S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Aug, 2021

By Yannic Rack

| An LNG import terminal operated by Snam in northern Italy. Like other gas companies, Snam hopes to find a second life for its infrastructure in the shift to green gases, such as hydrogen. |

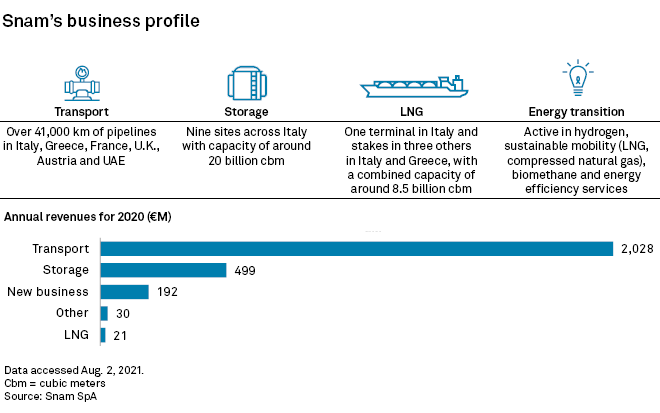

Since becoming CEO of Snam SpA in early 2016, Marco Alverà has turned one of the world's largest natural gas companies into a trailblazer in the burgeoning hydrogen economy.

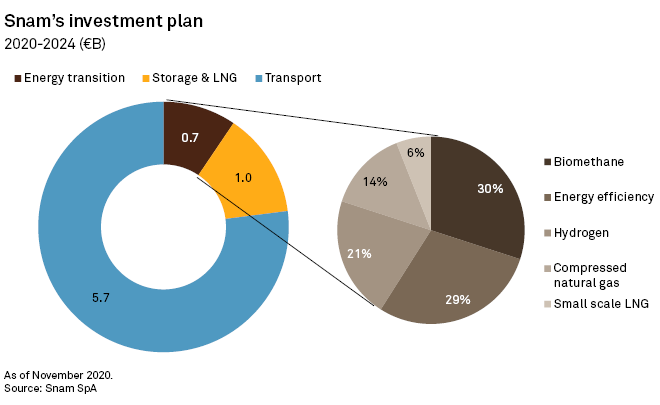

The Italian utility, which operates pipelines across Europe, is now spending half its four-year, €7.4 billion investment budget on getting its infrastructure ready for hydrogen, the "new oil" that has emerged as a key tool in reaching global net-zero emissions.

Alverà, meanwhile, is about to publish his second book about hydrogen in just two years, showing how the fuel's meteoric rise has surprised even its most ardent advocates.

"I joined Snam with a vision of using [the company] to become a global leader in green molecules," the CEO said in a video interview this month. "I didn't know at the time how quickly hydrogen was going to hit the road."

The former investment banker, who previously worked at utility Enel SpA and oil and gas major Eni SpA, now spends most of his time on initiatives related to Snam's net-zero goal for 2040. That includes replacing and upgrading its 41,000-kilometer network of pipelines for the hydrogen era, piloting decarbonization projects with industries from steel to glass and working with other utilities on a pan-European effort to link up infrastructure that critics of fossil fuels have long derided as a stranded asset.

"There are few CEOs of gas infrastructure companies that have led the debate on hydrogen like Marco has at Snam," Graham Cooley, CEO of ITM Power PLC, a U.K.-based maker of hydrogen electrolyzers, said in an interview. "They're a great example for the gas industry and indeed for the whole oil and gas sector."

Snam invested €33 million in ITM in October 2020, an early example of a wider trend of utilities backing providers of hydrogen technology. A month later, the company spent about €400 million to acquire one-third of Industrie De Nora SpA, a family-owned Italian company that also makes components for hydrogen production.

The investments, which were met with initial skepticism by some shareholders, are meant to boost the development of the wider industry that Snam's plans for the future depend upon to a large degree. If the production of hydrogen does not grow to scale and become cost-competitive, other alternatives could prevail — undermining the case Alverà has been making all along for the long-term value of his company's infrastructure.

To be sure, Snam is not placing all its chips on hydrogen. In the near future, it is spending more money on biomethane, a high-quality renewable natural gas that can be fed into existing gas pipes without requiring any upgrades. In the long run, the company hopes both fuels will play a key role in its business.

"We shouldn't think of Snam as a gas company that, in 20 years' time, will be a hydrogen company," Stefano Bezzato, an analyst at Credit Suisse who covers the company, said in an interview. Still, Bezzato said, "[h]ydrogen becoming a success ... that's basically what Snam is betting on."

First mover

Marco Alverà has led a strong pivot to green gases at Europe's largest pipeline company. |

In the past 12 months, most European countries have outlined how they want hydrogen to replace natural gas in long-haul transport, heavy industry and other areas. New demand for the fuel could reach 1.32 billion tons by 2050, or around 22% of total final energy consumption, according to modeling by Bloomberg NEF. That compares with less than 0.002% today.

Still, Alverà expects it will take 30 years before there are "significant reductions" in the use of natural gas, which today makes up two-fifths of total energy supplies in Italy, Snam's core market.

"We could very comfortably just wait another 10 years to see which direction the market goes and then adapt," Alverà said. "[But] I think there's a lot of value to be created in being a first mover."

Snam is planning to spend just over €700 million on its energy transition ventures over the period to 2024, which equals about 10% of its total investment budget. Aside from hydrogen, that also includes biogas, low-carbon mobility and energy efficiency.

Bezzato said the role of hydrogen in Snam's business plan is still negligible and will likely remain so until 2030. But the analyst agreed that there are bigger objectives at play in moving early into the market.

"It helps the company make a case for their gas infrastructure to continue to be maintained for the time being and for the regulators to continue to remunerate that gas infrastructure adequately," Bezzato said. "Their argument, for now, holds."

The EU's updated gas market directive, due this winter, and an ongoing regulatory review of transmission assets in Italy will indicate how successfully Snam and other companies have pledged their case.

'We're not the villain'

To date, Snam has already launched trials for hydrogen with railway operators, industrial manufacturers, power generators and other utilities. In 2019, it was the first company to test a blend of 5% hydrogen in its gas network, supplying a pasta factory and a water-bottling plant. Since then, it has successfully ramped up blending to test a 30% mix in steel furnaces. It also plans to install the world's first hydrogen turbine designed for gas networks at a compressor station in 2021.

"I think we're doing the right things. We're not doing it in a defensive way. We're building these [energy transition ventures] so that, over time, they can become, hopefully, as profitable as our core business, which means the company will grow four, five times in size," Alverà said.

The company is still Europe's largest natural gas transmission company, and its reorientation comes as many other energy groups are reducing their exposure to the fossil fuel altogether. National Grid PLC is selling its gas transmission network in the U.K., while Engie SA and SSE PLC recently announced deals to sell partial stakes in gas distribution networks in France and Scotland, respectively.

"There are investors that don't consider Snam as an investable stock because it's 100% gas," Credit Suisse's Bezzato said, adding that multi-utilities such as National Grid or Engie have the luxury of focusing on their power businesses instead. "Ultimately, Snam doesn't have a choice — at least for now," the analyst said.

Alverà, for his part, takes solace in the fact that Snam neither produces nor sells gas and said the company's capabilities — in transporting, storing, trading and supplying renewable energy in gaseous form where and when it is needed — mean its infrastructure will be immensely important in the future.

"We're not the villain. ... We're much more part of the solution than part of the problem," Alverà said. "There's just a lot that a company can do in 30 years."