Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Sep, 2022

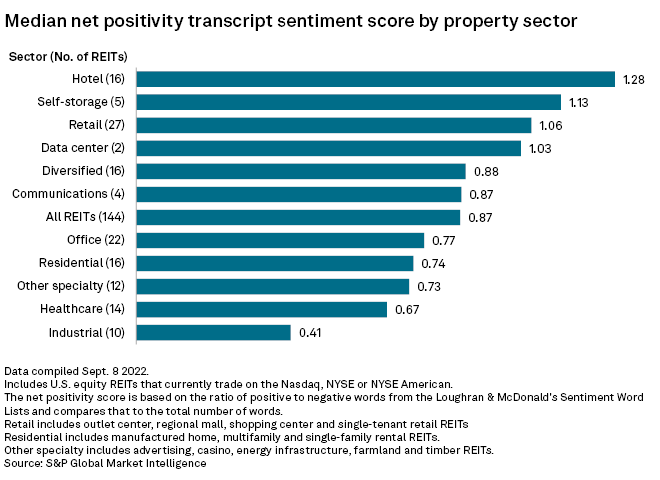

U.S. hotel real estate investment trusts expressed the most positivity on their second-quarter earnings calls, according to an analysis of REIT earnings call transcripts.

S&P Global Market Intelligence-calculated transcript sentiment scores use natural language processing to provide a way to look at earnings call transcripts quantitatively. Net positivity scores are based on the ratio of positive to negative words used in the transcript using the Loughran & McDonald's Sentiment Word Lists, compared to the total number of words in the transcript.

Sector net positivity transcript sentiment scores

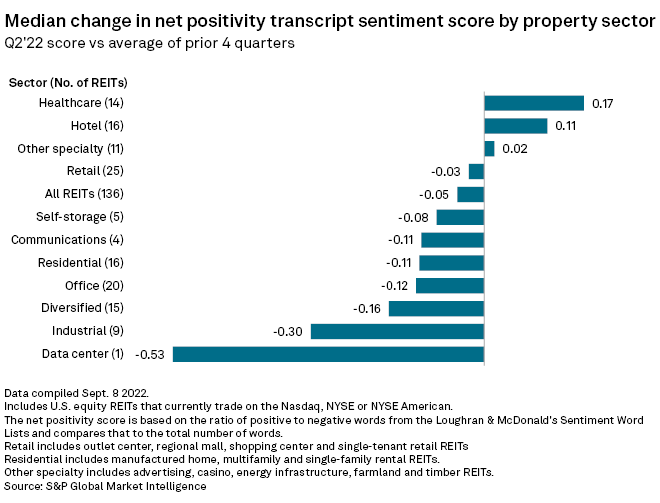

Transcript sentiment for the hotel sector was scored the highest, with a median net positivity transcript sentiment score of 1.28 for the second quarter, 0.11 point higher than the previous four-quarter average for the sector.

The self-storage and retail sectors followed next, with median net positivity transcript sentiment scores of 1.13 and 1.06, respectively.

* Click here to download the Excel file including individual company sentiment scores.

* Click here to set up email alerts for future Data Dispatch articles.

Conversely, the industrial sector was scored the lowest, at a median of 0.41, down 0.30 point compared to the previous four-quarter average.

The healthcare sector followed next, with a median score of 0.67.

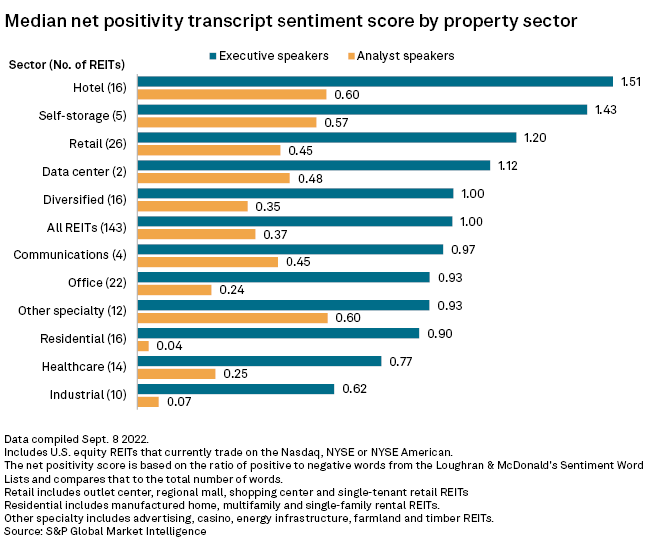

Executives speaking on the earnings calls used a larger ratio of positive words as compared to analysts.

For the hotel sector, the median net positivity score for words spoken by executives was 1.51, the highest of any property sector. Words spoken by analysts were scored at a median of 0.60, ranking second among the property sectors, only slightly behind the "other specialty" sector that includes advertising, casino, energy infrastructure, farmland and timber REITs.

After the hotel sector, words spoken by executives at self-storage and retail REITs ranked next, with scores of 1.43 and 1.20, respectively.

Looking at words spoken by analysts on the earnings calls, the self-storage sector held a median net positivity score of 0.57, while the datacenter sector was scored at a median of 0.48.

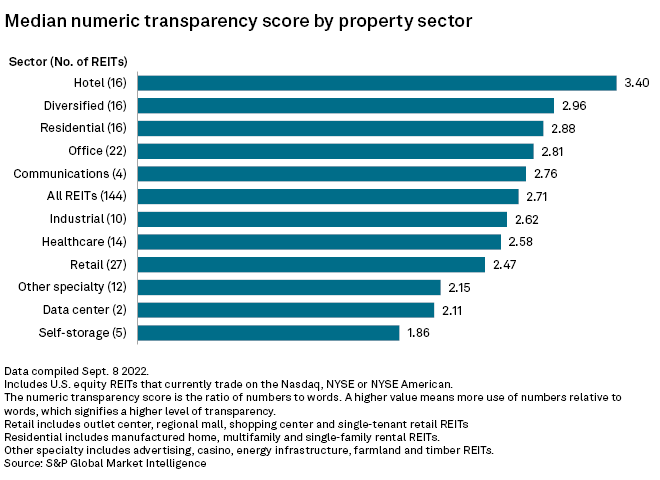

Sector numeric transparency scores

The hotel sector also scored the highest when it comes to numeric transparency, which is the ratio of numbers to words. A higher score means the REIT used more numbers relative to words during its earnings call and can signify a higher level of transparency.

After the hotel sector, the diversified and residential sectors ranked next.

The self-storage and datacenter sectors used the least amount of numbers compared to total words on their earnings calls.