S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Dec, 2022

The devastation of Hurricane Ian has added to the financial strain under which the carriers that constitute the troubled Florida domestic residential insurance market are currently operating.

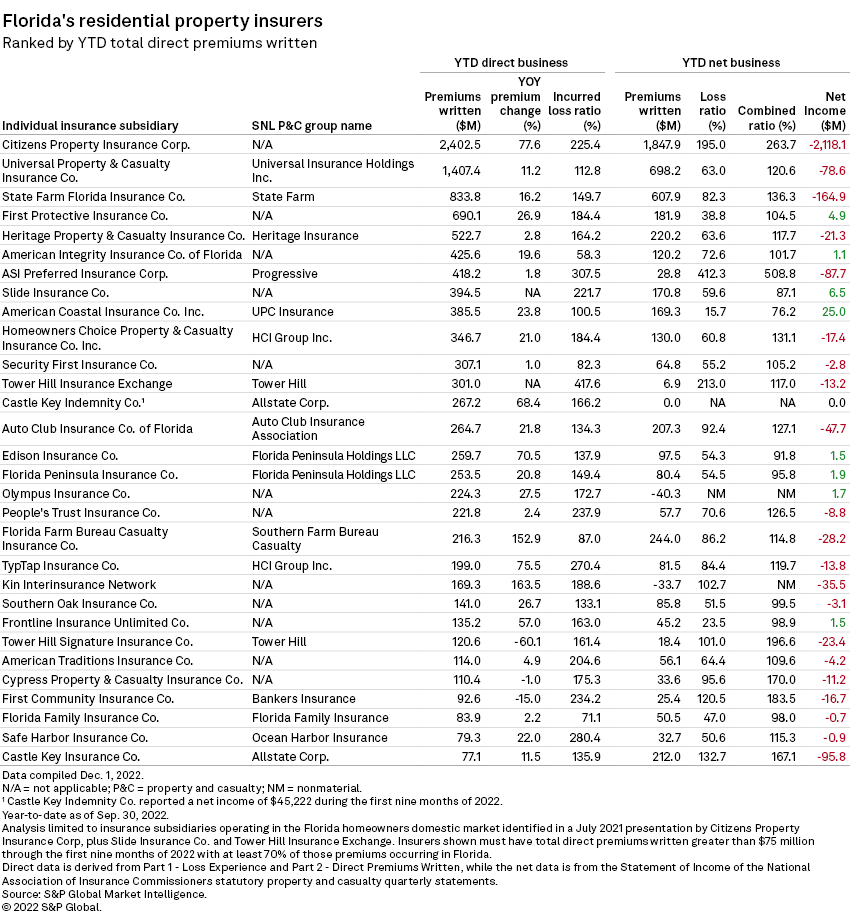

Those private insurers, including national carriers but excluding state-owned Citizens Property Insurance Corp., have collectively lost $1.20 billion through the first nine months of 2022, with about $900 million of the total occurring in the third quarter. This year's aggregate net income losses have already surpassed the previous year's total of $1.02 billion, which includes several insurers that are now insolvent.

The growing losses are draining some insurers' surplus positions, which could further impact their ability to write new or renew existing business and may require an infusion of additional capital.

Surplus erosion

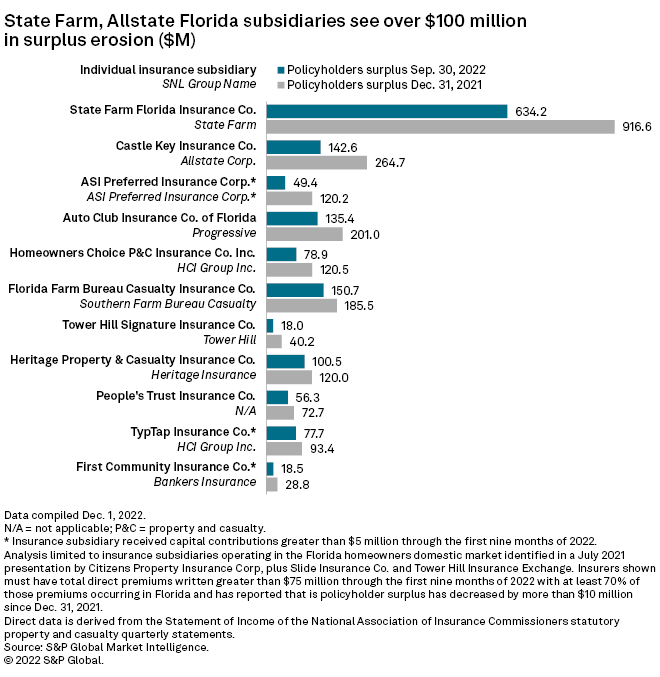

The nation's two largest homeowners insurers have seen their Florida-based units' policyholders surplus decrease by more than $100 million since the start of 2022.

The largest year-to-date policyholder surplus decrease among Florida's private insurers occurred within State Farm Florida Insurance Co. The insurer reported a policyholders surplus of $634.2 million at the end of the third quarter of 2022, a decrease of roughly $282 million from the end of the prior year.

|

* * Download a template to generate market shares across annual and quarterly property and casualty exhibits. |

The Allstate Corp.'s Castle Key Insurance Co., one of the insurer's subsidiaries that only writes business in The Sunshine State, has seen its surplus fall by $122.1 million over the course of the nine-month period. Its policyholder surplus was $142.6 million at the end of September, compared to $264.7 million as of Dec. 31, 2021.

ASI Preferred Insurance Corp., a unit of The Progressive Corp., has seen its surplus decrease by $70.8 million over the nine-month period to $49.4 million at the end of the third quarter. Its surplus amount was aided by a paid-in capital contribution of almost $21 million during the most recent quarter.

The insurer may need further capital contributions to avoid having its risk-based capital ratio fall below the mandatory control level. All other things being equal, comparing ASI Preferred's surplus of $49.4 million to its authorized control-level risk-based capital of $33.0 million at year-end 2021 would put its calculated risk-based capital ratio at about 150%. A risk-based capital ratio under 200% would put ASI Preferred at the company action level.

Net combined ratio soars for ASI

In addition, ASI Preferred's year-to-date 2022 combined ratio has jumped to 508.8% from just 102.9% during the previous-year period. The insurer reported net premiums written of $28.8 million during the first nine months of 2022, compared to $418.2 million of direct premiums during the same period. ASI Preferred cedes the bulk of its premiums to other affiliated Progressive subsidiaries.

Citizens, the state-run insurer of last resort, had a net combined ratio of 263.7% through the nine months ended Sept. 30. Citizens has seen massive growth within its customer base, pushing its direct premiums written to $2.40 billion so far in 2022, an increase of 77.6% over the prior-year period.

Another special legislative session

Florida's state legislature met for a special session this week — the second time this year — with the aim of reforming the private insurance market. The bill, which passed both the Florida House and Senate, would create a reinsurance assistance program to help insurers grappling with renewing their coverage, eliminate one-way attorney fees, and prohibit the "assignment of benefits." It also would require insurers to improve their methods of investigation and paying claims.

The American Property Casualty Insurance Association, or the APCIA, encouraged Florida Gov. Ron DeSantis to move quickly and sign the legislation into law.

"Rampant legal system abuse has caused insurance costs to skyrocket and burdened Florida families, and we applaud lawmakers for addressing this issue head-on to help stabilize the marketplace," Logan McFaddin, vice president of state government relations of the APCIA, said in a statement.