S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Apr, 2021

By Ranina Sanglap

Indian banks need to step up spending on technology as more customers shift to digital channels, straining their IT systems that have often been found to be lacking, including a series of glitches at the biggest private sector lender in the country that invited a rare rebuke from the regulator.

Lenders in India on aggregate spend between 1.5% and 2.0% of their annual revenue on technology, compared with a range of between 7.0% and 10% by global banks, according to PricewaterhouseCoopers India executives. Indian banks have invested more on customer-facing solutions than on their infrastructure backbone. Vivek Belgavi, India fintech and technology consulting leader at PwC, advised local lenders to scale up their technology spending to 5.0%, and up to 8.0% of their revenue.

"Indian banks will need to materially increase their spend on technology," Renny Thomas, senior partner, and Milan Mitra, associate partner at McKinsey & Company, said in a jointly written email. "This is largely in turn dependent on their transaction and product mix, with a larger intervention needed in retail banking segments," they said.

The coronavirus pandemic caused a surge in customers using digital banking channels and that, in turn, may have contributed to the overload on banks' IT systems in 2020. A report from FIS in September found that 68% of Indian consumers were using online or mobile banking to conduct financial transactions, with 51% expecting to continue to use these banking and payment methods after the pandemic.

Even before the pandemic, the Reserve Bank of India's Digital Payments Index rose to 207.84 in March 2020, from 153.47 a year ago and compared with a base score of 100 in March 2018 when the central bank started compiling the data. The numbers come with lag and the RBI is yet to publish the index for March 2021. More customers using online channels for their banking needs may have strained the IT infrastructure at some lenders.

Outages at major banks

The central bank on Dec. 2, 2020, ordered HDFC Bank Ltd. to temporarily stop all launches of its digital business generating activities following incidents of service outage over the previous two years. It ordered the lender's board to examine the lapses and fix accountability. The bank said at the time the latest outage in its internet banking and payment services on Nov. 21 was caused by a power failure at a primary data center. HDFC Bank's communications department didn't respond to an email from S&P Global Market Intelligence seeking details of the actions taken and progress made since the RBI order.

Customers of State Bank of India, the country's largest bank by assets, were unable to transact using the bank's YONO app in December 2020, just a month after the lender saw intermittent connectivity issues with its servers. Another outage was reported earlier this month.

SBI and HDFC are two of the leading banks in digital payments in India. SBI bank said it has a 24.7% market share in the number of mobile banking transactions and has signed up 32.8 million customers to its YONO digital app, according to the bank's third-quarter results announced in February.

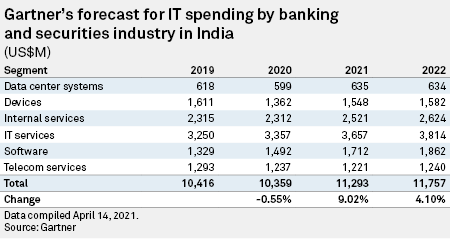

Research and advisory firm Gartner forecasts IT spending by Indian banks will increase by 9.02% in 2021 and 4.10% in 2022 from their total of US$10.36 billion in 2020.

Found wanting

"Only a few leading banks faced IT disruptions solely in their digital channels," Mahesh Hariharan, director and sales leader for financial services at Blue Prism, an intelligent automation software provider, told Market Intelligence. "For the most part, IT disruptions happened mainly at the infrastructure levels, as Indian banks had not planned for scaling these systems securely or at a fast pace," Hariharan said.

However, the banks' spending on IT may not be the only yardstick to measure digital success, particularly in India, said Hariharan. The cost of acquiring digital solutions is a lot less in India, so the impact of these digital solutions is huge due to scale, he said.

Banks don't have to completely throw away their legacy applications to update their systems. The key IT strategy for banks should be on a so-called "digital singularity" where all technology infrastructure, including legacy systems, can be combined to work together and have interoperability, Hariharan said.

"We're seeing the use of digital workers, or robotic processing automation software, as a key tool to do this. Other key areas of investment should be in cloud technology and intelligent automation," Hariharan added.

Indian banks will also be hard-pressed to invest more in their technology as competition intensifies in the banking space. The Reserve Bank of India in March set up an external committee to advise on new applications for banks. The move signals that the central bank may now be open to issue more bank licenses, potentially throwing open the sector to fintech players with stronger IT capabilities.