Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Feb, 2021

HSBC Holdings PLC confirmed plans to sell off its struggling U.S. retail banking division, marking the latest move by a major European bank to off-load significant operations in the country.

The U.K.-based banking group is embarking on a wide-ranging overhaul to its global business, under which it will concentrate its efforts on its Asia, wealth management and fee income operations.

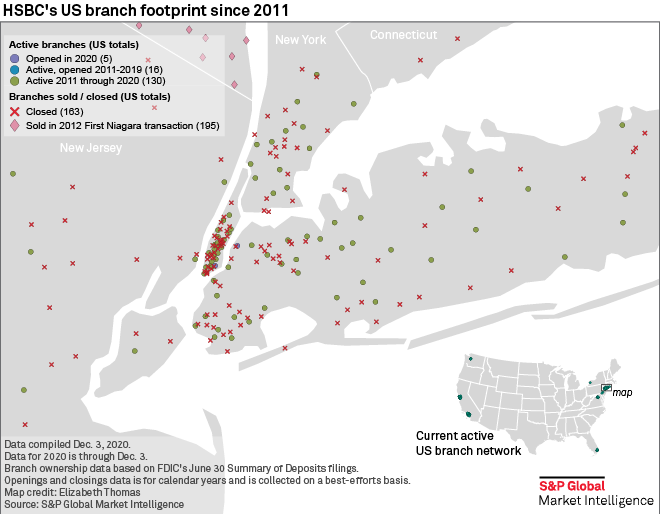

As part of the revamp, the lender also said it is looking to sell its 150-branch retail network in the U.S., which has been lossmaking over the last three years, the Financial Times reported. Most of HSBC's branches and deposits in the U.S. are in the New York City region, and the bank has a significant presence in other coastal markets, including San Francisco, Los Angeles and Miami.

The announcement comes just a few months after Spanish peer Banco Bilbao Vizcaya Argentaria SA agreed to sell most of its U.S. business to PNC Financial Services Group Inc. for $11.60 billion.

HSBC Group CEO Noel Quinn acknowledged that the bank lacked a strong competitive position in the U.S., saying low interest rates posed another challenge to the unit. The group, which previously outlined plans to reduce its American retail network as part of its restructuring program launched in February 2020, said it exceeded its target for the year after reducing its stateside branch footprint by about one-third.

"We reduced our U.S. branch footprint by more than 30% and cut our U.S. adjusted cost base by 8%," Quinn told analysts during a fourth-quarter earnings call.

"[T]he U.S. team did a great job in 2020, repositioning the business, closing branches, driving down costs and reducing capital. For the next stage, we will focus the vast majority of our resources into our international corporate and institutional franchise in the U.S. We'll continue to connect our U.S. wholesale clients into our international network," he said.

The bank also said it is in talks related to a potential sale of its French retail banking operations, warning that any deal would likely result in a loss for the group, given the underlying performance of the unit. British private equity firm AnaCap Financial Partners LLP was said to be preparing a bid for the business.

Ahead of targets

HSBC also provided an update on its overhaul, saying it reduced its risk-weighted assets by $51.5 billion in 2020, with nearly half of the amount taken from the group's European non-ringfenced bank. Quinn said the reduction took the bank more than halfway toward its $100.00 billion target just a year into its three-year restructuring, adding that the group expects to make further reductions of about $30 billion of gross RWAs in 2021.

"We're pulling the RWAs out of a lower return business, global banking and markets. In lower return geographies, Europe and the U.S. and redeploying into Asia in wealth and commercial banking and in global banking in Asia," Quinn said.

HSBC also expects to exceed its $4.5 billion cost-saving target ahead of schedule after reducing costs by more than $1 billion in 2020, and is now looking to deliver between $5 billion and $5.5 billion of cost savings, Quinn added.