S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Nov, 2022

By Michael O'Connor

| Shoppers are finding more discounts this holiday shopping season as retailers look to reduce inventories. |

High inflation and ongoing retail supply chain issues are casting dark clouds over the important U.S. holiday shopping period.

Sales forecasts for the period, which generally runs from October through December, show the growth of total sales over the prior year will be undercut by soaring inflation, leading to a marked slowdown from recent years that were buoyed by pent-up pandemic demand and consumers awash with extra cash.

Holiday sales growth can make or break the finances of many retailers and serves as a bellwether for the economy as consumer spending accounts for nearly 70% of U.S. GDP. Amazon.com Inc. has already warned that inflation and other macroeconomic concerns could negatively impact its holiday sales in the fourth quarter. As a growing number of signals point toward a recession, forecasters have taken a somber view of just how robust the season will be.

"Unfortunately, it's going to come down to a lot of the kind of bigger picture macro drivers that are a little bit out of the control of investors and retailers," said Mari Shor, a senior research analyst at Columbia Threadneedle Investments.

Consumer health

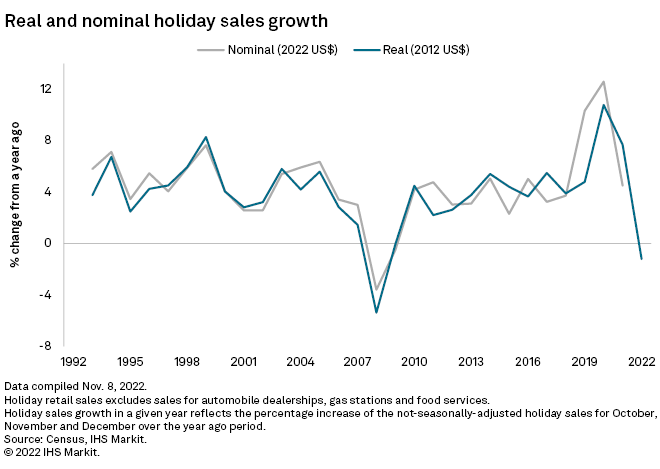

S&P Global Market Intelligence economists expect retail sales from October through December will fall 1.2% compared to the same three months in 2021 when accounting for inflation. Consumer price increases reached a 40-year peak over the summer and remained elevated, with October prices rising 7.7% from the prior year, according to Bureau of Labor Statistics data released Nov. 10.

The forecast represents the first time in 30 years that price increases are outpacing the rise in current-dollar spending, Market Intelligence economists wrote in a Nov. 3 report. Without accounting for inflation, total sales will rise 4.5% over 2021, faster growth than before the pandemic.

The upcoming holiday season will have a tough comparison. Sales grew by double-digits in 2020, even accounting for the milder inflation at the time, and rose 7.7% in 2021, according to a Market Intelligence analysis of U.S. Census Bureau data. The Census Bureau will give a preview of the holiday period Nov. 16, when it releases an advance estimate for October retail sales.

Meanwhile, the National Retail Federation, or NRF, is more optimistic in its outlook, calling for stronger growth of 6% to 8% in November and December retail sales, excluding spending at car dealers, gas stations and restaurants. Consumers are spending on holiday shopping despite the impact of higher prices, NRF President and CEO Matthew Shay said in a Nov. 3 release.

"Many households will supplement spending with savings and credit to provide a cushion and result in a positive holiday season," Shay said.

The slowing economy and declining demand will likely eat into holiday shopping, according to consultancy Deloitte. The firm expects slower holiday shopping growth this year than in 2021.

Retailer fortunes

Belt-tightening is also likely to weigh on the upcoming holiday shopping season, said Michael Arone, chief investment strategist for State Street Global Advisors. Holiday shoppers may get relief from retailers as they slash prices to unload unwanted inventory heading into 2023, Arone said. That could be bad news for retailers' bottom lines.

"Swelling inventories and price discounts will likely negatively impact retailers' fourth-quarter earnings results," Arone said.

Throughout the pandemic, surging demand for apparel, electronics and home products exacerbated supply chain problems and meant many retailers did not have enough inventory. As the pandemic abated demand has shifted away from those categories, but most retailers underestimated just how dramatic the switch would be, leaving them with more inventory than they would like, said Shor of Columbia Threadneedle Investments. Some retailers have reduced their orders for the holidays as they strike a more conservative approach, but it is unclear if they are being conservative enough given how heavy inventory is for everyone, Shor said.

"The risk that elevated inventories are carried into the new year is rising," Shor said.

With more people being called back to offices, business attire could be popular with shoppers, while electronics could suffer given how many people already upgraded their home offices and living rooms when lockdowns were more prevalent. Retailers have and are expected to continue aggressively discounting items in response to inventory challenges and high inflation.

For example, Walmart Inc.'s markdowns of apparel put financial pressure on the company but helped it reduce inventory levels and relieve pressures on stores and the supply chain, the company reported earlier this year. Walmart also canceled billions of dollars in orders to improve its inventory levels and be better positioned ahead of the holiday season. Target Corp., meanwhile, has enacted "countless" promotions and markdown programs to quickly move excess merchandise and improve its supply chain. The retailers will report third-quarter results later in November.

The pandemic accelerated the trend of retailers placing bigger bets on fewer items to avoid being left with excess inventory, and this will continue to be a trend as retailers try to increase their working capital and profit margins and become more precise with their inventory levels, said Dave Hamilton, senior director for retail industry strategy at Blue Yonder.

Another growing trend is the impact of returns, Hamilton said. With online shopping still popular among shoppers, there are likely to be increased returns, with the typical return rate around 20% of online sales, Hamilton said. And as inflation continues to drive up shipping and labor costs, the price of completing returns will continue to increase, Hamilton said. About $218 billion of online purchases were returned in 2021, according to the National Retail Federation.

"To avoid drag to their bottom lines, retailers must shift their policies, most likely charging a return fee that covers part of shipping, so they don't have to impact upfront prices during a time when shoppers are price-sensitive due to inflation," Hamilton said.