S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Mar, 2023

| The acquisition of Silicon Valley Bank's U.K. business will increase HSBC's scale in the technology and life sciences sectors. |

HSBC Holdings PLC's acquisition of U.K.-based Silicon Valley Bank, part of collapsed U.S. group SVB Financial Group, stands to be beneficial for both sides of the deal and for the technology industry as a whole.

The deal, which the U.K. Treasury and the Bank of England coordinated after a series of emergency meetings March 11 and 12, protects depositors and client assets at Silicon Valley Bank U.K. It also opens growth opportunities for HSBC at almost no additional cost or risk and could even boost the group's image, market observers said.

SVB is a key banker to a plethora of U.K. technology startups and is considered vital for the country's innovation ecosystem. Startups and their investors have welcomed the deal, which saw HSBC acquire SVB U.K. for a nominal sum of £1.

A failure of SVB U.K. would have been "manageable, but certainly not desirable," Elisabeth Rudman, global head of financial institutions at DBRS Morningstar, said in an email. A collapse could have led to potentially successful startup companies going under and damaging depositor confidence at a time when the economy is struggling, Rudman said. The acquisition will be "a useful, small add-on" to HSBC's existing U.K. business without implications for the group's strategy or ongoing restructuring, she added.

Buying assets at a knockdown price typically lowers the risk and increases the upside potential for business in future, Russ Mould, investment director at U.K.-based investment firm AJ Bell, said via email.

"There are few better purchases than a purchase from a distressed seller," he said.

Small but meaningful

The deal "makes excellent strategic sense" for HSBC's U.K. business and enhances its ability "to serve innovative and fast-growing firms" in the technology and life sciences sectors, among others, HSBC CEO Noel Quinn said.

"We are already active in this space and [the deal] gives us scale," a bank spokesperson told S&P Global Market Intelligence. HSBC will provide further details about the deal during its first-quarter earnings call on May 2.

SVB U.K. made a pretax profit of £88 million in 2022 and is expected to have about £1.4 billion of tangible equity. It has operated as a separate subsidiary of SVB Financial since September 2022, meaning it has an own capital pot and is supervised locally.

HSBC will take on about £5.5 billion of loans and £6.7 billion of deposits through the acquisition. These would account for only a small proportion of HSBC U.K.'s loans and deposits — 2.7% and 2.4%, respectively — and would be an even smaller part of the total loans and deposits of the wider HSBC group — about 0.7% and 0.5%, respectively — DBRS Morningstar said in a March 13 note.

While very small compared with the HSBC businesses, the SVB assets should strengthen the group's U.K. franchise in niche areas with significant growth potential such as tech startups, the rating agency said.

Political capital

The benefits for HSBC are potentially even wider as the purchase "could be seen as an act of public good and support for the economy, at a time when banks are (once more) under fire from the public and politicians amid accusations of profiteering thanks to higher net interest margins," said AJ Bell's Mould.

Executives at the four largest U.K. banks were called to a U.K. Treasury Committee hearing in February, where they were criticized for the slow transfer of higher interest rates to savers as people struggle with the cost of living crisis.

U.K. Prime Minister Rishi Sunak and Chancellor Jeremy Hunt said in statements March 13 that SVB U.K. clients "should feel reassured by the strength, safety and security" that comes with the bank's sale to HSBC.

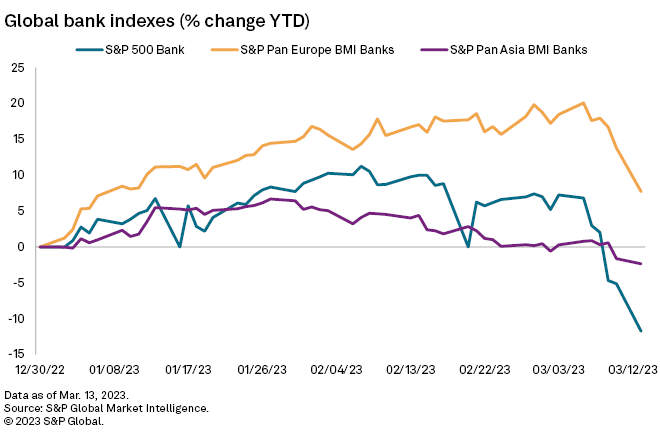

The speed of the resolution was important, too, given the sell-off in global banking stocks in recent days. European bank stocks were trading at more normalized levels on March 14 after several suffered double-digit percentage declines the previous day.

U.K. technology startups, their investors and trade bodies hailed the sale of SVB U.K. as the best option for the bank, which would have entered insolvency proceedings if a buyer could not be found.

Finding a private buyer means no public money has been used to protect the bank's depositors, most of which are U.K. tech sector startups. It also ensured "many of the investors like us who back them don't go bust," said Andrew J. Scott, founder of U.K.-based venture capital fund 7percent Ventures, according to a March 13 TechCrunch report.

The deal "saved hundreds of the U.K.'s most innovative companies," Dom Hallas, CEO of U.K. tech startup association the Coalition for a Digital Economy, or Coadec, said on Twitter.

The acquisition is testament to the long-term strength and potential of the technology and healthcare sectors in the U.K. and Europe, London-based investment fund Kreos Capital added in a LinkedIn post.

Culture clash

How tech-focused SVB U.K. and its niche client base will fit within one of the world's largest universal banks remains to be seen.

"It will be interesting to see whether under the HSBC umbrella, SVB U.K.'s approach to lending and target client remains the same or whether the parent company will consider these depositors as too risky going forward," said Victoria Scholar, head of investment at Interactive Investor.

A key reason tech startups use lenders such as SVB U.K. is that they specialize in financing "small businesses with hardly any revenue or profits," Scholar said. Often tech startups require large amounts of borrowing in order to fuel their long-term growth plans, yet larger banks such as Barclays PLC or HSBC "would often steer clear of helping such businesses because of their weak finances," Scholar noted.

"SVB has been a critical partner to the growth ecosystem and we hope HSBC is able to continue this legacy," Kreos Capital said.