Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Aug, 2021

Steel prices in the U.S. have stormed to record levels, contributing to inflationary pressures in manufactured goods.

Source: maki_shmaki via Getty Images North America

The recent surge in commodity prices, which has fanned inflation in the U.S. and Europe, could be sustained by new demand from the Western world just as Chinese requirements start to wane.

|

|

Economic stimulus measures, including as much as $4.5 trillion of infrastructure and other spending in the U.S., may help industrial metals such as steel and copper maintain multi-year high prices following a China-fueled spike this year. Progress in COVID-19 vaccinations is also likely to support the global economy and commodities demand, offsetting a post-stimulus slowdown in China, the world's biggest user of raw materials.

U.S. spending "could go a long way to offsetting the weakening in China's demand," Bart Melek, head of commodity strategy at TD Securities, said in an interview. "This could be a pretty robust cycle."

The effects of rising commodity prices have rippled across the world. In the U.S., the consumer price index rose 5.4% year over year each month in June and July as the increase in energy prices and manufacturing costs fed through into U.S. inflation data. Prices rose 2.2% in the EU in July and 2.4% in the U.K. during June, driven by similar pressures.

"Commodities have filtered through directly to consumer prices but also indirectly in consumer goods, while the energy component has been an important factor in CPI," Gregory Daco, chief economist at consultancy Oxford Economics, said in an interview.

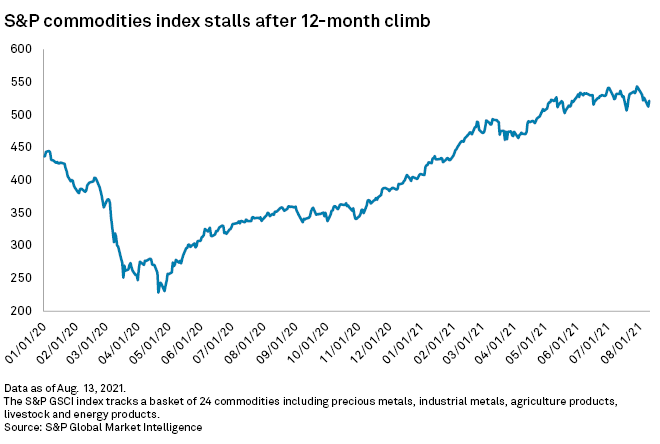

Commodity prices will likely only cool a little through year-end, according to an S&P Global Market Intelligence forecast, as infrastructure spending, supply constraints and the shift to renewable energy counter cooler Chinese demand. Global commodity prices are at the highest since late 2014, after surging 130% from a low in April 2020, based on the S&P GSCI index, which tracks a basket of 24 commodities.

Inflationary commodity prices

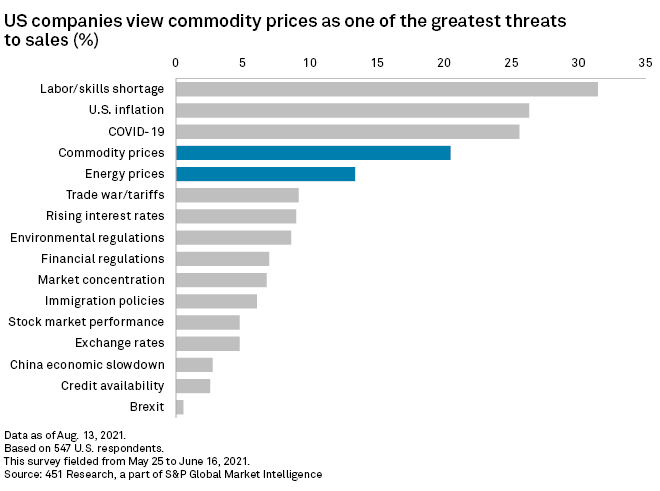

Businesses are feeling the pinch of higher input costs. A survey of 547 U.S. companies conducted by 451 Research found that about 21% of respondents consider commodity prices to be one of the greatest threats to their business's sales.

The rise in energy prices — considered separately in the survey — was a major threat for 13% of respondents.

Though China fed the surge in commodity prices, the country's industrial boom is showing signs of slowing down. The Caixin manufacturing purchasing managers' index — which tracks the performance of manufacturing firms — was 50.3 in July. A measurement of 50.0 indicates stability, so the latest reading means China's manufacturing sector is only expanding slightly.

The U.S. and Europe are poised to replace at least some of the falling demand from China, aided by the progress of their vaccination programs. About 50.7% of U.S. adults were fully vaccinated against COVID-19 as of Aug. 15, while the same figure for the EU was 63% and 77% in the U.K.

The U.S. has also unveiled a $1 trillion infrastructure plan to build bridges and roads, with the potential of a further $3.5 trillion spending plan to come. The U.S. Senate's recent passage of the infrastructure plan should boost commodity demand into 2022, while "continued momentum to tackle climate change through energy transition efforts could support commodities," Mark Ferguson, head of mining studies at S&P Global Market Intelligence, said in an email.

China sneezes, the world catches a cold

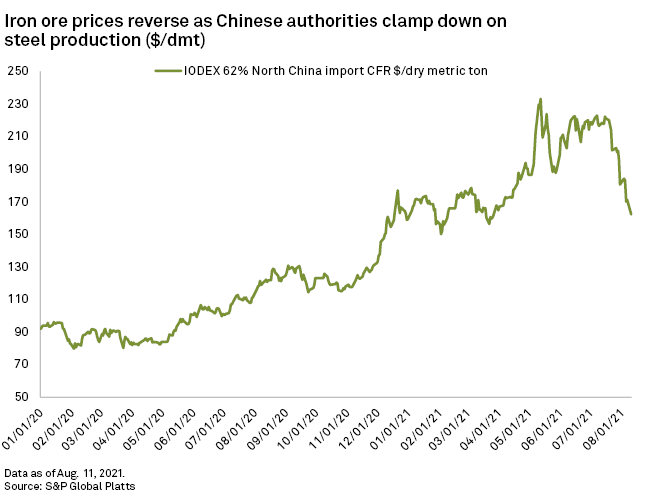

Chinese stimulus measures, including new spending and cost cuts for business, fueled a rebound in global commodity prices following a coronavirus slump last year. Global iron ore prices, for instance, hit a record-high of more than $233 per dry metric ton in May 2021, from $84 12 months earlier, according to the S&P Global Platts TSI index.

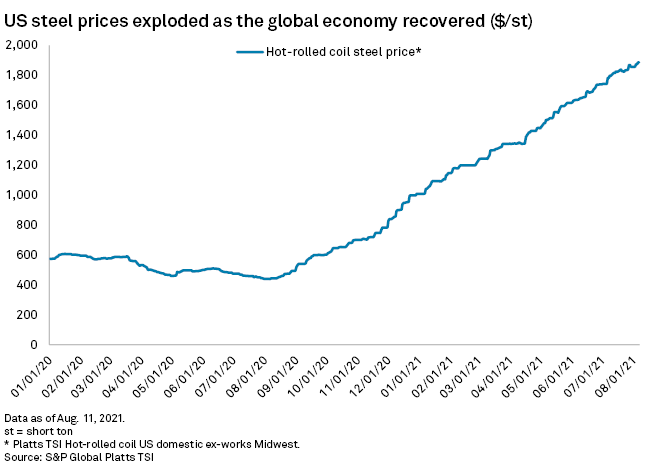

China produces more than half of the 1.88 billion tonnes of steel produced globally each year and drives global prices as a result. In the U.S., steel prices marched to record levels, leaving producers of home appliances, cars and other steel-dependent products to either absorb higher input costs or pass the costs onto consumers.

The jump in steel costs, along with a shortage of semiconductors, caused a surge in prices for new and used automobiles. Vehicles contributed 2 percentage points of the 4.5% rise in U.S. core consumer price index, which excludes volatile food and energy prices, in June .

As the Chinese government curbed steel production and imposed export tariffs to lower output, international iron ore prices fell even as demand remains robust elsewhere in the world. U.S. steel prices have continued to climb as demand outstrips supply.

COVID-19 rips through Asia

A resurgent COVID-19 adds uncertainty as the delta variant rips through Asia.

The price of oil has been volatile as the market reacts to the rising number of cases in China, and the International Energy Agency said the demand outlook has "shifted lower."

In markets such as copper, exporter countries such as Malaysia could reduce supply as COVID-19 spreads in the country, pushing up prices.

Meanwhile, the burden of high commodity prices for industrial producers has prompted Chinese authorities to act. State-held

TD Securities' Melek expects commodity supply issues to persist with the oil cartel OPEC being cautious in increasing output, potential strikes in mining locations and a broad lack of investment across the commodities spectrum.

The supply constraints, coupled with the increased demand from developed economies, could more than account for weaker Chinese demand.

451 Research is part of S&P Global Market Intelligence. S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.