S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

11 Jan, 2024

By Mark Anthony Gubagaras

After a broad pullback in M&A in 2023, Hewlett Packard Enterprise Co. is proving that 11-figure deals are possible in 2024, especially deals tied to artificial intelligence.

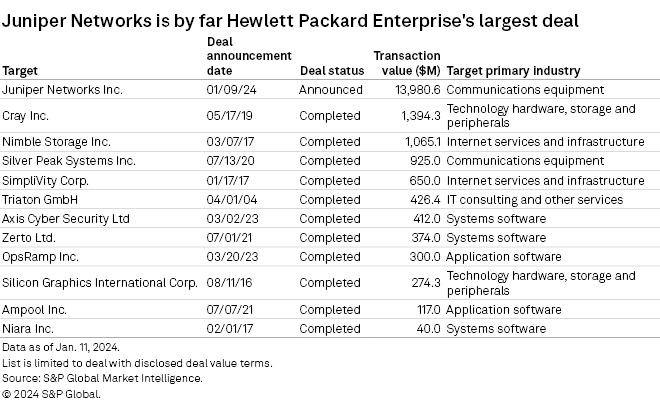

HPE agreed to buy networking hardware company Juniper Networks Inc. in a transaction valued at $13.98 billion, according to S&P Global Market Intelligence. If completed, the deal would be HPE's largest since its 2015 split from Hewlett-Packard Co. Notable, mega-size deals like this one are likely to face heightened regulatory scrutiny.

Even before its 2015 split, HPE had an acquisitive eye on the networking arena. The company acquired Aruba Networks Inc. for a gross transaction value of $2.98 billion in mid-May 2015, months before HPE and personal computer and printer maker HP Inc. split into separate entities.

With Juniper, HPE intends to build on the Aruba buy significantly — and Juniper's Mist platform, which relies on AI tools to improve wireless access, will play a key role. The platform's developer, Mist Systems Inc., became part of Juniper via a $404.2 million acquisition in 2019.

By acquiring Juniper, HPE will be able to integrate Mist with its competitor, Aruba. While combining the two might raise regulatory red flags, according to S&P Global Market Intelligence 451 Research analyst John Abbott; it could also double the size of HPE's networking business.

Mist can boost Aruba's "AI-native" credentials as well as edge and cloud capabilities, aligning with HPE's goal of becoming a one-stop provider of networking services for enterprise/hosted datacenters and cloud providers, said Abbott, who specializes in applied infrastructure and DevOps.

All in all, HPE expects a larger AI market to boost its total addressable market to over $340 billion over four years.

"We expect to have expanded edge, data center and wide area networking products and resources to drive even more innovation across all customer segments," said Juniper CEO Rami Rahim in an analyst call announcing the deal with HPE.

The Juniper buy is as much about boosting HPE's network business as it is about AI, according to Abbott. This is because the infrastructure needed for AI workloads is increasingly becoming network-centric, given the need for more capacity that comes with the use of more graphics processors especially for generative AI.

451 Research's "Voice of the Enterprise: AI and Machine Learning, Infrastructure 2023" survey identified high-performance networking as a key requirement for enterprise customers looking to boost AI performance, beyond accelerators in the cloud or faster standard servers.

"The network has become not a nice-to-have, but an absolute must-have for any company that's going through any form of digital transformation," said Rahim, who will lead HPE's combined networking business after the transaction.

The HPE-Juniper deal is expected to be completed in late 2024 or early 2025, subject to fulfilling various customary closing conditions, including securing regulatory and Juniper shareholder approvals.

The combined HPE-Juniper organization could become a formidable challenger to industry leader Cisco Systems Inc., which expanded its own wireless networking offering through the $1.20 billion purchase of San Francisco-based company Meraki LLC, now Cisco Meraki, in 2012.

Incidentally, both HPE and Cisco are long-established vendors and "serial acquirers" in the IT landscape, said 451 Research M&A analyst Brenon Daly.

Cisco in September 2023 embarked on its biggest acquisition to date with the proposed purchase of cybersecurity software company Splunk Inc. for a gross transaction value of nearly $31.0 billion, as part of a further push into AI.

The deal was an exception to a rather gloomy year for tech M&A in 2023, with total spending dropping to its lowest level in a decade.

The scenario is apparently changing, and there must be a reason to be optimistic in 2024 for tech M&A, according to Daly.

"The significance of blockbuster [deals] extends far beyond numbers. And when other companies hear 'come on in, the water's fine' from acquirers at the top end of the market, they start to think more seriously about a splashy deal of their own," Daly said.

While HPE is paying a hefty sum for Juniper, the transaction carries a relatively modest valuation at 2.3x trailing revenue.

HPE will initially fund the transaction using term loan commitments, to be partially replaced in the end with a mix of cash on the balance sheet, mandatory convertible preferred securities and new debt.

The proceeds of HPE's earlier sale of a 49% stake in its Chinese enterprise IT joint venture, New H3C Technologies Co. Ltd., to partner company Unisplendour International Information Technology Co. Ltd. for $3.50 billion is also expected to help finance the Juniper acquisition.

451 Research is a technology research group within S&P Global Market Intelligence.