Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

31 Oct, 2022

By Tom Jacobs and Hassan Javed

Damage from Hurricane Ian led to significant catastrophe losses for many large property-casualty carriers and reinsurers and for Florida's insurer of last resort, Citizens Property Insurance Corp., during the third quarter of 2022.

Many of the reporting companies in the S&P Global Market Intelligence analysis were affected by the hurricane, which hit the southwest coast of Florida as a Category 4 storm on Sept. 28 with 150 mph winds and dumped over 10 inches of rain on the state.

Berkshire Hathaway Inc.'s insurance and reinsurance operations reported catastrophe losses of $3.4 billion from Ian, the highest of any insurer that has reported specific losses.

Citizens Property, the largest insurer in the Sunshine State, reported a catastrophe loss total at $2.6 billion. The company had processed 100,000 claims from policyholders affected by Ian as of Oct. 14, according to an email from company spokesman Michael Peltier.

Several of the smaller Florida-centric carriers reported losses as well. HCI Group Inc. reported $78 million in losses from Ian, Heritage Insurance Holdings Inc. had $40 million and United Insurance Holdings Corp. absorbed losses of $36.4 million.

Munich Re and Swiss Re AG, two of four reinsurers in the top eight of the analysis, had losses of $1.61 billion and $1.30 billion, respectively.

Despite those heavy losses, Keefe Bruyette & Woods analyst Meyer Shields said reinsurers' capital is "more than robust enough" and will not impede their capabilities.

"Every reinsurer, even if they take heavy losses, will be around to capitalize on what we think will be a very hard market afterward," Shields said in an interview.

Chubb Ltd. said its catastrophe losses for the quarter were an estimated $1.16 billion, with $975 million of that attributed to Ian. The Allstate Corp. had losses totaling $763 million, $366 million of which were from Ian.

The Progressive Corp. had $760 million in losses for the quarter related to the hurricane, with vehicle losses accounting for $585 million, including boats and recreational vehicles.

Industrywide impact

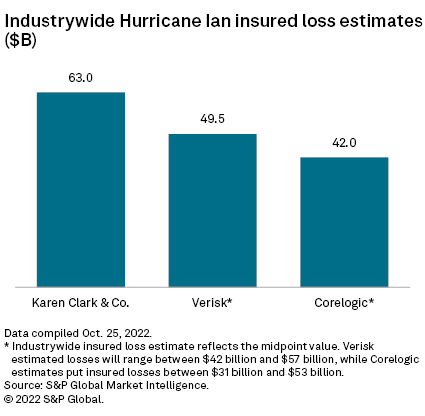

While the final cost of Hurricane Ian has yet to be determined, estimates from various risk modelers predict the insured losses will be heavy.

Karen Clark & Co. estimated a total of $63 billion in privately insured losses, which includes residential, commercial and industrial properties as well as autos. Verisk came in with an estimate of between $42 billion and $57 billion, while CoreLogic predicted a range of $31 billion to $53 billion.

Gallagher Re Inc, a subsidiary of Arthur J. Gallagher & Co. said in a report that total economic losses could approach or exceed $100 billion, making Ian one of the costliest U.S. hurricanes on record and one of the costliest U.S. natural disasters regardless of peril.