Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Jul, 2023

By Karl Decena

| Indonesia's President Joko Widodo has pledged to improve the environmental standards in the country's mining industry amid the nation's rise as a major cobalt producer. Source: Dan Himbrechts/Getty Images News via Getty Images |

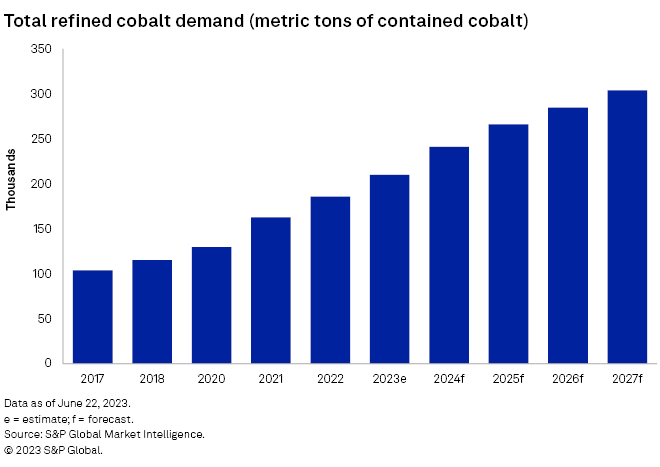

Indonesia increased its cobalt production more than fivefold in two years and is poised to become the world's second-largest producer of the blue metal, alarming top officials in the cobalt-dominant Democratic Republic of Congo.

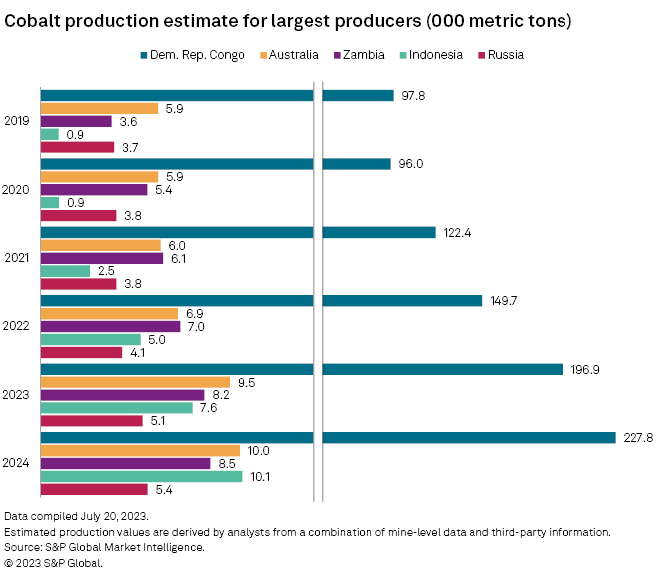

The Southeast Asian nation produced an estimated 5,000 metric tons of cobalt in 2022, surging from 2,500 metric tons in 2021, and 900 metric tons in 2019 and 2020, according to S&P Global Market Intelligence data. Indonesia's cobalt production is forecast to climb further to 10,100 metric tons in 2024 to slightly overtake Australia, the current No. 2 producer.

Indonesia's rise as a major cobalt producer has been driven by an influx of Chinese-backed investments in nickel-cobalt processing operations.

Indonesia's emergence as a top cobalt supplier could help diversify supply, but its cobalt producers face sustainability issues of their own, ranging from its environmental impact to worker safety concerns.

"The long-term growth potential of Indonesia is high," Dinah McLeod, director general of the Cobalt Institute, said in an email to S&P Global Commodity Insights. "However, it will be integral to ensure that Indonesian cobalt is mined in a sustainable and responsible manner."

Indonesia rising

Indonesia's cobalt industry has benefited from a push by the government to build a domestic supply chain for EVs. The government announced an export ban on nickel ore in 2019, which attracted several Chinese-backed investments in local processing including high-pressure acid leach (HPAL) facilities. HPAL uses sulfuric acid to recover nickel and cobalt from low-grade deposits of nickel laterite ore, which forms the bulk of the world's nickel resources.

China-backed, Indonesia-based PT Halmahera Persada Lygend, PT Huayue Nickel Cobalt, PT QMB New Energy Materials and PT Huayu own all four HPAL facilities in Indonesia that are running or scheduled to start operating in 2023, according to the Cobalt Institute's Cobalt Market Report 2022.

A further export ban in June on cobalt, nickel and other minerals has attracted additional investors. Carmakers Ford Motor Co. and Volkswagen AG have partnered with Chinese entities for new HPAL projects, as well as South Korea-based battery maker LG Energy Solution Ltd. and battery materials producer Ecopro Co. Ltd.

Indonesia could increase its cobalt production by more than 10 times by 2030 and by 14 times by 2040, the institute said.

"We have some concerns about the cobalt market. We have a challenge with logistics and power," Lukama told the Financial Times in late June. "The window of opportunity we had to drive the market and keep big value here — we lost it."

HPAL facilities pose environmental risks, as they are usually coal-fed and are known to have more than three times the emissions compared to traditional refining methods. In addition, they produce a high volume of waste.

"HPAL mining is considered to be polluting and harmful to the environment, which in turn has started to drive out sustainability-conscious investors," said Andries Gerbens, a cobalt trader at UK-based Darton Commodities.

Worker safety is also a concern in Indonesian mining, with a series of fatal accidents reported in recent years. Workers at some sites have also protested over pay and working conditions, according to a July 11 report by Al Jazeera.

In July 2022, numerous nongovernment organizations wrote an open letter asking Tesla Inc. CEO Elon Musk to avoid investing in Indonesia's nickel industry, citing alleged environmental damage and human rights violations in the sector. Indonesian President Joko Widodo has been reportedly wooing the carmaker to invest in the country, offering various incentives including tax breaks and a nickel mining concession.

Widodo has vowed to improve environmental standards in the country's mining industry. The government has reportedly banned the dumping of tailings in the sea and would also grant approvals for new smelters if powered by renewable energy sources.

"All of these concerns are being addressed but some will take longer than others to mitigate," said Harry Fisher, an analyst at UK-based Benchmark Mineral Intelligence. "But it is worth noting that there is a spectrum of [environmental, social and governance] compliance across the country."

International investors needed

Investment from ESG-conscious investors may help improve Indonesia's nickel-cobalt processing sector. Germany-based BASF SE and France-headquartered Eramet SA are developing their own HPAL project without Chinese support, and the plant is expected to start operating in 2026.

Investment interest in Indonesia is high due to its potential to become a major player in the EV supply chain, said Sacha Winzenried, an energy, utilities and resources lead advisor at PwC Indonesia.

"Given the size of the potential opportunity in the battery supply chain, it's likely that investment will come from many sources," Winzenried said in an email to Commodity Insights. "Indonesia's significant resource of critical minerals puts it in a good position to attract investment from major EV, metals and battery companies from around the world."

However, China's head start may make it difficult for international investors to make an impact in Indonesia's minerals processing industry.

"Running a large-scale mining operation in Indonesia that is both profitable and ESG-compliant is challenging, especially when competing with abundant Chinese capital," Gerbens said. "Like in the DRC, Indonesian nickel and cobalt mining will be dominated by Chinese players."

Questions about Congo's industry practices have led to reforms to ensure that cobalt production complies with high ESG standards. Experts believe the same can be done for Indonesia.

"The whole supply chain is focused on improving ESG standards for each part of the chain, particularly with rising scrutiny from the battery supply chain and governments," Fisher said. "However, this will take time."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.