Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Apr, 2021

HSBC Holdings PLC is looking to use extra capital for acquisitions to boost its wealth management capabilities, according to CEO Noel Quinn.

The U.K.-based bank's primary focus within its wealth and personal banking business is to grow the wealth part of the division, Quinn said on an April 27 earnings call, noting that the group is on the lookout for both organic and bolt-on inorganic opportunities to drive that growth. "We will look at opportunities as they emerge," said Quinn.

HSBC is particularly considering acquisitions that will boost its product or distribution capabilities in wealth management, insurance and private banking, and deals would largely be in Asia, where Quinn is looking to move the heart of the business in a bid to chase higher returns.

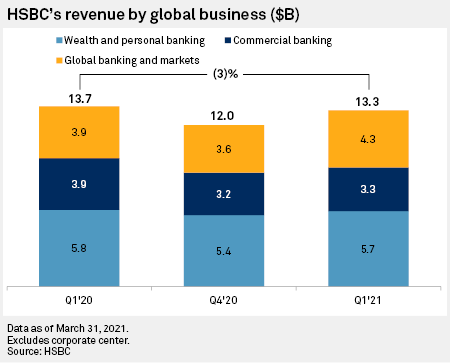

Adjusted revenue at the group's wealth division reached $2.38 billion in the first quarter, up 65% from $1.45 billion in the same period a year ago. Meanwhile, adjusted revenue at HSBC's commercial banking arm fell 14% on a yearly basis to $3.33 billion, which Quinn attributed mainly to the impact of low interest rates on global liquidity and cash management.

The group's global banking and markets division posted a 10% year-over-year increase in adjusted revenue to $4.29 billion on the back of strong performances in the bank's global debt markets, equities and capital markets and advisory businesses.

With regards to shareholder returns, CFO Ewen Stevenson said HSBC expects to be in a position to pay an interim dividend in the first half, but the potential payout is subject to the group's performance in the second quarter. Stevenson also said the bank still has no plans to carry out share buybacks in 2021.

Meanwhile, HSBC said it remains in negotiations over a potential sale of its French retail banking operations, noting that it expects to book a loss from any deal, given the underlying performance of the business. The group is reportedly in final talks to sell the business to U.S. private equity firm Cerberus Capital Management LP, possibly for a token sum.

HSBC said it continues to consider both organic and inorganic options for its struggling U.S. retail banking division, which the group is also reportedly looking to sell.