S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Jun, 2022

By Kiran Shahid and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Rising inflation and interest rates are sapping the momentum of private equity dealmaking.

Dealmaking surged in late 2020 after private equity shook off a temporary COVID-19-related slowdown, setting the industry up for what turned out to be a record-setting year in 2021. Expectations that private equity could maintain that pace through 2022 met hard reality in the first five months of the year, with a tight labor market, Russia's war in Ukraine, ongoing supply chain snags and rising inflation.

"At the very least, the first five months of this year have put the fear of God into [general partners]," Kelly DePonte, managing director and head of research at Probitas Partners LP, recently told S&P Global Market Intelligence.

With valuation multiples tumbling, DePonte said private equity firms eyeing potential acquisitions now face new downside risks, as well as opportunities. Timing can make the difference between a bargain and a bad deal, a lesson DePonte said the industry saw play out in the late 2000s, during the global financial crisis.

Read more on the shifting outlook for dealmaking.

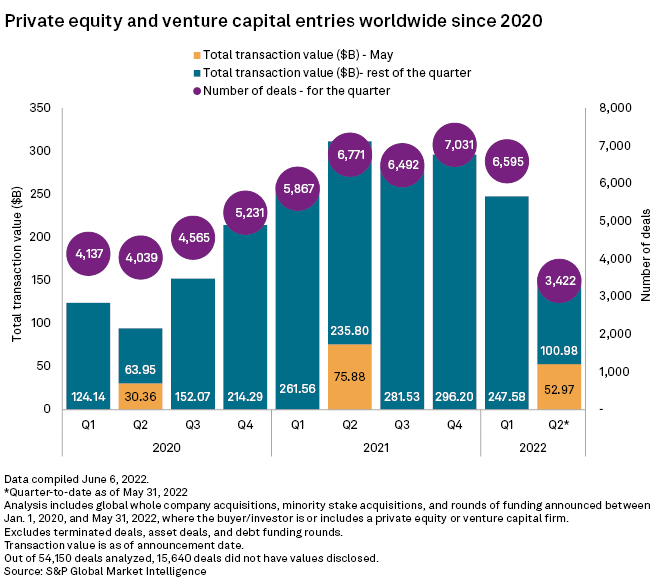

CHART OF THE WEEK: Deal value sinks to 12-month low

⮞ Measured in terms of both deal volume and value, global private equity and venture capital entries in May were at their lowest in at least 12 months.

⮞ The $52.97 billion of entries announced in May was down more than 30% from the same month a year ago.

⮞ Technology, media and telecommunications led all other sectors in deal value at $17.74 billion in May, but that total was down more than 40% from the $29.6 billion worth of deals announced in May 2021.

FUNDRAISING AND DEALS

* KKR & Co. Inc. agreed to buy a majority stake in Contabo Gmbh from Oakley Capital Investments Ltd.'s Oakley Capital IV fund. As part of the transaction, Oakley Capital V will acquire a minority stake in the cloud hosting platform.

Separately, KKR reached a deal to buy a majority stake in apexanalytix, which provides supply chain risk management software and services, from Carousel Capital Partners LP. Carousel will remain a minority shareholder in the company.

* The Carlyle Group Inc. is in exclusive talks to divest a controlling stake in France-based Euro Techno Com SAS to Cinven Ltd. The private equity giant had invested in the equipment distributor through Carlyle Europe Technology Partners IV. It will reinvest for a significant minority stake.

* Bain Capital LP plans to acquire a minority stake in sous vide cooking product manufacturer Cuisine Solutions Inc. via a $250 million growth capital investment.

* Thoma Bravo LP and cloud-based connected planning platform Anaplan Inc. amended the terms of their merger deal to $63.75 per share, down from the original purchase price of $66 per share, Dow Jones Newswires reported.

ELSEWHERE IN THE INDUSTRY

* Hahn & Co. agreed to purchase South Korea-based SK Group Ltd.'s polyester film business for about $1.3 billion.

* Branford Castle Partners LP, through its Branford Castle Fund II LP affiliate, purchased Handi Quilter Inc. from Premier Needle Arts Inc. The company manufactures and designs longarm quilting machines and related products and software.

* Greater Sum Ventures LLC led a majority investment in Vehlo, a shop management software provider serving the automotive repair industry. Existing Vehlo backers PSG Equity LLC, HarbourVest Partners LLC and Parkwood participated in the investment, along with new investor Lightyear Capital LLC.

* Atlas Holdings LLC wrapped up its acquisition of chicken company Foster Farms, Dow Jones Newswires reported.

FOCUS ON: HEALTHCARE

* EQT AB (publ) unit EQT Partners AB and Mubadala Investment Co. PJSC agreed to purchase Sweden-based Envirotainer AB for about €2.8 billion, Dow Jones reported. The medical freight provider is owned by Cinven and Novo Holdings. The deal is slated to close in the third quarter.

* Preclinical contract research organization AnaBios Corp. Inc. received a growth equity investment from Ampersand Management LLC.

* Frazier Healthcare Partners bought Apollo Intelligence LLC, a data and insights provider for the life sciences and healthcare industries.

* RoundTable Healthcare Management LLC, through RoundTable Healthcare Partners V LP, made a majority investment in Polymedco Inc., which supplies colorectal cancer and cardiac diagnostic tests.