Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Nov, 2022

| After stonewalling fellow Democrats' climate agenda for about a year, Sen. Joe Manchin, D-W.Va., reversed course in July, paving the way for a hydrogen production tax credit. Source: Anna Moneymaker/Getty Images News/Getty Images North America |

A pair of federal hydrogen initiatives are giving natural gas utility executives renewed confidence in their ability to deploy the low-carbon fuel in distribution systems.

Hydrogen commentary was fairly muted throughout previous earnings reporting periods, as gas utilities launched previously announced pilot projects and awaited clarity on federal policy. But the chatter picked up during the most recent round of quarterly earnings calls, which wrapped Nov. 18.

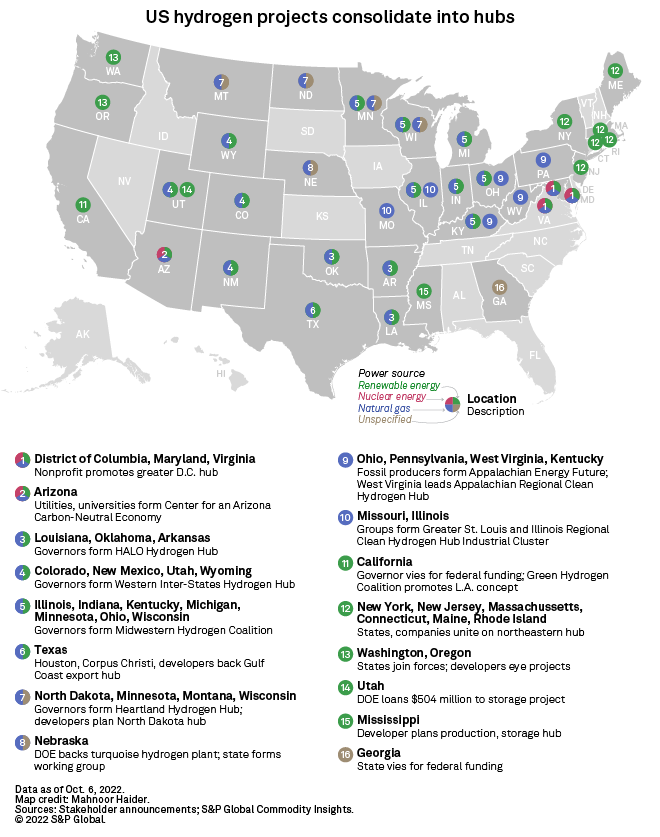

The catalysts were clear. In August, U.S. lawmakers included a low-carbon hydrogen production tax credit in the Inflation Reduction Act, the nation's largest-ever investment in clean energy. Additionally, the U.S. Energy Department advanced a plan to invest $8 billion to develop several regional hydrogen hubs.

The Inflation Reduction Act's renewable fuel incentives have "the potential to help accelerate our existing efforts to decarbonize" the gas grid, New Jersey Resources Corp. President and CEO Steve Westhoven told analysts during a Nov. 17 conference call. The company launched the first East Coast hydrogen blending pilot project about a year ago.

Xcel Energy Inc. Chairman, President and CEO Robert Frenzel said the Inflation Reduction Act's hydrogen production tax credit "should improve our competitive advantage in delivering low-cost, clean fuels." Like many of its peers, Xcel executives also linked the federal hydrogen hub program and other DOE support to its participation in the emerging hydrogen economy.

Pilot projects advance alongside hydrogen hub proposals

Xcel is participating in two hydrogen hub applications, one in the Upper Midwest and another among Western states including Colorado, Frenzel noted during an Oct. 27 conference call. Xcel has received a $12 million DOE grant to pilot high-temperature hydrogen production using excess steam and electric power from its Prairie Island nuclear plant in Minnesota.

Xcel's electric and gas utilities in Colorado, Minnesota, Wisconsin and neighboring states could also be consumers of hydrogen, Frenzel said. The company has committed to making some of its gas turbines hydrogen capable, the executive said.

The company is also evaluating opportunities to incorporate hydrogen into clean heat plans, which gas utilities will need to file in Colorado under new regulations, Xcel CFO Brian Van Abel said.

NiSource Inc. is participating in three regional hydrogen hubs, executives at the Merrillville, Ind., multi-utility told S&P Global Commodity Insights. The company is also studying the effect of hydrogen-gas blends on its distribution system and end-use equipment at a Pennsylvania training center, NiSource Senior Vice President for Strategy and Chief Risk Officer Shawn Anderson said during a Nov. 7 meeting with analysts.

"It is hard to forecast a time horizon" for blending substantial amounts of hydrogen, Anderson said in a Nov. 8 interview. "I think what's probably more likely is a few dedicated lines to industrial or commercial customers that are seeking that particular fuel source, as opposed to trying to blend it across your entire service territory."

During a Nov. 7 conference call, Essential Utilities Inc. Chairman and CEO Christopher Franklin highlighted the participation of Peoples Natural Gas Co. LLC in the Appalachian Regional Clean Hydrogen Hub, or ARCH2. The initiative, announced Sept. 28, is competing for federal funds to develop a blue hydrogen hub centered in West Virginia, with cooperation from stakeholders in Ohio, Pennsylvania and Kentucky. The initiative would produce hydrogen from gas using carbon capture.

Peoples Gas on Sept. 21 announced a partnership with the University of Pittsburgh to study the potential of "safely and securely transporting hydrogen through natural gas systems," Franklin said. The partners will initially study existing information and data on hydrogen distribution, focusing on the technical issues of shipping hydrogen and hydrogen-gas blends through gas pipelines. Afterward, they expect to conduct a pilot project to test the impacts of hydrogen on Peoples' distribution system.

During a Nov. 4 conference call, Martin Lyons, President and CEO of Midwest multi-utility Ameren Corp., promoted the formation of the Greater St. Louis and Illinois Regional Clean Hydrogen Hub Industrial Cluster in August. Just days earlier as earnings season ramped up, Dominion Energy Inc., Duke Energy Corp., Southern Co., Tennessee Valley Authority and PPL Corp. subsidiaries announced the formation of a Southeast hydrogen hub coalition.

Projects test regulatory waters

Executives also gave updates on several hydrogen projects that have advanced to the regulatory approval stage.

In Oregon, Northwest Natural Gas Co. on Nov. 1 withdrew its application for a long-planned hydrogen pilot project in West Eugene, Ore., while it conducts additional community outreach. Yet on Nov. 8, executives touted plans to test distributed hydrogen production through methane pyrolysis, sometimes called turquoise hydrogen. The Northwest Natural Holding Co. subsidiary also continued to progress its hydrogen blending study, with engineers set to test 10% and 15% blends of hydrogen at its Sherwood, Ore., test facility by year-end.

Southwest Gas Holdings Inc. and Sempra subsidiaries Southern California Gas Co. and San Diego Gas & Electric Co. were also awaiting approval of a pilot project to blend up to 20% hydrogen into the gas grid in three parts of California. The process could take 18 months, Justin Brown, president of Southwest Gas Holdings' gas utility subsidiary Southwest Gas Corp. told analysts Nov. 9.

Meanwhile, plans to develop a Los Angeles green hydrogen hub backed by SoCalGas hit a speed bump. Amid concerns from environmentalists, the Los Angeles City Council's energy committee delayed a vote to move forward with a plan to convert the Scattergood gas-fired power plant to run on hydrogen produced from zero-carbon electric power.

SoCalGas is also awaiting approval from state regulators to record project development costs for Angeles Link, a proposed pure hydrogen pipeline, Sempra Group President Kevin Sagara told analysts Nov. 3. An administrative law judge on Nov. 7 proposed allowing SoCalGas to record up to $26 million in feasibility studies in a memorandum account, with the option to increase the cap by 15%. The California Public Utilities Commission must approve the decision.

"That would be a very, very strong signal from the policymakers in the state of California about their commitment to making sure that we fully optimize the hydrogen future," Sempra Chairman and CEO Jeffrey Martin said.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.