S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 May, 2022

By Jon Rees

| HSBC opposes calls for the spinoff of its Asia business, which generates almost two-thirds of group profit. Source: S3studio/Contributor, Getty Images News via Getty Images AsiaPac |

HSBC Holdings PLC's second-biggest shareholder, Ping An Insurance (Group) Co. of China Ltd., is facing skepticism as it advocates a breakup of the U.K.-headquartered bank.

Other investors and analysts are unconvinced the Chinese insurer's push to carve out HSBC's Asian business would boost returns, given the potential costs and distractions involved. The plan would also call into question HSBC's unique status as a global lender with significant footholds both east and west — a major selling point for large companies and high net worth individuals.

"Having that kind of cross-border reach can be invaluable," said Gary Greenwood, analyst at Shore Capital.

The sheer logistical challenge of breaking up such a complex global business would also risk causing considerable difficulties, said Redburn analyst Fahed Kunwar.

"It seems very unlikely a breakup of a $3 trillion balance sheet bank is feasible," said Kunwar.

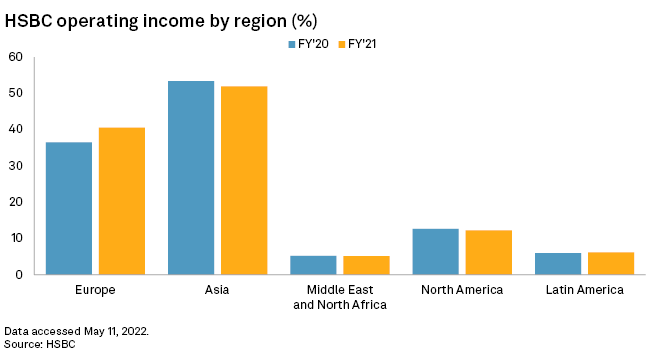

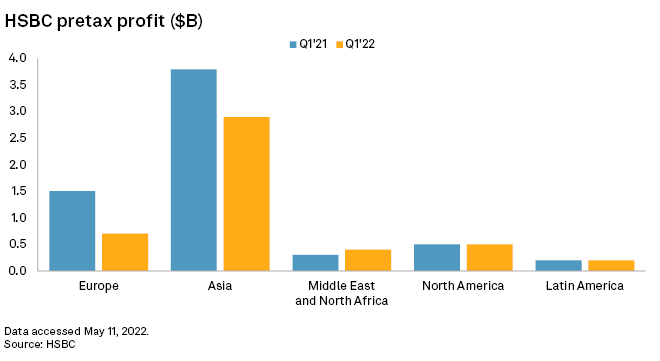

Ping An has pushed for HSBC to split off its Asia operations, which generate almost two-thirds of the group's profit, saying an independent Asia-listed business would be more profitable and autonomous and have lower capital requirements, the Financial Times (London) reported, citing people familiar with the matter. The insurer, which owns 8.23% of HSBC, also said a breakup would end an increasingly difficult balancing act between the bank's interests in China and the West, the report said.

Ping An did not respond to requests for comment.

Limited benefits

HSBC is opposed to the proposal, and it has highlighted that its long-term strategy is already a "pivot to Asia." The lender is redeploying $100 billion of capital to the continent while shedding 35,000 jobs, mainly in Europe and the U.S., as part of a $4.5 billion cost-cutting push.

"We don't think a breakup of the bank makes any sense at all," CFO Ewen Stevenson said at first-quarter earnings.

HSBC's global reach is a key strength for the lender, with about 77% of revenue from commercial banking and investment banking linked to its international network, analysts at Jefferies said in a note to clients.

Breaking up the bank would be a huge challenge, particularly its global investment banking operations and its fixed-income products on both the asset and the liability sides, according to Kunwar.

"The quantum of restructuring charges could be very large," Kunwar said. The bank has already been through two restructurings since 2015, which together incurred charges of about $12 billion.

The risks of disentangling the bank's IT systems in the event of a split are also considerable, as TSB Bank PLC found after its separation from Lloyds and subsequent integration into Banco de Sabadell SA, analysts at Jefferies wrote in a research note.

A breakup would "almost certainly" lead to credit-rating downgrades as well as lower profits and less diversification, said Filippo Alloatti, head of financials in the credit team at HSBC shareholder Federated Hermes. "If an Asia spinoff were to happen, we would regard it as negative," Alloatti said.

One possible advantage of a breakup is that HSBC may be able to retain less capital, according to Jefferies. This is because the lender could lose its status as a global systemically important bank, thereby ending the need for an additional 2% capital buffer.

Still, these capital savings would likely be wiped out by separation costs, the Jefferies analysts said. The wider bank would also lose some of the benefits of rising U.K. interest rates, they said.

Geopolitical

A breakup could ease an issue that has dogged HSBC in recent years: its increasingly awkward relationship with China.

The bank has become embroiled in controversy in Hong Kong, its Asia hub, regarding China's introduction of the National Security Law. The lender was criticized in 2020 by a former leader of the city for not publicly supporting the law; it then faced criticism in the U.K. and the U.S. after it ended years of political neutrality and backed the law.

"The cynical view of Ping An's move is that it is the Chinese government leaning on HSBC by the backdoor," said Greenwood.

A new Asia-based HSBC bank would likely become a Hong Kong- or China-regulated entity in order to reduce geopolitical risk from China, he said. Still, switching regulators would be a considerable challenge since The Bank of England is the main overseer of HSBC's issued debt, Greenwood said.

Market confidence

Within China, HSBC boosted its loan book 11% last year, as market share gains helped offset slower GDP growth, CFO Stevenson said at first-quarter results. China's economy has faltered in the wake of tight COVID-19 restrictions and concerns over the commercial property market.

HSBC's stock has also outperformed this year, with its London-listed shares gaining 5.4% compared with a 0.8% drop in the FTSE 100. Its Hong Kong-listed stock is up 1.9%, while the Hang Seng Index has fallen 14.5%.

HSBC was founded in Hong Kong and relocated its headquarters to London in 1993 after its takeover of British high street bank Midland. The bank considered moving its headquarters back to Hong Kong following the introduction of the U.K. banking levy in 2011. It ultimately concluded that it made sense to remain in London.

The bank now intends to retain its current structure amid its pivot to Asia.

"Delivering on this strategy is the fastest way to generate higher returns and maximize shareholder value," the bank said in a statement.