S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

19 Nov, 2021

|

Investors expect prices for groceries and other basics to continue rising, boosting U.S. equities in many sectors. |

As inflation surges to levels not seen in decades, investors may be turning to an unlikely haven: the U.S. stock market.

"Stocks have become one of the best inflation hedges because they can come with long-term, above-inflationary growth characteristics," said Phil Toews, CEO and portfolio manager of Toews Asset Management.

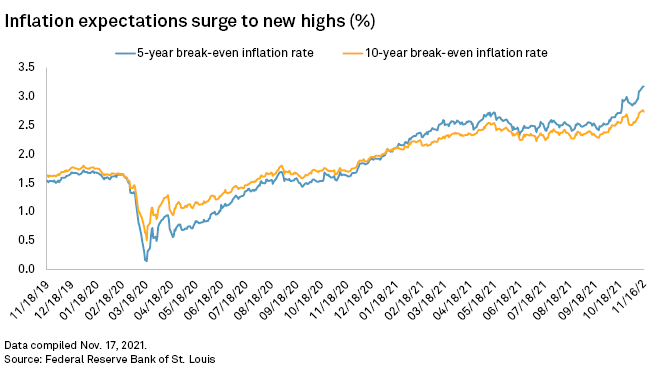

In October, the consumer price index, the market's preferred inflation metric, jumped 6.2%, the highest year-over-year increase since November 1990. The five- and 10-year break-even rates, a rough measure of the bond market's view of short- and long-term inflation, have surged to new highs, up 122 and 78 basis points, respectively, since the start of 2021.

The impact on equities will not be felt equally, as stocks of different sectors and sizes will respond differently, said Paul Schatz, president of Heritage Capital. "At the most granular level, stocks have idiosyncratic risk, so just because a company falls in a given sector doesn't mean it will succeed in an inflationary environment," Schatz said.

Energy windfall

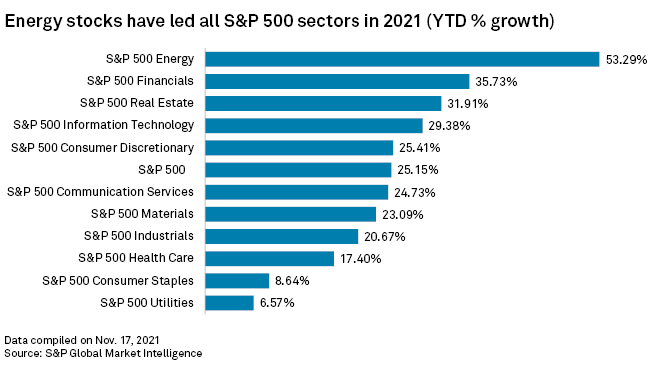

Surging inflation has been a windfall for the energy sector as crude oil and fuel prices have skyrocketed in the face of rising demand and limited supply growth. Since the start of 2021, S&P 500 Energy stocks jumped more than 53%, roughly double the large-cap index's 25%-plus growth over that stretch.

Energy and financials have been the top-performing S&P 500 sectors in 2021.

An analysis by S&P Dow Jones Indices found that energy stocks had the highest sensitivity, in terms of asset returns, to changes in inflation of any sector. Energy had twice as much inflation sensitivity as the next highest sector, materials.

Healthcare, consumer discretionary and communication services were the least sensitive to inflation increases, the analysis found.

Since the start of April, when inflation began to ramp upward, the benchmark U.S. Treasury 10-year bond yield has remained relatively steady, falling 6 bps to 1.63% as of Nov. 17. Bond yields tend to move inversely to prices.

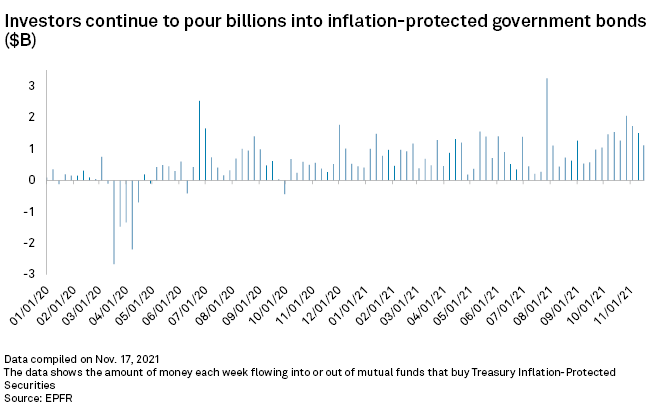

Investors have also moved into inflation-protected Treasurys. Since the start of April, investors have poured about $34.2 billion into mutual funds that buy Treasury Inflation-Protected Securities, compared to just $13.8 billion during the same period in 2020, according to EPFR, a company that provides fund flows and allocation data.

Cycling upward

Cyclical stocks — shares in companies that traditionally follow economic cycles of expansion and recession — have historically been highly sensitive to rising inflation, said John Davi, founder of Astoria Portfolio Advisors. Along with energy stocks, industrials, financials and materials will likely continue to rally with rising inflation.

"We believe this cohort of stocks would provide protection against higher inflation," Davi said. "In fact, it is doing so this year as we speak."

Investors should focus on companies with real pricing power, along with companies with products and services with relatively inelastic demand, said Steven Chiavarone, portfolio manager at Federated Hermes. "This includes energy, materials, industrials, parts of consumer."

Value stockswill likely fare better during high inflation than growth stocks, which could see their returns hindered by rising prices.

"Value companies have shorter duration. I buy these companies because I believe that they will be revalued higher today — or their dividend will rise in the short-run," Chiavarone said. "Therefore, that is less susceptible to being eroded away over time."

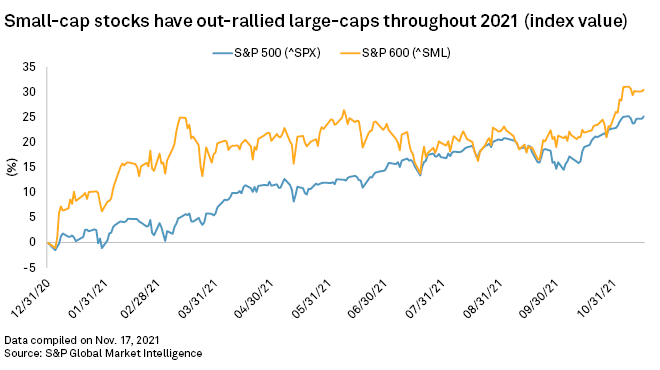

Small-cap stocks, which have outperformed large-cap stocks for much of 2021, are likely to continue to outperform as inflation rises, said Steven Lipper, a senior investment strategist at Royce Investment Partners. Small-cap value stocks, particularly materials suppliers and industrial distributors, have historically performed well during periods of high inflation.

Banks are also expected to perform well, as business loans increase to boost growth and as confidence grows in low loan losses in the future, Lipper said.

Is the peak approaching?

The question now is how long the current inflation cycle will continue, said Schatz of Heritage Capital, who believes a peak is near. "If I'm right, we should see certain indices, sectors and stocks begin to build tops over the coming few months."

In its Nov. 8, survey of consumer expectations, the Federal Reserve Bank of New York's median one-year ahead expected inflation rate reached 5.7%, up from just 3% in January and the highest level since the bank began tracking inflation expectations in 2013. Its three-year ahead rate climbed to 4.2%, up from 3% in January.

"It has been a perfect storm for higher inflation," said Davi of Astoria Portfolio Advisors, pointing to broken supply chains and excess liquidity from governments and central banks. "Remember, inflation was largely ignored over the past decade, and we think we are still in the early stages."

While high inflation boosts certain stocks, if it continues to rise it could cause an overall 25% decline in the S&P 500 in 2022, David Kostin, chief U.S. equity strategist at Goldman Sachs, wrote in a Nov. 16 report.

"Worse-than-expected inflation pressures could weigh on consumer demand, damage profit margins and lead to a more aggressive Fed than currently priced," Kostin wrote. "This would lead to zero earnings growth in 2022, alongside a large decline in valuations."

S&P Dow Jones Indices and S&P Global Market Intelligence are owned by S&P Global Inc.