliminate the red that we currently see on the national broadband map," Goldman said. "It's a significant amount of funding for broadband infrastructure, and there's a lot of interest from a whole variety of parties, including providers, in using this as an opportunity to expand their networks into areas where they currently aren't."

Roughly 14.5 million Americans still lack access to fixed broadband, with the majority of those living in rural and on tribal lands, according to the Federal Communications Commission's 2021 annual broadband deployment report. While 98.8% of the urban areas have broadband deployed, only 82.7% of rural areas and 79.1% of tribal lands do. The commission defines broadband as speeds of at least 25 Mbps downstream and 3 Mbps upstream.

The $42.45 billion Broadband Equity, Access and Deployment Program envisioned by the infrastructure bill sets priority first for rural areas and secondly for other areas where broadband deployment has consistently remained low.

Tribal lands

Big mobile players such as AT&T Inc., Verizon Communications Inc. and T-Mobile US Inc. are likely to be interested in this program, but they must adhere to strict regulations around affordability, quality of service, reliability and shorter build-out timeframes, said Mark O'Connor, co-founder and member with the Communications Law Counsel PLLC in Washington, D.C.

Some larger companies may opt out of partnering on broadband projects with smaller entities, such as tribal communities, where they may not be as agile to respond. The bill allocates $2 billion for making broadband more accessible to indigenous communities.

"It's yet to be seen whether the large companies will dive into that," O'Connor said. "I don't think they are used to the complexity of dealing with tribal organizations."

Smaller local or regional telecom players, however, may have more flexibility to implement broadband in tribal lands, O'Connor said.

'Icing on the cake'

AT&T has previously shared plans to build out its network to unserved areas even without federal funding. "Over the next three years, we're committing $2 billion ... to help the nation's underserved communities," AT&T CEO John Stankey said during a June investor conference.

But Stankey said he sees "some opportunity areas ... in rural domains that the [infrastructure] bill can help." While federal monies will not change AT&T's private funding commitment, he said government support in this arena would be "icing on the cake."

T-Mobile and Verizon have both emphasized their fixed wireless internet offerings in regards to rural service, with T-Mobile unveiling its home internet service with 5G features in April. While these are not purely fixed internet offerings, the T-Mobile service provides average speeds of over 100 Mbps with no data caps and thus is seen as competing with cable broadband.

Affordability

Beyond deployment, the new infrastructure bill also aims to address affordability. For example, the Emergency Broadband Benefit Program, which was introduced in May, is being renamed the Affordable Connectivity Program and an additional $14.2 billion in funding is being allocated for it. The program, which aims to assist low-income households and unemployed workers, includes a monthly broadband service discount of $50 per household, or $75 on tribal lands, and reimbursement for connected devices.

Today, 30 million households do not subscribe to broadband even where it is available, and 36% of households without a fixed broadband connection have income below $20,000, according to estimates from ACA Connects- America's Communications Association, whose members include small- to midsize cable companies.

Ernesto Falcon, senior legislative counsel at the Electronic Frontier Foundation, said how successful the bill is at lowering the cost of broadband over the long term depends in part on what types of networks are built with the money. While it will make a home internet connection affordable for more families in the short term, if the funds are supporting older technology, the benefit may be short-lived.

"The bill does not actually ensure access is useful if fiber is not replacing [older networks]," Falcon said in an interview with S&P Global Market Intelligence. "Older networks are going to get more expensive to run and slower."