S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Feb, 2023

By Taylor Kuykendall, Darren Sweeney, and Anna Duquiatan

| NiSource Inc. subsidiary Northern Indiana Public Service Co. will retire the 469-MW Michigan City coal plant in LaPorte County, Ind., by 2028 as the company exits coal-fired generation. |

U.S. coal-fired power capacity has been fading quickly for nearly a decade, but the Inflation Reduction Act passed in 2022 will accelerate the trend, according to a forecast from S&P Global Market Intelligence.

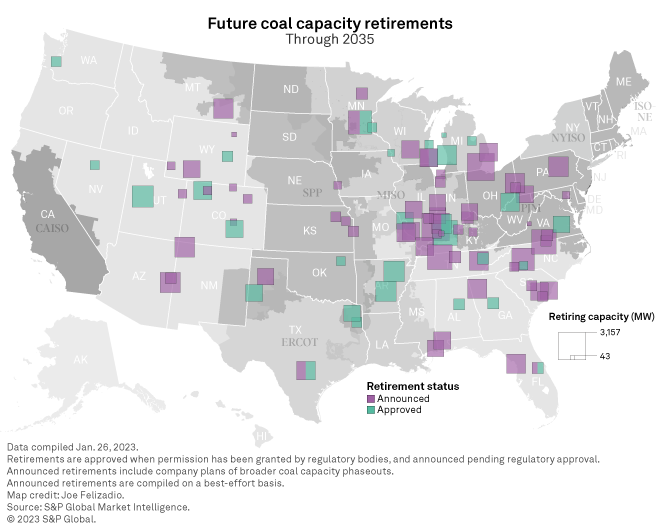

Of the 58.7 GW of coal plant capacity projected for retirement by 2030, about 24.3 GW, or 41.4%, are due to the Inflation Reduction Act, or IRA, making coal less competitive than other resources, said Steve Piper, director of energy research for S&P Global Commodity Insights.

"Utilities with coal are unspooling their individuated plans to unwind those assets and build up stuff that [utility] commissioners support and the public supports: net-zero, renewables, storage, all of that," Piper said.

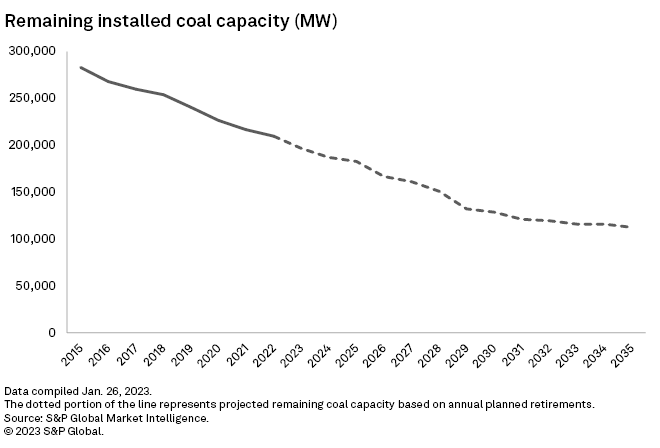

By 2030, Market Intelligence forecasts that electricity demand for coal will decline by 33.6% and coal-fired power will account for just 10.4% of electricity generation.

'Tipping point'

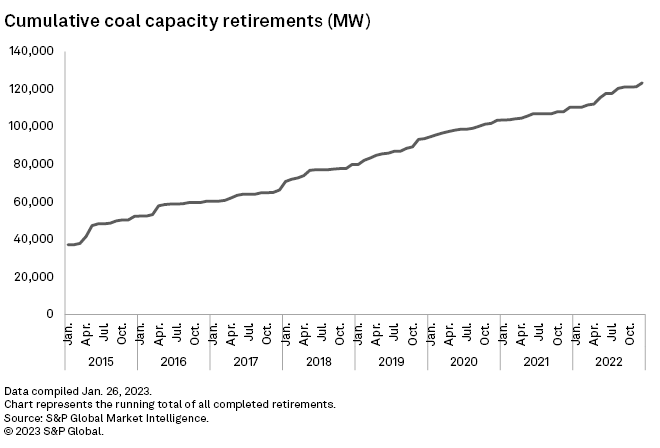

Market Intelligence data also shows that power generators have shut down 86.2 GW of coal capacity since 2015, an average of 10.8 GW per year. Based on existing retirement announcements — many of which occurred before the IRA became law — the pace of retirements will be steady through 2030. Utility-announced closures will peak in 2028.

The falling price of renewable energy, a boom in low-priced natural gas production, and clean air and water regulations have long pressured the declining U.S. coal sector. Now, the Biden administration aims to decarbonize the power sector by 2035, a move that may require coal plants to retire or install costly emissions abatement technology.

Retirements are also likely to increase as plants age and end efficient operations. The capacity-weighted average age of the U.S. coal fleet is 43 years, while the average age of a retiring coal unit has dropped to 47 years in 2021, compared to an average retirement age of 49 years between 2007 and 2021.

Counting only plants with announced retirement years, U.S. coal generating capacity will fall to below 100 GW as soon as 2037, down from about 283 GW at the end of 2015. Many of those retirements are frontloaded, with particularly large drop-offs expected in 2025, 2027 and 2028.

Planned retirements decrease after 2030, but with the IRA, more are likely to be added to the list.

"I think it is pretty clear that coal generation has surpassed the tipping point," Morningstar analyst Travis Miller told Commodity Insights. "Even before the IRA, I think it was clear that coal was on its way out. ... I think there is still some debate out there about the length of time it takes to get to a small amount of coal generation or even eliminate coal generation."

Michigan-based DTE Energy Co. said the IRA is an overall positive for its business. The company announced the closure of two of its coal-fired power plants in December 2022 to help reach net-zero greenhouse gas emissions by 2050. The law not only supports a transition to renewable energy but also helps the company reach customer affordability goals, company executives said on an October 2022 earnings call.

"The wind and solar production tax credit support a more affordable acceleration of our clean energy transition as we build our renewable portfolio," David Ruud, senior vice president and CFO of DTE, said on the call.

Other elements of the IRA, such as tax credits for nuclear generation and other forms of energy, are further bolstering a shift away from carbon-intensive energy generation, Ruud said.

"We did see that just the decreasing costs of wind and solar would eventually start catching up with more and more coal plants," said Eric Gimon, a senior fellow at Energy Innovation. "What this report shows is that [the shift has] really been significantly accelerated by the IRA. That acceleration opens up some really interesting opportunities. The savings are so substantial that you can start funding local replacement of capacity as well as energy by putting in batteries."

Companies have a schedule to keep

Some utilities have no plans to change their retirement schedules for coal plants.

American Electric Power Co. Inc., or AEP, is moving forward with plans to retire more than 4.7 GW of coal-fired capacity from 2023 through 2028, including its Pirkey, Northeastern 3, Rockport and Welsh units. Coal generation is expected to represent less than 5% of AEP's fleet by the end of 2028.

"Our planned retirement dates have not changed, and we will continue to evaluate how we most efficiently meet our customers' generation needs through our comprehensive integrated resource planning processes," AEP spokesperson Scott Blake said. "As with all plant retirements, we are working with our regulators, local officials and community members to examine the best use of plant sites going forward."

Duke Energy Corp., one of the nation's top investor-owned utilities with about 16 GW of coal-fired generating capacity, plans to fully exit coal by 2035, subject to regulatory approval.

The company sees potential for reusing former coal plant sites for battery storage and cleaner generation resources.

"We do put a priority on using existing sites (including coal sites) for new generation so we can leverage the existing transmission infrastructure, roads for transporting materials, etc.," Duke Energy spokesperson Neil Nissan said in an email.

A role for coal

A role for coal

Despite the headwinds facing coal generation, Morningstar's Miller said, "coal is a phenomenal domestic, secure energy supply source."

Miller said coal plants could keep operating "in places where the grid is extremely sensitive to reliability issues," with the development of carbon capture systems providing another potential lifeline.

Alliance Resource Partners LP President and CEO Joseph Craft said on a Jan. 30 earnings call that coal continues to play a vital role in keeping the lights on. "Forced retirements of a significant portion of the country's coal-fired generation has exposed the grid" to potential blackouts, Craft said.

"If the technology and the costs around carbon capture improve, I think you could see a lot more coal plants stick around in 20 years," Miller said.