S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Jan, 2021

By David Feliba

Even as the COVID-19 pandemic rattled markets, more than 1.5 million Brazilians ventured into it for their first time in 2020.

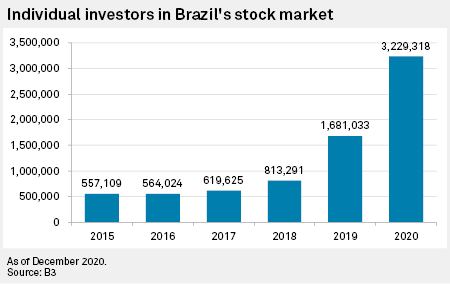

Despite GDP falling by as much as 5% and dollar returns in Brazilian equity deep in the red, the mass of retail stock investors in Brazil doubled in size last year. Individual accounts in the market grew to 3.23 million at year end from 1.68 million at the start of 2020, the fastest yearly gain on record according to data by B3 SA - Brasil Bolsa Balcão.

The meteoric evolution is established on a mix of two major factors that are driving structural, underlying change. On the one hand, a prolonged low rate environment is pushing Brazilians away from traditional investments that no longer produce historical returns. On the other, the swift expansion of large, digital investment platforms like XP Inc. is making it far easier for Brazilians to take part in the stock market.

The combination of those two features is modeling a highly positive scenario for the financial market as a whole, and a gigantic opportunity in the coming years both for fintech incumbents and banks to benefit from.

"It is a very profound, cultural change in the Brazilian investor," said Leandro Miranda, investor relations officer with Brazilian heavyweight bank Banco Bradesco SA. "Brazilians had become used to a 10% return rate at the very least."

According to the executive, "extraordinary high interest rates in bonds" had discouraged Brazilians from investing in the stock market in the past. But such returns have ended as the Selic, Banco Central do Brasil's benchmark rate, has fallen precipitously in recent years.

Over a four-year period, the benchmark rate sunk to record-low 2.00% from 14.25% in 2016, negatively impacting returns on lower-risk fixed-income investments. With inflation running at about 4.5% in 2020, analysts expect the premium in stocks to continue to drive a steady shift toward equity, either through shares directly or mutual funds targeting the asset class.

Bradesco expects the stock market to continue to draw in new investors at a pace of 1 million to 2 million per year, according to Miranda. This would mean that the 10 million threshold could be surpassed in less than five years.

"It is a secular trend that can be compared to what happened in the U.S. in the 1980s with Charles Schwab and Fidelity," Marcelo Flora, a partner with Banco BTG Pactual SA, Brazil's largest investment bank, said in an interview. "We have lived with high rates for the last 15 years and Brazilians got used to just investing in CDI [overnight bank rate deposits]."

Yet despite the low-rate environment as a key driver, technological advances and fintechs have also played a major role. Even though the economy was badly hurt and in lockdown, Brazilians still managed to place some 80 billion reais new money in stocks through digital and mobile channels, according to B3.

"This goes beyond low rates," Armando Castelar, an economics professor with think tank Fundacao Getulio Vargas, said. "Trading stocks was simply made much easier."

A study by stock market operator B3 maintained that digital transformation and better access to information had been "crucial for the investment market to develop a lot" during the past few years in Brazil.

As result, the profile of the average investor is quickly shifting. The typical profile of the two million Brazilians that have flocked to the market since 2019 is 32 years old, male, without children and with a midrange income. However, growth in investing by women has also surged; while they still account for only about 26% of all investors, their numbers have more than quadrupled in the past few years, to 809,533 in 2020 from 179,392 in 2018.

How these new investors learn and inform themselves about the market is also revealing a lot about the new profile. The study by B3 found that the vast majority of the interviewees relied heavily on YouTube and so-called financial influencers to educate themselves on market investing.

Digital lenders are gearing up for competition

Rapid growth in retail investing, as well as changing habits, have presented a unique opportunity to digital startups looking to make a breakthrough in market share. Although the expansion of the market is virtuous for nearly every player, tech-savvy digital players are in a stronger position to profit.

"It benefits Bovespa and all brokers through higher commissions, some of which are owned by banks," Cynthia Cohen Freue, a bank director with S&P Global Ratings, said. [But] those who have benefited the most from local investments are XP and BTG Pactual." In the third quarter of 2020, for instance, XP reported a yearly 1.1 million gain in active clients.

Amid this surge, financial technology firms have been active M&A players in 2020 as they gear up for competition with heavyweight traditional bank players. For some, impressive performance in the retail investor market has emboldened an acceleration in strategy.

In September 2020, the largest online bank in Brazil Nu Pagamentos SA purchased digital investment platform Easyinvest in order to incorporate the product into its bank offering. XP, meanwhile, has been one of the most active players in the Brazilian M&A market. Late last year, it announced it had acquired Riza M&A to strengthen its capital market ecosystem, the last in a handful of acquisitions made throughout the year.

Other recent moves include BTG Pactual looking to issue a $2 billion reais follow-on in order to fund its initiatives, while digital lender Banco Inter SA announced it had tapped the former head of investing at Santander Brasil to lead its own efforts in the industry.

Banks shift strategy

Some traditional banks are also moving in. Bradesco recently announced that spinoff its digital bank Next along with its digital investment arm, Agora. According to Miranda, who leads the initiative at Bradesco, rapid investment demand has moved forward the bank's plan to launch an IPO of the spun-off division.

The bank had initially planned to go public in five years' time, but Miranda said in an interview that "it is going to be much, much sooner than that," potentially just two years.

"The number of trades, clients and volume is simply very high and growing. The market is extremely favorable," he said.

In addition to picking up new investors entering the market, some fintech also see an opportunity to steal market share from Brazil's big banks.

"More than 90% of the wealth of Brazilian families is still being invested in the five big retail players," Flora, who leads the banks retail investing venture BTG Digital, said. "The big opportunity for us is clients who are coming from big retail banks."

To that end, players like BTG and XP are placing their bets on a strategy that relies not only on pure digital acquisition but also on attracting financial advisers — and the clients they may bring with them — from competitors including the major banks.

For Flora, the role of the financial adviser is key for their growth strategies. "Here in Brazil, people are very used to visiting a brick and mortar branch and having a coffee with a relationship manager in order to invest. It is difficult to believe that they will shift right away from this habit to go 100% online."