Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Nov, 2021

|

A proposed U.S. hydrogen production tax credit would give an advantage to green hydrogen produced with electrolyzer technology and zero-carbon power. Source: CNW Group/Air Liquide |

The hydrogen production tax credit proposed in the Democrats' latest federal budget reconciliation bill favors hydrogen produced from zero-carbon energy, but is likely substantial enough to also support facilities that use natural gas as a feedstock.

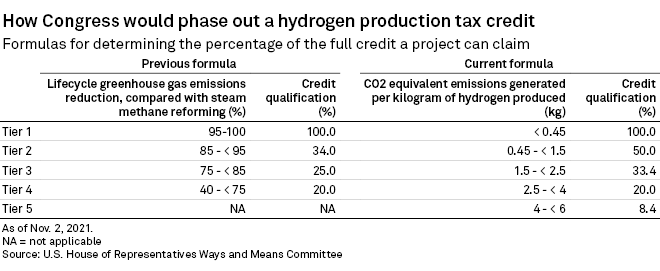

The latest version of the bill left the overall tax credit, known as a PTC, intact: A facility developer would still qualify for a credit of $3 per kilogram of hydrogen produced, or 60 cents per kilogram if the project does not meet labor requirements. What changed is the way in which the credit phases out — and how that would affect blue hydrogen production, which pairs carbon capture technology with steam methane reformation or autothermal reforming of natural gas.

Blue hydrogen has lately become a flashpoint in energy transition talks, following a study that found burning the fuel is more carbon intensive than simply combusting natural gas. There is emerging consensus among climate activists that the U.S. should only support green hydrogen, which is produced by splitting water using zero-carbon electric power and heat.

The Biden administration and much of Congress has taken a more color-blind approach to hydrogen, focusing instead on the carbon intensity of supplies and reflecting the view that blue hydrogen would help scale up a U.S. hydrogen economy. But a day before the House Ways and Means Committee revealed the slimmed-down budget bill, a group of progressive lawmakers came out against federal subsidies for blue hydrogen.

Room for blue hydrogen

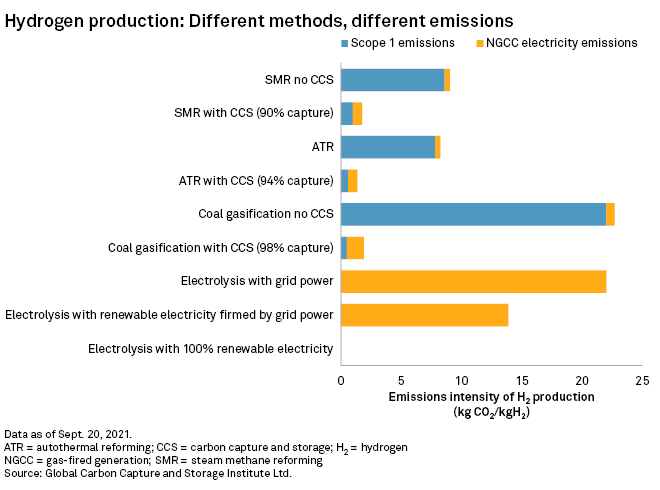

Both the initial and pared-back budget bills gave green hydrogen an advantage. Under the latest bill, producers need to generate no more than 0.45 kilograms of CO2-equivalent greenhouse gas emissions for each kilogram of hydrogen produced in order to claim the full $3/kg credit. Few blue hydrogen operations would be able to economically drive down their carbon intensity to below 0.45 kg of CO2-equivalent emissions, which pencils out to a roughly 96% carbon capture rate. Consequently, only green hydrogen facilities will likely be able to claim the full credit.

Yet the new formula gives hydrogen producers the opportunity to claim a larger percentage of the credit than the previous iteration allowed. Producers that generate no more than 1.5 kg of CO2-equivalent emissions would be able to claim 50% of the credit, or $1.50, while those that cap emissions at 2.5 kg would qualify for 33.4% of the credit.

Previously, producers had to achieve an 85% to 95% reduction in lifecycle greenhouse gas emissions to claim 34% of the credit. By comparison, if operators can achieve an 80%-95% capture rate, they would likely qualify for either 50% or 33.4% of the credit under the new formula, according to Neil Beup, head of global government affairs at industrial gas company Linde PLC.

"The technology has evolved and become much more reliable, and we have very, very high levels of confidence that the carbon capture for blue hydrogen is going to be at the top end of that chart," Beup said in an interview.

Those capture rates are within reason, particularly if the facility runs steadily at or near full capacity, according to Michael Wara, a senior research scholar at the Woods Institute for the Environment and director of the Climate and Energy Policy Program at Stanford University. Well-documented challenges in carbon capture pilots are largely tied to the difficulty of following non-baseload power generation and peaky production curves at other industrial facilities, he noted.

"The question is, can you run the system 24/7 in a particular way that's very stable? Because then the capture systems, which are well tested in other industrial applications, are going to work better," Wara said in an interview.

Restrictions and flexibility in bill

Since the legislation does not allow taxpayers to pair the PTC with the federal 45Q carbon capture tax credit, many blue hydrogen producers would likely seek to stack the PTC with another incentive. That could include participation in California's Low Carbon Fuel Standard market, which is oriented around transportation fuel.

While the legislation does not include an explicit investment tax credit, or ITC, it would allow a hydrogen facility developer whose project qualifies as an energy-producing facility to claim a Section 48 ITC. An ITC could be beneficial to a company seeking to build and operate a plant or carbon capture equipment to generate hydrogen for its own energy or feedstock consumption.

The new version of the legislation also specifies that the lifecycle greenhouse gas emissions for qualified hydrogen projects will only include emissions through the point of production. That means any emissions tied to the use of hydrogen will not count against a facility, which would benefit both blue and green hydrogen.