Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jan, 2021

By Lindsey Hall

|

|

CEOs from across corporate America spoke out in response to President Donald Trump's refusal to commit to a peaceful transition of power and the subsequent violence on Jan. 6 in Washington, D.C. Last week's events make it clear that expectations of business leaders in times of social unrest are rapidly changing and inaction is less of an option as the environmental, social and governance movement gains traction in the U.S.

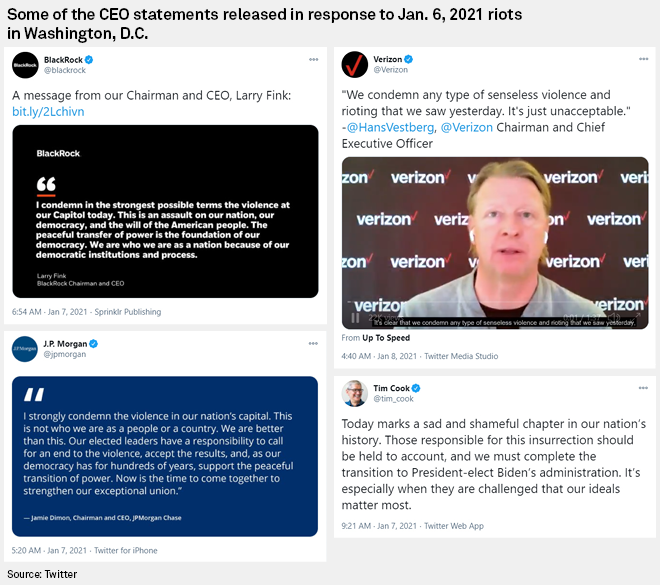

After rioters stormed the Capitol building in an attempt to prevent Congress from certifying the Electoral College results, many CEOs issued statements condemning the violence. BlackRock Inc. CEO Larry Fink, head of the world's largest asset manager, called the riots "an assault on our nation, our democracy, and the will of the American people."

The National Association of Manufacturers, a trade group that has been supportive of Trump in the past, called the rioters "armed thugs" and urged Vice President Mike Pence to consider invoking the 25th Amendment to remove Trump from office for his role in inciting the violence.

This is not the first time in recent memory that the business community has spoken out in response to social unrest. In 2020, video of George Floyd's arrest shocked the nation and led to marches, demonstrations and a flurry of CEO statements condemning racism and pledging support for people of color. And after white supremacist riots in Charlottesville, Va., in August 2017, Trump went on television and said that there were "very fine people on both sides." That led a number of CEOs to leave various presidential councils and working groups and generally distance themselves from the Trump administration.

|

|

"There was a rush of action in August 2017. And then they kind of tiptoed back," said Jonas Kron, chief advocacy officer at sustainable investment firm Trillium Asset Management LLC. "CEOs, boards of directors, company leadership — they can't go through this sort of ebb and flow anymore."

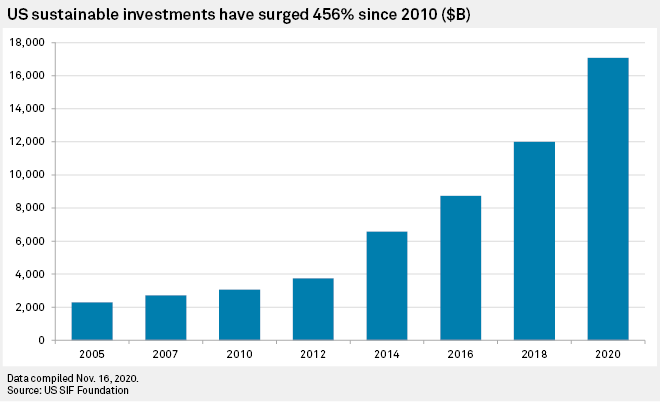

That is in part because the ESG movement is becoming increasingly mainstream. Sustainable investments grew in the U.S. to more than $17 trillion at the outset of 2020, according to U.S. SIF, or the Forum for Sustainable and Responsible Investment. The group found that assets sustainably invested at the beginning of 2020 accounted for about one-third of the total $51.4 trillion of assets under management in the U.S. Those investors are demanding that companies pay attention to social issues like the racial diversity of their boards, management teams and workforces, and in some cases are submitting shareholder proposals.

"More and more, employees, investors and consumers are expecting public companies to respond to social and other ESG issues," said Gary LaBranche, president and CEO of the National Investor Relations Institute, a trade group. "This is especially the case for larger consumer-facing companies, which are expected to condemn violence and to be on the right side of history."

Employees are increasingly holding companies accountable for their policies on social and political issues, and employers are paying attention. Even amid COVID-19, competition for talent is fierce and retention efforts remain a big focus for corporate America. The riots occurred the same week that Google LLC employees formed a workers' union.

"I've heard from senior leadership at very large companies that [employees are] one of the biggest drivers for them right now when it comes to these policy issues," Kron said. "The companies know that people care, that people don't leave themselves at the door when they go to work anymore, and that for the sake of their businesses — at the very least, the sake of their ability to attract and retain and have good productivity for their employees — they need to address these topics."

For sustainability-minded investors like Trillium, the point is that companies can no longer treat ESG and politics in separate silos from their business. Some companies appear to be taking note. Indeed, on Jan. 10, Bloomberg News reported that some of the largest U.S. banks — including JPMorgan Chase & Co., Citigroup Inc., Goldman Sachs Group Inc. and Morgan Stanley — are planning to suspend their political donations in light of the attack on the Capitol. That list continues to grow and includes companies across sectors.

"Companies have been behaving like they could pick and choose what part of the system they are interacting with, and they can't," Kron said. "You can't spend four years saying, 'Oh, I really appreciate the tax cuts and the deregulation, but I'm going to check out on the racism, sexism and xenophobia.'"

When to speak out?

Timing of statements on social unrest remains a delicate dance for CEOs. Several business leaders spoke out even before the Jan. 6 riots occurred. Partnership for New York City, for example, issued a letter Jan. 4 calling on Congress to certify the election results. PFNYC comprises the top CEOs based in and around New York or with a substantial presence in New York, including Republicans and Democrats. CEO support for the letter was swift, according to PFNYC President and CEO Kathryn Wylde. The group reached out to members the morning of Jan. 3 — the Sunday of a holiday weekend— and within four hours, had 91 signatures, Wylde said in an interview.

The business community had "no choice but to speak out" in response to the suggestion that America's electoral process was rigged, she said. "That means the creation of political instability, which is anathema to business and to business investment and to job creation."

The letter ultimately had about 200 signatures. "We're still adding signatures because I'm still getting calls from CEOs who say they want to be on the letter," she said Jan. 7. She said PFNYC chose not to issue a statement in the immediate aftermath of the Jan. 6 riots, however, because the violence was "predictable" and "the events spoke for themselves."

Many other CEOs issued statements about the riots only after the presidential vote was certified and once it was clear that Democrats won two seats in Georgia and would control the Senate.

"Business leaders wanted to make sure the public understood whose side they were on and that the Democratic leadership, the president and the majority in the Senate and Congress, knew that they were on the right side of this issue after the violence," Wylde said.

Those who made statements after the fact "felt it was both comfortable and important to speak out individually because [the Jan. 6] atrocities were so appalling that I think they couldn't stay silent without embarrassing themselves and their companies."

There are some risks in taking a public stance. Wylde said she spoke to CEOs who received nasty messages in response to their public statements from people threatening to take away business or calling the CEOs' comments inappropriate.

But that is a risk business leaders must grapple with as the playbook evolves for companies responding to social unrest.

"There's an approach in the world of crisis management and PR that [says] 'just hunker down and things will pass,'" said Trillium's Kron. "Things don't pass anymore."

Observers say the Washington, D.C., riots will only accelerate the growing expectation that business leaders step in to comment publicly on things that have historically been the purview of government.

"I believe that the political class has generally failed us and that business leaders are going to have to speak out at a local level as well as a national level," Wylde said.