S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Feb, 2023

By Michael O'Connor

Increased debts and limited savings are straining consumer spending.

Source: Nikola Stojadinovic/E+ via Getty Images

Persistently high inflation and weakening consumer demand are eating into U.S. retail sales expectations this year.

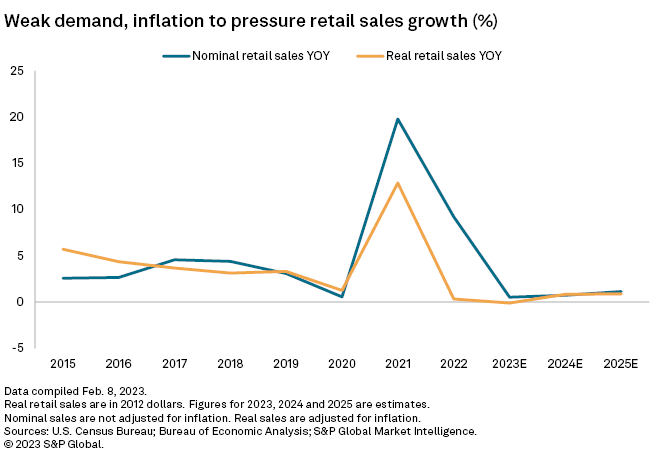

S&P Global Market Intelligence economists predict retail sales growth of 0.5% in 2023, or a 0.1% decline when accounting for inflation, before returning to slower growth than pre-pandemic levels afterward. Price growth, meanwhile, will shrink to 0.6% in 2023 from 8.9% in 2022. Belt-tightening consumers will hinder sales in 2023 compared with previous years that benefited from post-lockdown spikes in demand and strong household balance sheets.

This year's retail sales will help determine whether the U.S. enters a recession as consumer spending accounts for nearly 70% of U.S. GDP. Retail sales declined in November and December as consumers saved more and spent less, while the U.S. Census Bureau will release January sales figures on Feb. 15. Amazon.com Inc. recently reported fourth-quarter profits below expectations, and Walgreens Boots Alliance Inc. reported a sales decline for the three months that ended Nov. 30.

"If the consumer is pulling in their horns, then to a significant degree that is going to contribute to slower economic growth and maybe recessionary growth," said Phil Orlando, chief equity strategist at investment manager Federated Hermes.

Consumer health

Retail sales during the critical November and December holiday shopping season grew 5.3%, falling short of the National Retail Federation's forecast of 6% to 8% growth. Recession fears rippling across the economy likely weighed on consumers who opted to pull back on spending, Orlando said. After falling throughout 2022, the personal saving rate rose each month from September to December, according to Bureau of Economic Analysis data.

"Consumers have spent the last three months — October, November, December — adding to savings, which means that there was less money that they were spending," Orlando said. "And that manifested itself in relatively soft Christmas sales."

As consumer savings declined in 2022, household debt rose. Total household debt rose by $351 billion, or 2.2%, to reach $16.51 trillion in the third quarter of 2022, according to the latest quarterly report from the Federal Reserve Bank of New York. The share of debt transitioning into delinquency increased for nearly all debt types, after two years of historically low delinquencies. The combination of historically low savings and rising debt is putting a strain on consumers that will weigh on retail sales in 2023.

"The consumer is going to have to find a way to pay down that debt to start spending more," said Christopher Anselmo, principal of investor relations intelligence at Nasdaq.

Challenges ahead

If a recession occurs in 2023, as many believe it will, the economic slowdown would be a drag on retail sales. On the other hand, a downturn in retail sales could help push the economy into recession. Whether or not a downturn occurs also hinges in large part on whether the U.S. Federal Reserve continues hiking rates to tame inflation.

Consumer prices appear to have peaked after posting in December annual growth of 6.5%, the smallest annual increase since October 2021, according to Bureau of Labor Statistics data released Jan. 12. But the Fed's goal is for inflation to be at 2%, and Fed Chairman Jerome Powell has warned the fight is far from over.

The Fed's rate hikes have the potential to dampen consumer demand as it becomes more expensive for people to finance purchases for vehicles and other goods, said Andrew Forman, who studies consumer behavior at Hofstra University's Frank G. Zarb School of Business.

Even if inflation cools, recession wariness among consumers fueled by high-profile layoffs makes it hard to be too optimistic about retail spending in the coming year, Forman said. Plus, many consumers spent big in recent years when lockdowns and stimulus money were more prevalent, making it less likely they will continue to do so if they are worried about inflation and a slowing economy.

"Spending will be soft, if not necessarily cratering to the extent which we would see a large pullback on the part of consumer spending," Forman said.

Labor market

Even with more modest expectations for retail sales this year, the labor market will likely help bolster consumer checkbooks.

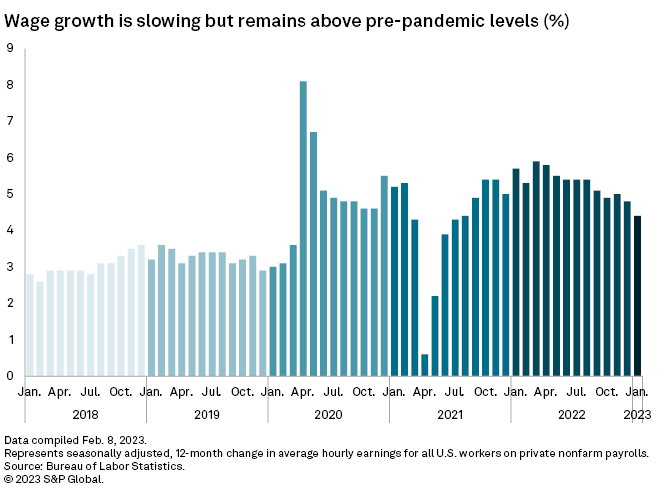

Unemployment remains at historic lows and the economy keeps adding jobs month after month. Wages are also growing at a faster pace than before the pandemic, hitting 5.1% for the year ending in December, according to the Bureau of Labor Statistics.

The strong labor market has helped strained consumers avoid a broad precipitous drop-off in spending, said Phillip Neuhart, director of market and economic research at First Citizens Wealth Management.

"As long as consumers have jobs and are seeing decent wage gains, there is a floor to how bad consumer spending can get," Neuhart said.