Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Jun, 2021

After decades operating as a regional electric utility focused primarily in North Carolina, Duke Energy Corp. has expanded into one of the largest integrated electric and natural gas utilities, by several measures, in the U.S.

But a proposal made public May 17 by activist investor Elliott Investment Management LP, an affiliate of Elliott Management Corp., would break Duke Energy into three parts, a breakup the firm says would increase shareholder value by as much as $15 billion compared to the company's current valuation.

|

Duke Energy's initial response to the proposal was not receptive. "Given the performance of the company, there is no strategic logic to breaking the company apart, and there is serious risk of dis-synergies that would weigh down the various spun-off entities and raise questions about the viability of the dividend to shareholders," it wrote in a May 17 response to Elliott's offer.

Wall Street's immediate reaction was tepid. "[W]e don't believe the proposal makes much sense," CreditSights analyst Andrew DeVries wrote in a May 18 research report. "[I]t seems like the consensus view also doesn't see any low-hanging fruit for Elliott to 'unlock.'"

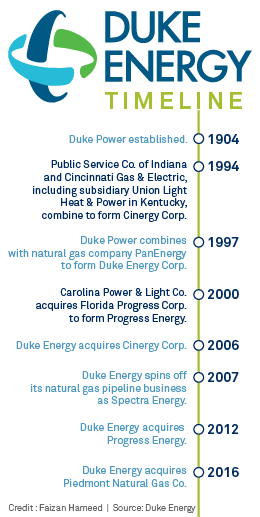

Duke Power, which traces its origins to 1904, went through a transformation in 1997 when it acquired a natural gas pipeline company called PanEnergy, with pipelines in the Midwest and Texas stretching as far east as New Jersey. By the mid-2000s, the company, now Duke Energy, soured on the acquisition, citing, among other things, affiliate rules that would have prevented the sharing of information between business units. The pipeline business was spun off as Spectra Energy in early 2007 and a decade later was acquired by Enbridge Inc.

As Duke Energy was exiting the gas pipeline business, it was expanding its retail electric and natural gas utility business. In 2006, the company acquired Cincinnati-headquartered Cinergy Corp., adding utilities in Indiana, Kentucky and Ohio. In 2012, Duke Energy expanded again, acquiring Progress Energy Inc., which had electric utility operations neighboring Duke's in North and South Carolina, as well as in Florida.

In somewhat of a diversification move, Duke Energy in 2016 added Piedmont Natural Gas Co. Inc., more than tripling the number of retail natural gas customers it serves.

Elliott's plan, however, would put an end to Duke Energy's expansion, splitting the company into three separate, more regionally focused utilities. The separate utilities, Elliott said, would have a total market valuation of $90 billion to $93 billion, compared to the company's market valuation of $77 billion as of May 28.

If Duke Energy were split as Elliott proposes, the Carolinas business would be the largest of the three companies, with a projected market value of about $55 billion. It would include Duke Energy's two electric utilities operating in North Carolina and South Carolina, Duke Energy Carolinas LLC and Duke Energy Progress LLC; natural gas utility Piedmont Natural Gas, whose Carolinas service territory largely overlaps the electric utilities and also operates in and around Nashville, Tenn.; and Duke Energy's commercial renewables, transmission and international segments.

The two electric utilities serve about 4.3 million customers in the two states and together own about 35,000 MW of generating capacity, including six nuclear plants. Duke Energy's competitive renewables business owns another 2,700 MW in multiple states. Piedmont serves about 1.1 million natural gas customers.

The Duke Energy Progress business was once known as Carolina Power & Light Co. In 2000, it combined with a Florida utility company, Florida Progress Corp., to become Progress Energy.

Duke Energy Florida LLC, formerly called Florida Power Corp., serves about 1.9 million electric customers in northern and central Florida. The utility also owns about 11,700 MW of generating capacity. Elliott values the Florida utility at up to $23 billion.

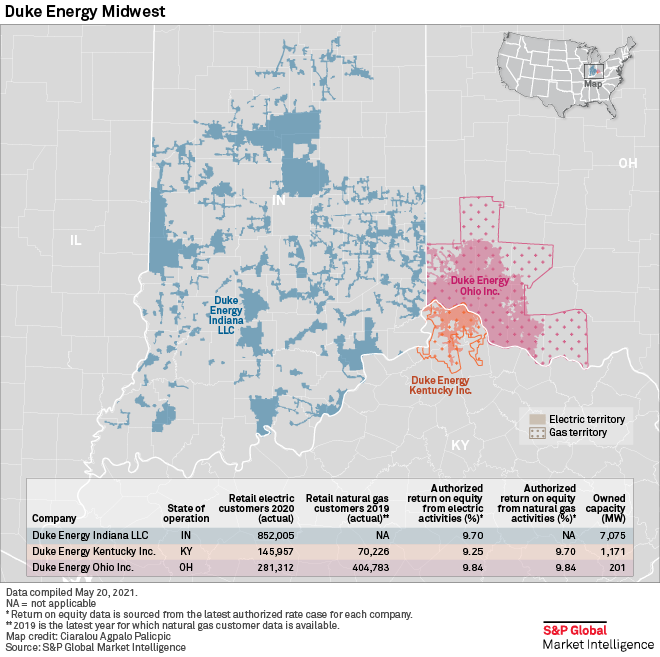

In 1994, two neighboring utilities, Public Service Co. of Indiana and Cincinnati Gas & Electric Co., which already had a subsidiary operation across the Ohio River in northern Kentucky called Union Light, Heat & Power, combined to form Cinergy Corp. The companies are now known as Duke Energy Indiana LLC, Duke Energy Ohio Inc. and Duke Energy Kentucky Inc. and together serve more than 1.1 million electric customers and about 405,000 natural gas customers. They also own about 8,400 MW of generating capacity. Elliott values this business at about $15 billion.

State utility commissions have generally authorized Duke Energy electric and gas utilities returns on equity that have exceeded national averages. According to Regulatory Research Associates, a group within S&P Global Market Intelligence, the average ROE authorized electric utilities was 9.44% in 2020 and 9.46% in the first quarter of 2021. For gas utilities, the average ROE authorized was 9.46% in 2020 and 9.71% in the first quarter 2021. See our report Major Rate Case Decisions January - March 2021 for more information.

While the current return authorized for Duke Energy Kentucky's gas utility approximates industry averages, the 9.25% ROE authorized its electric utility is modestly below industry averages. RRA currently ranks Kentucky regulation Average/1, indicating it is somewhat more constructive than average from an investor perspective.