S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Jun, 2021

By Corey Paul

The way that Cheniere Energy Inc. responds to the emissions concerns of its customers could be a key driver for a U.S. natural gas industry that is becoming more export oriented.

|

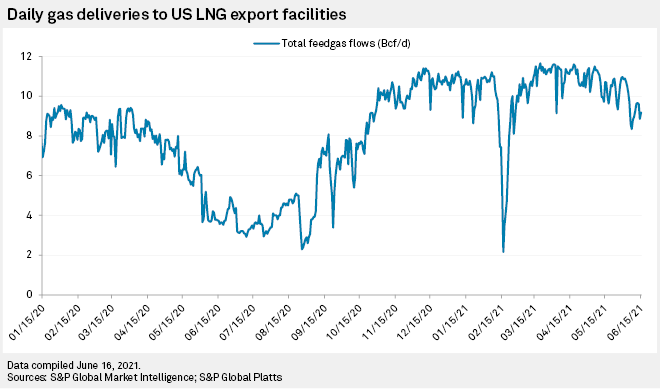

Once Cheniere's ninth liquefaction train starts producing LNG by the end of 2021, the company will be procuring up to about 8% of U.S. gas production on any given day, it said. |

A series of climate initiatives launched by Cheniere, the country's biggest LNG exporter, came on the eve of the company bringing its ninth liquefaction train online. The train will raise the company's annual export capacity to a combined 45 million tonnes per year across its two export plants in Louisiana and Texas.

"Any given day, at that point, we will be procuring roughly between 7% and 8% of all the gas that is produced in the U.S.," Executive Vice President and Chief Commercial Officer Anatol Feygin told S&P Global Market Intelligence.

Feygin also noted that Cheniere is the only U.S. LNG exporter that sources its own gas supplies. "We do occupy an enviable position from that standpoint and with the integrated procurement model that we have," he said. "If not us, who should be doing this?"

Cheniere has embraced its role as a bridge to international markets that have aggressive climate policies. The company has ramped up efforts to tackle one of the most pressing risks for the gas industry: climate-warming emissions throughout the natural gas supply chain.

LNG feedgas demand is expected to be the single-largest driver of growth in domestic gas consumption in the next 20 years, according to S&P Global Platts Analytics. That will make other countries' attitudes about the climate footprint of U.S. gas increasingly important to its future in the energy transition.

So far, efforts announced by Cheniere have focused on measuring the emissions associated with the LNG it exports, from wellhead to delivery point. Cheniere in late May announced that it is partnering with researchers to monitor emissions on a Cheniere-charted LNG tanker during a round-trip voyage from the company's Corpus Christi LNG export plant to a delivery point in Europe.

Next, Cheniere unveiled a collaboration with a handful of natural gas drillers in different regions and academic researchers to measure emissions of carbon dioxide and leaked or vented methane. This project will include ground-based, drone, aerial and satellite monitoring technologies with a goal of establishing an emissions baseline that Cheniere can then work to reduce. Cheniere expected the results of the studies to be published.

"You have to start somewhere, and the challenge that we have — that the North American industry has — is that for better and for worse it is a very fragmented industry, with us on any given day literally purchasing molecules from 100 producers, and transporting the molecules on dozens of systems, and using dozens of LNG carriers to move those volumes to market," Feygin said. "All of that has very different footprints, and we need to figure out what those are to focus our effort and improve on that initial baseline."

The complexity of the U.S. gas supply chain makes cleaning up lifecycle emissions especially challenging in the U.S. compared to projects in other parts of the world, where gas is most often coming from an integrated upstream project, IEA analyst Akos Losz said in an interview.

Satellite monitoring could also lead to a disproportionate amount of scrutiny on U.S. emissions, for mostly technical reasons, and a competitive disadvantage for U.S. LNG over time if methane emissions are not brought under control, Losz said. But a significant share of North American emissions can be eliminated at a "small or even negative cost," he said, meaning there is ample room to cut emissions "before the question of cost-competitiveness comes into play."

Offsets are secondary to mitigation

Cheniere also said it expects the emissions-measuring initiatives to support its plan to give LNG customers the emissions data from each cargo that it exports from 2022 onward to make its environmental footprint more transparent. One reason for providing the cargo emissions tags is so customers can offset lifecycle emissions by purchasing carbon credits, which support projects like reforestation efforts that absorb equivalent emissions from the atmosphere.

There has been a spate of such deals, with at least 14 carbon-neutral LNG cargoes announced by exporters throughout the world. Cheniere also said it delivered its first carbon-neutral cargo in early April to Royal Dutch Shell PLC.

"We view offsets as secondary to mitigation efforts," Tim Wyatt, Cheniere's senior vice president of corporate development and strategy, said in an interview. "Mitigation efforts on emissions are by far our priority and preference."

Competition to market the cleanest LNG

Questions remain about how the nascent efforts to assign greenhouse gas emissions to LNG cargoes will develop, and whether there will be widespread adoption and standardization of the practice as LNG sellers compete to offer the cleanest supplies.

"The market will find a way to get an answer to this question, and if it is a lack of transparency by the project, by the LNG supplier, it will use some kind of an estimate," Feygin said. "And I think in the not-too-distant future we are going to find ourselves in the place where projects that are better than that model will suggest will be transparent, and projects that are worse will be handicapped by the fact that they are assumed to be the modeled-number at best."

"That transparency is part of our commitment to our customers, will be part of our reputation, part of our performance, and like with a lot of things under the Cheniere umbrella, we will continue to improve on that," Feygin said.

Cheniere has said it is looking at the possibility of buying renewable energy to power the liquefaction trains at the Corpus Christi facility. Other steps the company is studying include carbon capture and storage, although officials acknowledge that government policy support would be critical.

Cheniere has also begun reporting on climate change policy scenarios to assess risks. Its first such report in April said the company expects LNG demand growth to continue for the next two decades, but that "continued action to reduce global [greenhouse gas] emissions may cause LNG demand to decline beyond 2040." The company also said its business model would be resilient under the scenarios it considered or other market factors.

"We think that natural gas and LNG, in particular, has a very long runway — well beyond the 2040 time frame," Feygin said. "And if we continue down this path of continuous improvement and reduction of our carbon footprint along our value chain, that just ensures that durability and longevity."

S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.