S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jul, 2022

| Prices are up for battery storage stations in 2022, but that does not necessarily make them less competitive against fuels like natural gas. |

Central Coast Community Energy, a local government-run power agency in California, has inked more than a dozen long-term deals for wind, geothermal, solar and battery power to aid its shift to 100% clean energy by 2030.

Now, as guaranteed commercial operation dates approach, several project developers have asked the community choice aggregator, or CCA, to pay more for battery storage, citing a litany of inflationary pressures. Agreeing to all the proposed increases would cost the CCA roughly $250 million over the 10- to 20-year terms of the contracts, threatening to drive up customer bills.

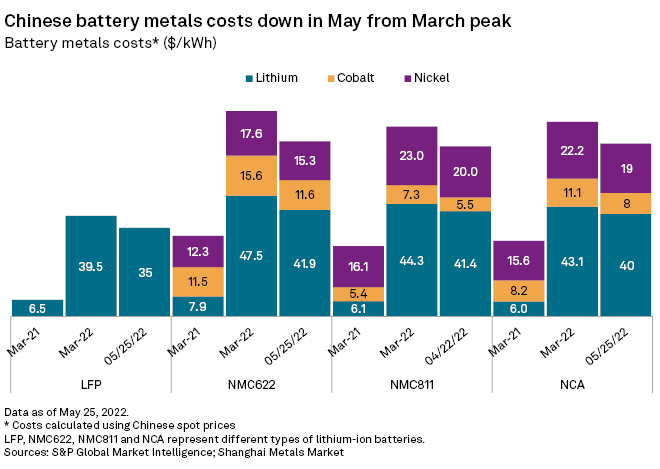

"The wave really started in March," Central Coast Community Energy CEO Tom Habashi said in an interview. Habashi is engaged in discussions with developers and acknowledges the extraordinary challenges many have faced, including skyrocketing battery metal costs. He has no intention, however, of haggling over prices that have already been locked down. "It is what we committed to, and if the price of the commodity would have gone down ... we would never go back and say, 'We need to reopen this contract.'"

The requested price hikes range from high single digits to more than 200%. While lithium-ion battery storage costs have historically declined, the trend abruptly reversed over the past year, prompting developers to reevaluate contracts already signed or under negotiation across the U.S.

Central Coast Community Energy and Silicon Valley Clean Energy, another aggregator, filed a lawsuit alleging that BigBeau Solar LLC requested a 233% increase in the rate the CCAs agreed to pay in 2018 in separate agreements for the 40 MW, four-hour battery component of the Big Beau Solar+Storage Project.

After the 128-MW photovoltaic portion of the project was operational, BigBeau — a subsidiary of EDF Renewable Development Inc. — sought to renegotiate the storage rate, according to the suit filed in May in the California Superior Court in Santa Clara County. The new rate would charge the CCAs an additional $76.8 million over the life of the contracts.

When the two buyers rejected the notion, the Electricité de France SA affiliate unilaterally terminated the deal, according to the suit. The CCAs are asking the court to declare that move a material breach of contract, triggering a "termination payment" unless the move is rescinded.

EDF did not immediately respond to a request seeking comment on the lawsuit.

Habashi is concerned that the debacle, combined with other requested price increases and project delays, could expose Central Coast Community Energy to state penalties if it is unable to meet requirements for resource adequacy and renewable energy purchases.

Given the vast proliferation of CCAs in California, for the state to continue decarbonizing its power sector, "eventually, this is going to have to go away," he said. The agency is working with state lawmakers, regulators and Gov. Gavin Newsom's office to tackle the challenges.

'Period of reassessment' in 2022

Developers have walked away from energy storage projects in other states this year as well, including Hawaii and New Mexico, because of eroding economics.

PNM Resources Inc. operating arm Public Service Co. of New Mexico is renegotiating two solar-plus-storage deals — part of its now-delayed plan to retire the coal-fired San Juan generating station — after the original contract partners pulled out. "New developers have expressed interest in renegotiating the contractual price and delivery time frame," a utility spokesperson said in an email. "PNM is performing its due diligence to determine whether these renegotiated contracts would be in the best interest of its customers or whether there are better alternatives to meet our customers' needs."

Battery storage pricing in New Mexico has risen "anywhere from 30% to up over 100%" in the past six months to a year, Nicholas Phillips, the utility's director of resource planning, said in May at a meeting of the Western Electricity Coordinating Council.

"Everyone thought that battery prices would come down. The same way that solar panel prices came down over time, the thought is that battery prices would do the same thing," Louise Pesce, managing director of Mitsubishi UFJ Financial Group Inc.'s project finance banking team, said in an interview. "And this inflationary environment has obviously proven that that is not the case."

With many project sponsors already facing "razor-thin returns," developers are reassessing where they might be able to cut costs and which projects to prioritize "to keep yielding the returns that they are expecting," said Pesce, whose unit has financed a host of battery storage facilities.

"And when you couple the cost increases on the equipment side and the labor side with interest rate increases, the whole cost of projects, including the financing, is now materially higher than many had assumed it would be in their forecasted assumptions," the banker said.

"We're seeing a period of reassessment right now," Pesce added.

Some more advanced solar-plus-storage projects that were poised to seek financing before being stalled by the U.S. Commerce Department's import tariff investigation "are coming back now," Pesce said, after the Biden administration in early June waived potential tariffs for two years. "It's the projects that were in the planning stage [where] everyone's having to think about, 'What do I prioritize?'"

'Complete market correction' after 2023?

Energy storage experts widely expect battery storage installations to remain robust in the face of pricing headwinds and supply constraints, linked to the much larger demand for lithium-ion batteries from the auto sector.

"Despite rising battery prices, we still see very solid demand growth for battery energy storage," said Sam Wilkinson, a director on the clean energy technology and renewables research team at S&P Global Commodity Insights. Increasing capital expenditures are being offset by "highly volatile" wholesale electricity prices that create "stronger arbitrage opportunities for batteries," Wilkinson said. Surging home energy costs are making home solar-plus-storage more attractive amid an overarching push to reduce reliance on fossil fuels — all pointing toward building a business case for battery storage.

"When you're talking about the supply of things like metal, steel; when we are talking about interruption of shipping channels, geopolitical issues or even concerns about how components of any system are received anywhere in the world — those impacts are not unique to storage," said John Fernandes, a senior consultant at energy advisory and services firm Customized Energy Solutions. "We're not experiencing inflation on grid-scale batteries; we're experiencing inflation, period."

The recent trend of rising battery storage prices is likely temporary, according to Fernandes.

"I definitely don't perceive that this is going to be the new normal. We're looking at this as perhaps a 12- to 18-month phenomenon," Fernandes said, pointing to a potential "complete market correction or readjustment after 2023."

S&P Global Commodity Insights estimates that energy storage module costs have increased to nearly $200/kWh in 2022, after dropping from $376/kWh to $175/kWh between 2015 and 2020. By 2030, battery module costs will drop to $91/kWh, Commodity Insights predicts.

The battery storage industry faces ongoing supply constraints, however, stemming from its "relatively insignificant size" compared with the electric vehicle industry, Wilkinson said. The combined pipeline of the 10 largest energy storage system integrators, for instance, "is equal to less than 10% of the amount of batteries that Volkswagen AG is expected to buy in the next three years," Wilkinson added, citing a Commodity Insights estimate.

But two major factors point toward supply constraints easing for energy storage, according to Wilkinson. First is the anticipated scale-up of lithium iron phosphate, or LFP, technology, which is lower in materials cost than other lithium-ion chemistries but needs higher-volume production to lower manufacturing costs.

All 40 LFP manufacturers tracked by Commodity Insights are in China, by far the world's largest lithium-ion battery-maker and exporter to the United States, with the top tier of LFP suppliers largely focused on EVs.

The second, related factor is the possible emergence of a second tier of LFP manufacturers in China with sufficient capacity to serve the energy storage industry.

"Energy storage system integrators will look to form partnerships with these companies, and if the quality and reliability of their batteries can be validated to the extent they are considered bankable, a group of specialized energy storage battery manufacturers is likely to emerge, alleviating supply constraints," Wilkinson said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.