Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Aug, 2021

By Jakema Lewis

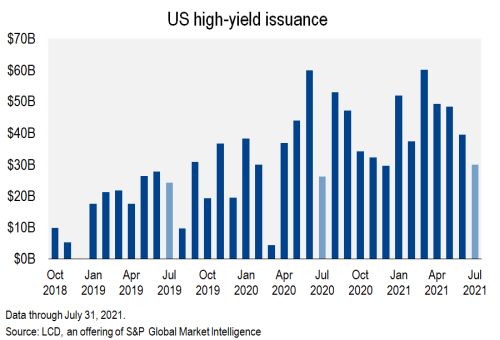

High-yield issuance continued at a record pace in July, even as the fast-spreading coronavirus delta variant rattled risk sentiment. The month wrapped with $30 billion in volume, the most ever for a July period, according to LCD. The figure reflects a 14.5% increase from the $26.2 billion logged for the month in 2020.

The sum extends a streak where monthly issuance has ranked as highest, or second-highest, against comparable calendar periods since May 2020.

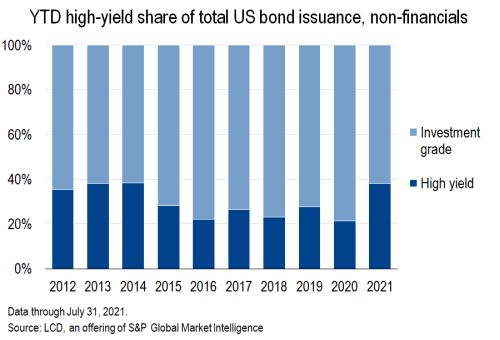

With the breakneck pace in the high-yield primary market persisting, year-to-date volume through July 31 totals $316.3 billion, tracking 32% ahead of the 2020 pace. Notably, high-yield's share of the $808 billion of overall U.S. corporate bond issuance this year (excluding financials and hybrid-structure deals) swelled to 38% through July, up from 21% for the same period last year.

July's high-yield total declined 24% from June's $39.5 billion output. At the same time, leveraged loan issuance ticked higher to $65.5 billion in July, from $59.3 billion in June. Net of those progressions, the overall $95.5 billion of leveraged finance volume across those two categories was down only slightly from June's nearly $99 billion total. Worth highlighting, the U.S. leveraged finance market topped $3 trillion in size for the first time as of June 30, according to S&P Global and LCD indexes.

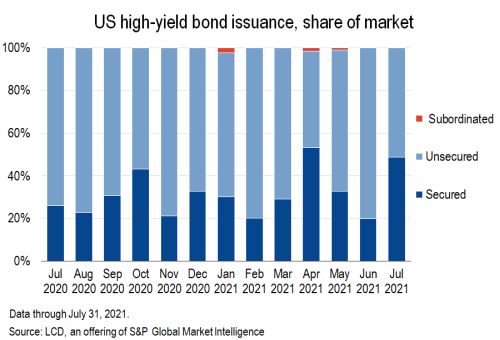

Secured bond placements clawed back in July to $14.6 billion, following a slim $7.9 billion in June. Unsecured bond issuance retreated to $15.4 billion, from $31.7 billion.

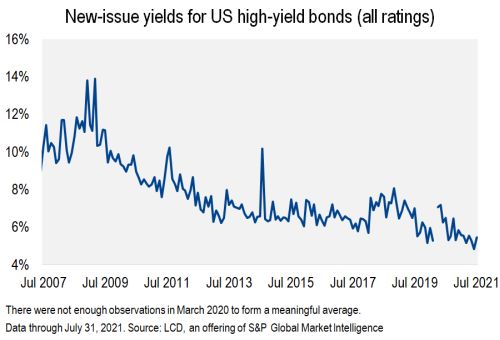

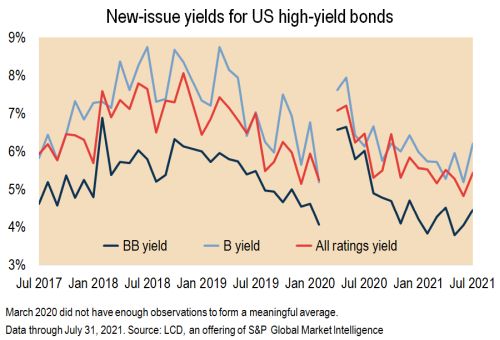

While borrowers may have remained undeterred by wobbly conditions, the cost of tapping the bond markets did tick higher. New issues were inked with an average 5.43% yield in July, the highest reading since April 2021, and 60 basis points wide of June’s 4.83% closing level.

Across ratings segments, the widening was more pronounced within the riskier, single-B class, which averaged a 6.20% new-issue yield in July, up from 5.19% the previous month. For BB bonds, the increase was logged as 41 bps, jumping to 4.46%, from 4.05%.

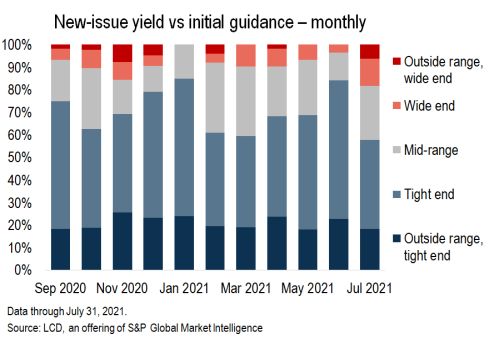

Also observed was a rise in investor-friendly concessions. Across a sample of 33 of the month’s placed tranches, two were finalized wide of guidance, and four at the wide end of talk, both up from June’s count.

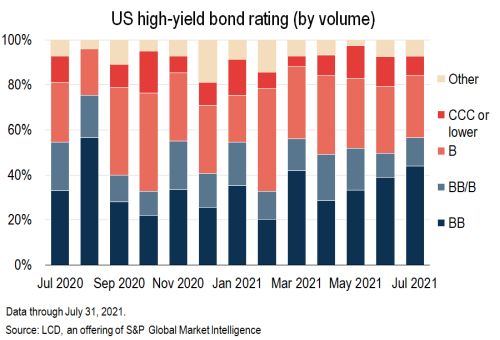

As for the mix of new paper, higher-quality BB prints again held greater share, accounting for 44% of completed supply during the month, its largest carve-out since August 2020. Single-B paper dipped to 27%, from 30% in June, as did triple-C bonds at 9%, from 13%.

High-yield issuers tapped the bond markets in size to finance M&A and leveraged buyouts, with that carve-out accounting for 31% of the July total, versus 25% in June. Debt raises for McGraw-Hill, First Student/First Transit, Centerfield Media, Performance Food Group Co., and Allen Media Group LLC helped to beef up the total.

Refinancing efforts, meanwhile, still drive the most substantial volumes, accounting for 62% of July issuance, including deals for Carnival Corp. & PLC, Centene Corp., Jefferies Finance LLC, and Air Canada, and DirecTV Entertainment Holdings LLC.

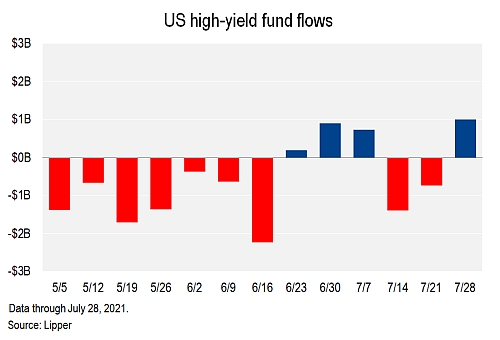

U.S. high-yield funds reported a net inflow of $995.7 million for the final assessment of the month (through July 28), following on back-to-back weekly outflows, according to Lipper. The four-week rolling average remained negative, at an outflow of $103.5 million per week.

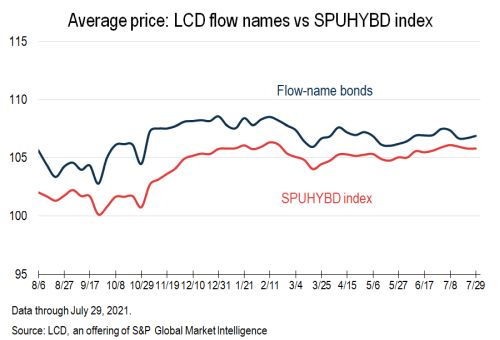

In the secondary market, bond prices declined steadily before working to retrace losses at month-end. The average bid for LCD's 15-bond sample of liquid high-yield issues advanced to 106.89% of par on July 29, with a 4.06% yield to worst, at T+313. The final monthly reading was supported by continued signaling from the Fed on dovish policy accommodation and a belief in transitory inflation pressures. For reference, the final June reading was noted at 106.96% of par and a 3.62% yield to worst, at T+293.

Per the S&P U.S. High Yield Corporate Bond Index, the T+305 option-adjusted spread on July 29 reflects a gain of 20 bps from June's close.