Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jan, 2022

By Anser Haider

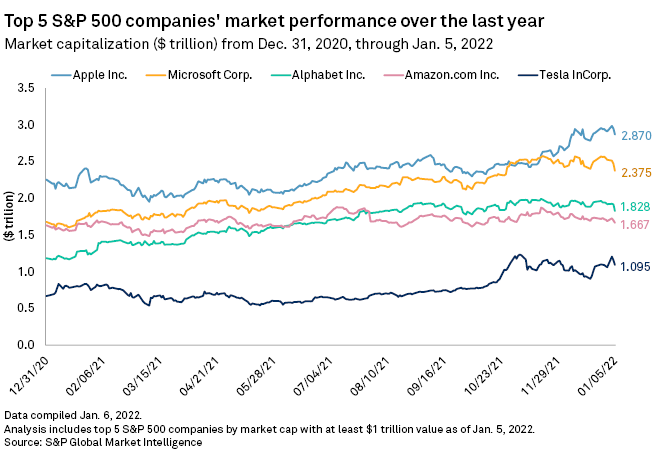

Apple Inc. became the first company this week to hit the $3 trillion market cap milestone, but the best stock days are yet to come for the iPhone maker, analysts say.

After hitting an intraday record high of $182.88 on Jan. 3, Apple became the first U.S. public company to go over the $3 trillion mark as sales of its devices soared due to a surge in demand amid the COVID-19 pandemic. Although supply chain issues threaten to impact Apple's bottom line in the near term, analysts are convinced that the company's long-term success is all but guaranteed as it continues to launch best-selling products and explores lucrative new markets, such as self-driving cars and augmented reality.

"While the supply chains issues have curtailed some growth for Apple on this massive product cycle playing out across its entire hardware ecosystem, we believe the pent-up demand story for Cupertino is still being underestimated by investors with chip issues a transitory issue in our opinion," Wedbush analyst Dan Ives wrote in a recent analyst note.

Growth for existing products

Supply chain troubles notwithstanding, Apple reported year-over-year revenue growth of 28.8% and profit growth of 62.2% in the September 2021 quarter. Although the chip shortages are expected to impact the company's results for the quarter ended December 2021 as well, revenue is expected to hit a record $117.48 billion on sales of Apple's line of iPhone 13 smartphones.

"Based on our supply chain checks over the last few weeks, we believe demand is outstripping supply for Apple by roughly 12 million units in the December quarter, which now will add to the tailwinds for Cupertino in the March and June quarters as the supply chain issues ease in 1H22," Ives said.

Apple has also tightened its grip in China, the world's largest smartphone market, said Daniel Morgan, vice president and senior portfolio manager at Synovus Financial Corp.'s Synovus Trust.

"Apple shipments tracked at 7.3 million for the month of November, which is higher than the historical average of 6.4 million, and also the highest shipments for the month of November since 2016," Morgan said. "Long story short, iPhone demand in China has been very strong."

While some of Apple's other product categories — including iPads, Apple Watch and Macs — are also going through a renaissance, a bigger opportunity for the company is its ever-expanding services offerings, such as the App Store, Apple Music, Apple Pay and Apple TV, Morgan said.

"Apple's ecosystem is a key asset that keeps users locked in as they accumulate content including pictures, videos, movies and other content that makes a switch to Android very difficult," Morgan said. "Apple will continue to leverage its massive user base to cross-sell other products and services to diversify revenues away from just the iPhone franchise."

Wedbush estimates Apple's services business is currently worth $1.5 trillion and is poised to reach more than $100 billion in annual revenue by 2024.

New product lines

While Apple's future devices include the annual updates to stalwarts like the iPhone, iPad and Mac computers, the company has been eyeing new product categories, including augmented/virtual reality headsets and electric vehicles.

Ives expects Apple to debut its AR headset Apple Glasses in the second half of 2022, adding a potential $20 per share to the company's sum-of-the-parts valuation, given the massive market opportunity of the broader metaverse ecosystem.

"In addition, we believe Apple is aggressively ramping up its auto ambitions behind closed doors and we continue to expect an Apple Car by 2025 with new growth levers coming to the Apple story over the next few years," Ives said.

The electric and autonomous vehicle market also has the potential to provide enormous upside to Apple's revenue in the long term when factoring in potential services that the company could launch to supplement its new business, said CFRA Research analyst Angelo Zino.

"All Apple has to do is throw in a little pre-installed app and they'll have an opportunity to pull in massive services revenue from their vehicles," Zino said. "The company will definitely be intrigued by opportunities, such as a ridesharing offering."

Cloud providers narrow gap

While Apple continues to lead the pack on market cap, other major tech companies are gaining ground by leveraging the unprecedented demand for cloud-computing services.

Microsoft Corp., which topped $2 trillion in June 2021, is expected to be the next tech company to hit the $3 trillion mark this year, driven mostly by the growth of its Azure cloud-computing platform. As of Jan. 5, its market cap was valued at $2.38 trillion.

"Microsoft's rapid ascent just goes to show what a leadership change can do for even the biggest companies," said Scott Kessler, global sector lead for TMT, at research firm Third Bridge.

Since Satya Nadella took over as CEO of Microsoft in 2014, the company has doubled down on its cloud business, making its Azure platform the No. 2 player in perhaps the most lucrative market in tech today, Kessler said.

"Microsoft's recent success is reminiscent of when Bill Gates suddenly recognized that the internet was going to be a big thing," Kessler said. "I think Nadella has done the same for cloud by completely refocusing the entire company around that and the results are showing."

As the pandemic continues to linger on, the transition to the cloud has accelerated within industries around the globe. This trend will not subside anytime soon and will continue to significantly contribute to the growth stories of cloud providers such as Microsoft, Amazon.com Inc. and Alphabet Inc., said CFRA's Zino.

As of Jan. 5, Google-parent Alphabet's market cap was at $1.83 billion, while cloud market leader Amazon followed with a market cap of $1.67 billion.

"In addition to cloud, Microsoft's pricing power for a number of their product offerings will continue to drive the upside potential of the company's consensus estimates," Zino said. "On the Alphabet side of things, they have their hands in a number of different opportunities, so there are clearly several different moonshots that they could potentially take."