S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Jun, 2022

By Ranina Sanglap and Mohammad Abbas Taqi

Indian banks are likely to see their profits improve further in the current fiscal year that started April 1, as they benefit from rising interest rates, declining nonperforming loans and higher loan growth.

Moderate policy rate increases would allow banks to reprice their floating rate-linked assets faster, thus helping boost their interest margins and profitability, said Anand Dama, a senior analyst at financial services research firm Emkay Global.

"Moderate inflation and rate hikes are credit/margin positive for banks," Dama added.

"Rising interest rates are beneficial for banks as the bulk of their loan books get priced upwards while deposits reprice with lags and hence net interest margins should go up in the near term," Krishnan Sitaraman, senior director at CRISIL Ratings, told S&P Global Market Intelligence.

India's central bank raised its benchmark repo rate by 40 basis points to 4.4% at an unscheduled review of its monetary settings on May 4, marking the first rate hike in nearly four years. It had cut the key rate to a record low of 4.0% in May 2020 to support the country's pandemic-hit economy. More rate hikes are likely as inflation is projected to remain high due to soaring commodities and food prices. In April, the IMF projected 2022 inflation to be 5.7% in advanced economies and 8.7% in emerging market and developing economies, 1.8 and 2.8 percentage points higher, respectively, than its previous projection in January.

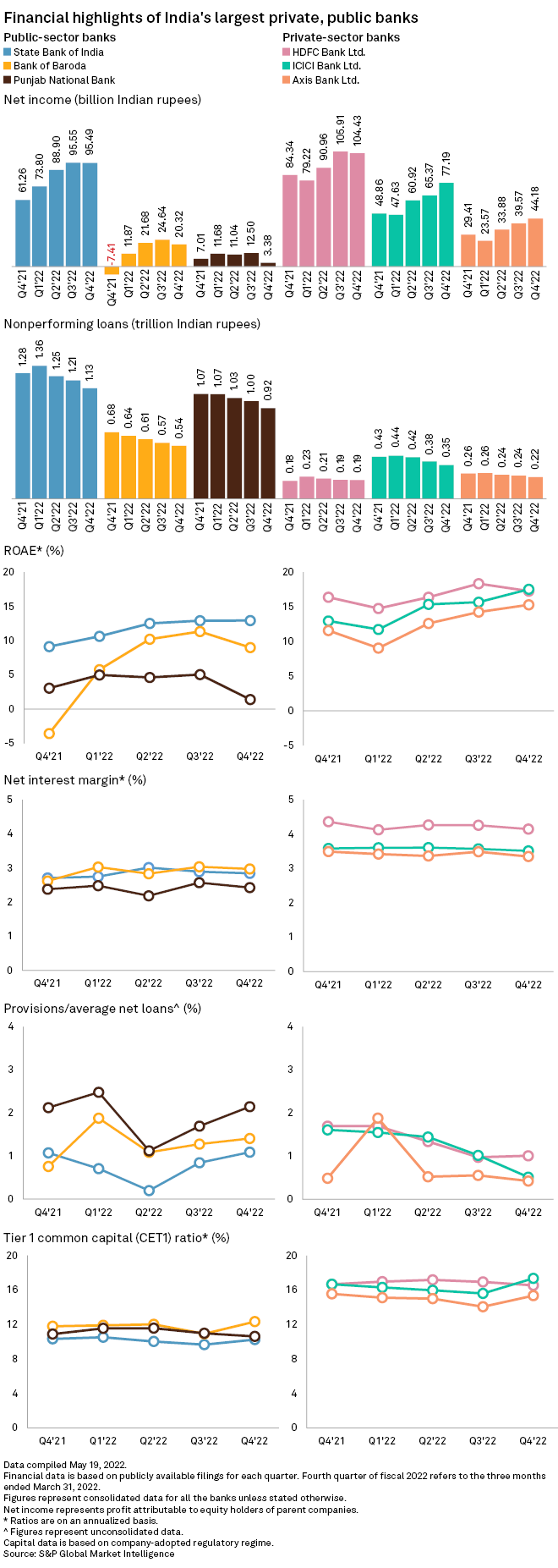

Except for state-run Punjab National Bank, all six of the largest public and private sector banks logged year-over-year increases in net profit in the fiscal fourth quarter ended March 31. State Bank of India, the country's biggest lender by assets, reported 95.49 billion rupees in net income for the fiscal fourth quarter, up from 61.26 billion rupees in the prior-year period. HDFC Bank said its net income for the period increased to 104.43 billion rupees from 84.34 billion rupees.

For the fiscal year ended March 31, all the six banks reported year-year-year increases in net profit.

Bad loans, credit growth

India banks' profits will also get a boost from lower nonperforming loans and higher credit growth in the country, analysts said. Aside from some pockets of potential fresh stress in banks' loan books from export-oriented sectors, including textiles and jewelry, Dama does not expect any meaningful stress from the recent macroeconomic slowdown.

"Asset quality stress is largely behind," the analyst said, citing the Indian lenders' healthy provisions.

Except for HDFC Bank, all six banks saw year-over-year declines in their nonperforming loans for the fiscal fourth quarter.

Looking ahead, analysts expect the decline in overall nonperforming loansto continue for banks. Sitaraman said the trend of falling nonperforming loans was driven by an improvement in the asset quality of banks' corporate books, which constitutes 40% of bank credit.

Meanwhile, bank credit growth continues to pick up pace as the Indian economy recovers from the pandemic-induced slowdown.

According to Reserve Bank of India data released May 25, the banking sector's annual credit growth rate in India reached 10.8% in the March quarter, up from 8.4% recorded in the previous quarter and 5.6% in the prior-year quarter. Private sector banks logged an annual credit growth rate of 15.1% in the March quarter, compared to 7.8% for their public sector counterparts.

"Going forward, we expect credit growth of the banking system to pick up to 11% to 12% in [fiscal 2023], driven by an uptick in corporate credit where growth is expected to double to 8% to 9%," Sitaraman said.

As of May 31, US$1 was equivalent to 77.62 Indian rupees.