S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Aug, 2022

By Gaurav Raghuvanshi, Zia Khan, and Mohammad Taqi

India's central bank has reignited the debate on bank privatization after it published a paper that offers an apparently contrarian view amid the government's efforts to overhaul the state-dominated sector.

The Reserve Bank of India on Aug. 18 published a paper authored by its executives that cautions the government against any wholesale privatization of government-owned banks, contrasting with the views of two leading Indian economists, one who previously led the government's top policy advisory body and the other who currently advises the prime minister's office.

"A big bang approach of privatization of these banks may do more harm than good," central bank researchers Snehal Herwadkar, Sonali Goel and Rishuka Bansal said in their report. "The government has already announced its intention to privatize two banks. Such a gradual approach would ensure that large scale privatization does not create a void in fulfilling important social objectives of financial inclusion and monetary transmission."

The views do not represent those of the Reserve Bank of India, the central bank said in a disclaimer. It followed up with another statement on Aug. 19, stressing that its researchers had only cautioned against any sudden moves to privatize lenders and noting that the government's current approach "would result in better outcomes."

The Indian government in February 2021 announced plans to eventually privatize all its companies in the so-called nonstrategic sectors while retaining a "bare minimum presence" in four strategic sectors that include financial institutions and defense. Finance Minister Nirmala Sitharman said at the time that the government plans to sell two state-owned banks and launch an initial public offering of Life Insurance Corp. of India to help raise funds to bridge its fiscal gap, made worse by the COVID-19 pandemic. While Life Insurance Corp. of India shares were listed in May, the proposed sale of banks has yet to happen.

Need to overhaul

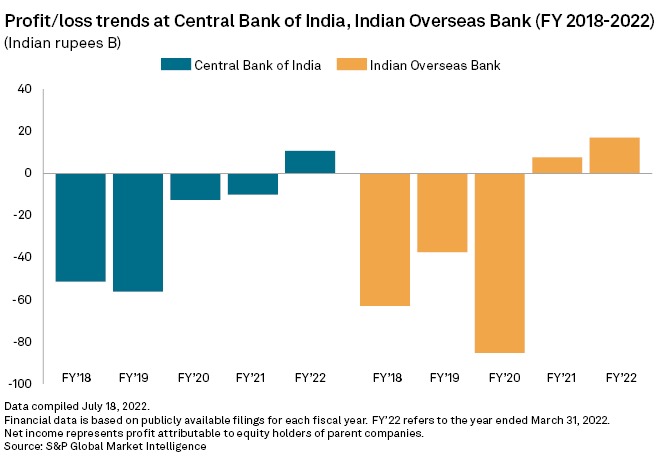

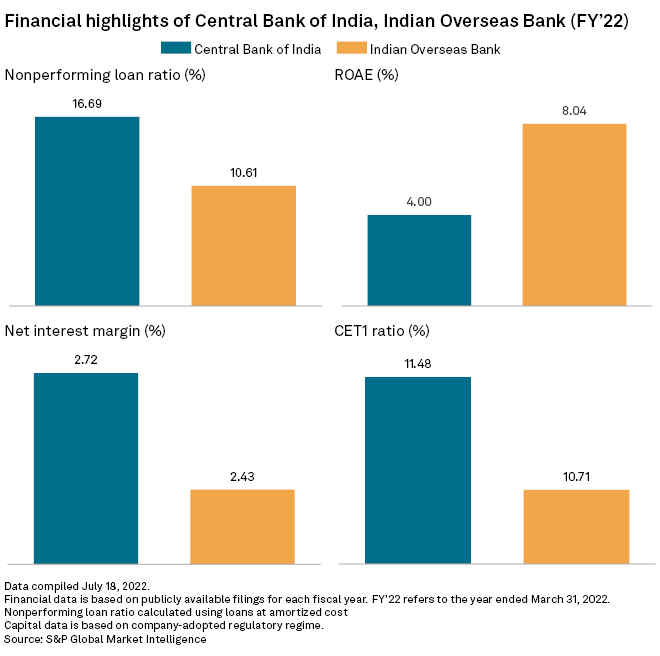

India sought to overhaul the state-dominated banking system in recent years through mergers and other initiatives as government-owned banks continued to underperform compared with their private sector peers despite receiving billions of dollars in capital injections.

Economists Arvind Panagariya and Poonam Gupta in July wrote in a paper for the India Policy Forum that the government should privatize all state-owned banks, except State Bank of India, the nation's biggest lender by assets. The government infused about $65.67 billion into state-owned banks over the last decade to help them tide over a bad loan crisis, Panagariya and Gupta said in the

Panagariya, who teaches Indian political economy at Columbia University, was previously chief of the government's main policy and planning adviser, Niti Aayog. Gupta is a member of the prime minister's economic advisory council and director general of the National Council of Applied Economic Research, a quasi-government think tank.

Panagariya and Gupta cited data to show that state-run banks have historically underperformed their private sector peers in key performance metrics. They warned that maintaining the status quo of a state-dominated banking system will result in further erosion of the market share of government banks, impeding the country's economic growth and inflicting substantial costs onto all stakeholders.

Faster, nimbler

Private sector banks have been growing at a faster pace in India and are now expanding their branch network to cover smaller cities and rural areas currently served almost exclusively by government lenders. In the last fiscal year ended March 31, for instance, private sector banks recorded double-digit growth in both credit and deposits in all four quarters, compared with single-digit growth at their public sector counterparts, according to Reserve Bank of India data.

The Reserve Bank of India paper said that while private sector banks are "more efficient in profit maximization, their public sector counterparts have done better in promoting financial inclusion." State-run banks have helped "the countercyclical monetary policy action to gain traction" by consistently allocating a larger proportion of their total credit to agriculture and industry.

The central bank noted that during the last easing cycle, state-owned lenders cut their rates substantially more than their private counterparts, and their deposit rates were relatively stickier. "By playing a crucial role in monetary transmission, the [public sector banks] have contributed to larger social goals," it said.

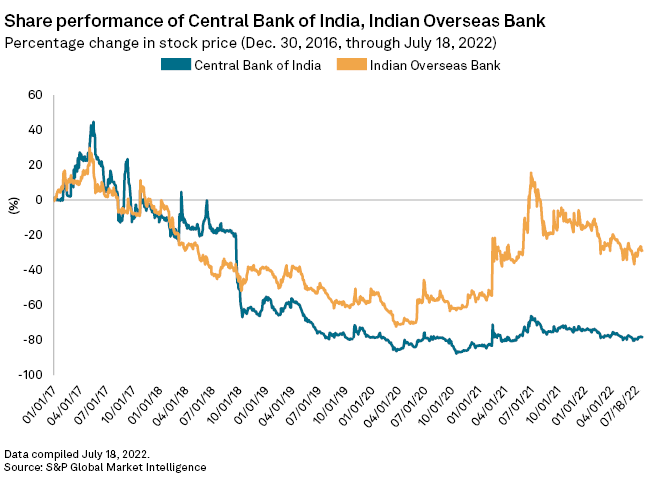

The government has not yet officially disclosed the names of the lenders to be privatized, but media reports said Central Bank of India and Indian Overseas Bank were shortlisted by the Niti Aayog. Reports had speculated that a bill to amend existing rules that require the government to own at least 51% in state-owned banks would be brought to the nation's parliament in the last session, though the bill was not introduced.

Privatization no panacea

The government and the central bank should continue with the banking sector reforms and clean-up exercises and should not assume that privatization is "some kind of a magic wand" that solves all problems, said Prasanna Tantri, associate professor of finance at the Indian School of Business.

"On the margin, [privatization] may improve the efficiency of capital allocation," Tantri said. To further reduce state-owned banks' bad loans, it is important to improve the insolvency and bankruptcy process, deepen the market for distressed loans, and improve bank governance and audit mechanisms, Tantri

Tantri said the government should not try to time the market. The signal it will send by privatizing one or two banks is far more valuable than the money it may lose in the short term, he said, adding that such a move would

Hemindra Hazari, a Mumbai-based independent banking analyst, said the government should improve management of state-owned banks and strengthen their governance norms instead of privatizing them.

"You have to strengthen your governance norms. You should put in structures, [and] change the management to address the problems," Hazari said. "That is where the problem has to be tackled. Even in the private sector, there have been a lot of scams."