S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Jan, 2022

By Rebecca Isjwara and Rehan Ahmad

India’s green bond issuance is set to reach a new record in 2022, following an exceptionally strong 2021.

Corporate and bank issuers in India are likely to tap the climate-related debt market more actively as the world's third-largest emitter of carbon dioxide will need as much as $10 trillion to be carbon-neutral by 2070, experts said. More issuers will also turn to the offshore market where there is a deeper and wider pool of climate-conscious investors.

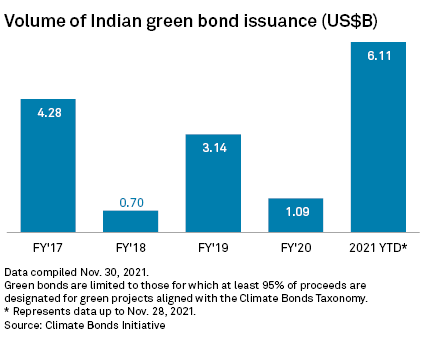

India issued $6.11 billion in green bonds during the first 11 months of 2021, according to U.K.-based green bond tracking agency Climate Bonds Initiative. It was the strongest year since green bonds from the country were first issued in 2015.

"We expect 2022 to be another stellar year for issuance of these bonds as Indian companies become increasing conscious of their carbon footprint," said Nidhi Sharma, director of investment strategy and products at LC Capital India, an investment management firm.

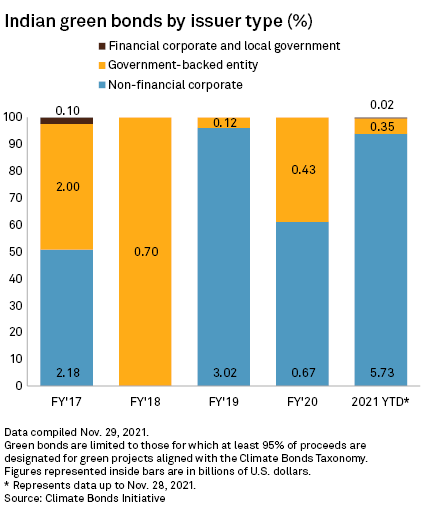

Banks will likely step up issuance of green debt to fund their growing lending program to accelerate India’s energy transition, said Sivananth Ramachandran, director of capital markets policy, India, CFA Institute. During the first 11 months of 2021, 94% of green bonds were issued by nonfinancial corporates, according to Climate Bonds Initiative.

"With much lending still dominated by banks, and with pressure on banks to accelerate lending to sustainable projects, it could be just a matter of time before more of them become active issuers of green bonds," said Ramachandran.

Offshore investors

More Indian issuers will also turn to the offshore bond market to access the wider and deeper capital pool outside their home country, experts said.

"While onshore green financing in India has grown substantially from its modest beginnings in 2004, financing net-zero for the world’s third-largest contributor of emissions will require access to the deep pool of capital that exists offshore," said Mitch Reznick, head of sustainable fixed income at Federated Hermes, a U.S.-based investment manager.

Green bonds issued by emerging markets such as India have a strong appeal to foreign investors, due to relatively attractive valuation and decent economic growth prospects, Reznick added.

Offshore funding could also help plug the $3.546 trillion gap between the total investment required to achieve net-zero and the amount that can be reasonably contributed by domestic banks, nonbank financial companies and capital markets, according to a Nov. 18 report by the Council on Energy, Environment and Water Center for Energy Finance, or CEEW-CEF, an Indian think tank.

The CEEW-CEF estimated India will need to invest $10.103 trillion by 2070 to be carbon-neutral. About $8.412 trillion will be needed to transform India's coal-reliant power sector to renewable energy sources, while another $1.494 trillion will be required to develop carbon capture and storage and green hydrogen technology, according to the think tank.

"The cumulative investments needed for net-zero societies may be bigger than India’s current size of economy. Hence there should be some shortfalls on their funding needs," said Jay Lee, Hong Kong-based partner at Simmons & Simmons, a law firm. India's nominal GDP was $2.66 trillion in 2020.

"To plug this gap, the country will need investments from developed economies in the form of concessional finance as well as private capital infusion from overseas investors in the form of bond and equity investments," said Prachurjya Bharaly, associate director, investment banking at Acuity Knowledge Partners, a research and analytics firm.

Rising rates, costs

While low borrowing costs were behind the strong issuance of green bonds in India in 2021, the momentum to go green will likely offset some of the impact from rising interest rates in the near future.

"If the hikes are at moderate levels, they may not meaningfully affect the growing green bonds issuance as the issuers’, the intermediaries’ and the investors’ interests in green bonds may be bigger than the adverse effect of the moderate-level hikes," said Simmons' Lee.

In addition, more financial incentives from the Indian government will also be crucial to accelerating the growth of the nation's green bond market, analysts said.

"These stimuli can assume the form of government grants to completely or partially cover the costs of external review, costs of credit rating and other costs linked to green bond issuance or tax deduction for issuance costs,” said Acuity's Bharaly.

For instance, regulators in other markets such as Hong Kong and Singapore fully reimburse issuers for external reviews if they meet government criteria, LC Capital’s Sharma said. "Such strategies could be followed in India which may make them more appealing to investors," Sharma added.

"Unlike China, which has grown its green bonds and financing steadily over seven to eight years, India seems to be a late comer on the significant growth of the green bonds. But, [2021] seems to show some good momentum of growth," said Lee.